Trading 212 Revenues balloon 4x in 2020 to £124 million

FNG has learned via regulatory filings that UK/Bulgarian Retail FX and CFDs broker Trading 212 took a huge step forward in 2020, with Revenues at parent company Trading 212 Group Limited increasing by more than 300% (!!) to a whopping £124 million (USD $166 million), versus £29.7 million the previous year.

The company’s expansion came at a cost, though, as profits at Trading 212 were up a more modest 40%, from £7.2 million to £10.1 million in 2020. But still, a great result.

As of 31 December 2020, the company had four principal subsidiaries:

- Trading 212 UK Limited (registered in the United Kingdom and regulated by the FCA)

- Trading 212 Limited (registered in Bulgaria and regulated by the Bulgarian Financial Supervision Commission)

- Trading 212 Markets Limited (registered in Cyprus, and following approval in 2021 the entity is now

regulated by CySEC) - Trading 212 Europe GmbH (registered in Germany and currently going through the approval process with BaFIN)

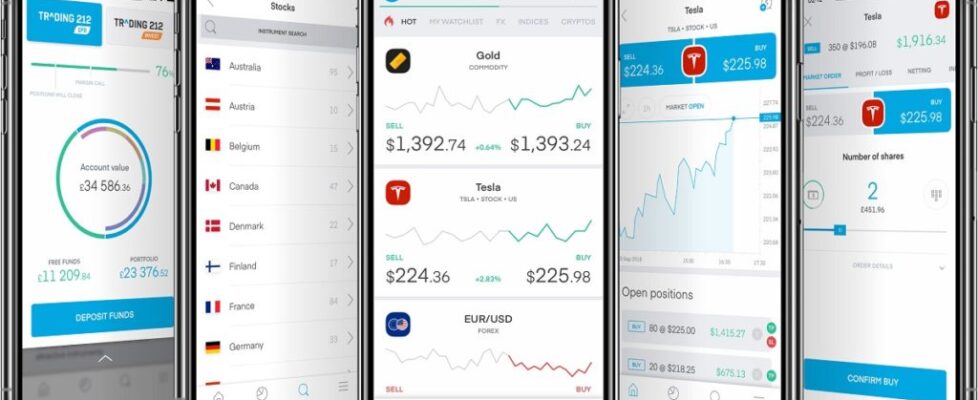

Trading 212 said that its growth has been caused partly by broader market trends and activity, but also crucially by the increasing popularity of the platform and product. For example, Trading 212’s zero commission pricing structure, the ability to trade in fractional amounts of shares, and the functionality within the platform including the T212 mobile app have proved to be extremely popular with the tech savvy demographic.

The company added that this demand for Trading 212’s products and services continued into 2021, with revenues and profitability for the year ended 31 December 2021 having grown further.

Trading 212 said that it has invested significantly in the UK entity and its operating model, including:

- Increasing the share capital of the Trading 212 UK business by an additional £19.8 million;

- The hiring of a new UK based senior management team with significant experience in this sector, including a new “C-Suite” of executives. These have included, as were exclusively reported by FNG, CEO Mukid Chowdhury (hired from Tickmill), COO George Mantilas, and CFO Philip Parsons.

- Appointing new directors to the Board, including two new independent non-executive directors, Gary Dixon and Andrew Bole, taking the total to six directors at the date of this report.

- Increasing headcount in the UK from six to around 40 at the time of approval of the financial statements, with further approved recruitment planned for 2022.

Trading 212 is controlled by Bulgarian entrepreneurs Borislav Nedialkov and Ivan Ashminov.