Swissquote introduces new investment and saving solution Invest Easy

Swissquote, the Swiss leader in online banking, introduces an innovative investment and saving solution for simplicity seekers: Invest Easy, launching on 4 July 2023.

This new gateway to guided wealth building makes investments easier and more accessible than ever – with four professionally predefined strategies, highly competitive interest rates of up to 1% percent on cash-deposits in CHF and up to 2% in GBP, and low-to-no-fees. Invest Easy is integrated with Swissquote’s online banking account and allows one-click investments tailored to one’s personal opportunity and risk inclination.

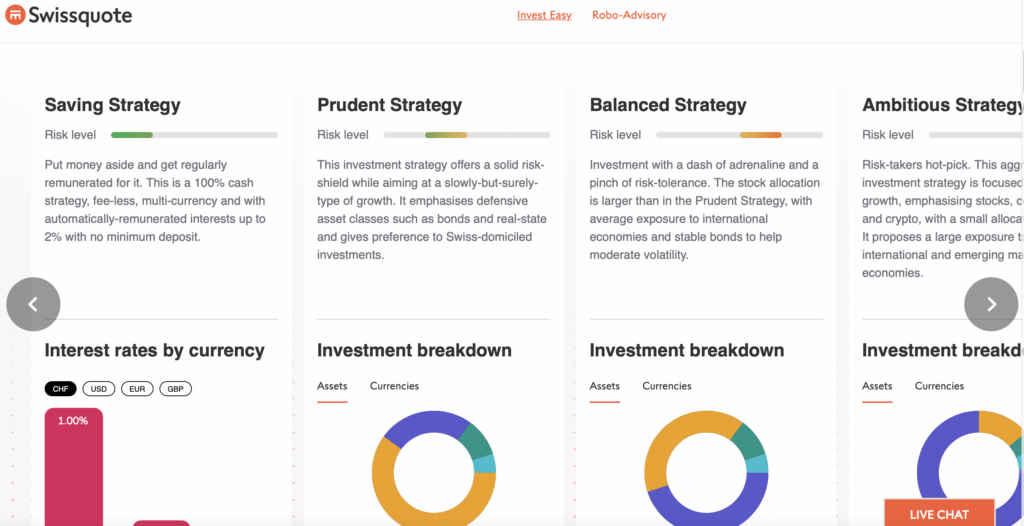

In its initial phase, Invest Easy provides four professionally predefined strategies with tiered growth opportunities and risk profiles for fast, easy and intuitive investment decisions. This allows Swissquote clients to earn attractive interests on their savings or invest automatically and regularly without having to spend much time and effort.

- Saving Strategy: 100% cash, no fees, and with automatically remunerated interests of up to 1% from CHF 1 of deposit (up to 1.75% for deposits in USD, up to 1.5% in EUR, up to 2% in GBP).

- Prudent Strategy: A solid risk shield with long-term growth potential; defensive asset classes such as bonds, real estate, and Swiss-domiciled investments.

- Balanced Strategy: Investing with a pinch of risk tolerance; higher stock allocation, average exposure to international markets; stable bonds to moderate volatility.

- Ambitious Strategy: Aggressive high-growth investments; focus on stocks, commodities and crypto, large exposure to international and emerging markets.

“Invest Easy offers noteworthy savings interests and return-packed opportunities combined with competitive investment fees and fee-free saving”, says Jan De Schepper, Chief Sales and Marketing Officer at Swissquote. “Our four professionally predefined strategies make investing and saving easy, convenient and intuitive. This offering also strengthens Swissquote’s position as the primary bank for clients who want to reduce complexity and banking fees in their daily lives.