StoneX registers 53% Y/Y increase in revenues from FX/CFD contracts in Q1 FY24

StoneX Group Inc. (NASDAQ:SNEX), the owner of Forex brands such as FOREX.com and City Index, has published its financial results for the fiscal year 2024 first quarter ended December 31, 2023.

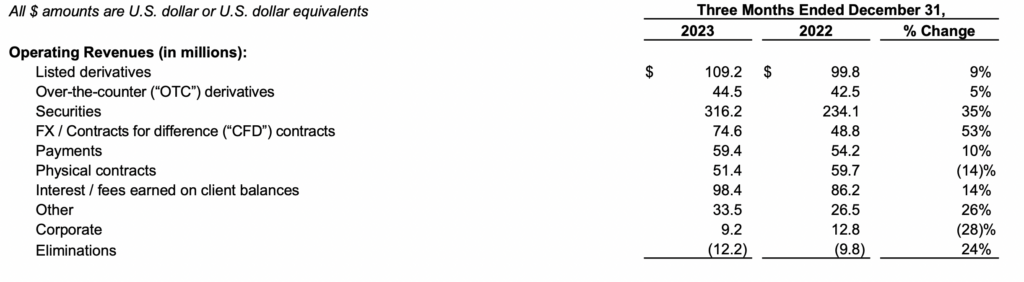

Operating revenues derived from FX/CFD contracts increased $25.8 million, or 53%, to $74.6 million in the three months ended December 31, 2023 compared to $48.8 million in the three months ended December 31, 2022, principally due to a 73% increase in the FX/CFD RPM, which was partially offset by a 15% decline in the FX/CFD contracts ADV, compared to the three months ended December 31, 2022.

Operating revenues derived from listed derivatives increased $9.4 million, or 9%, to $109.2 million in the three months ended December 31, 2023compared to $99.8 million in the three months ended December 31, 2022. This increase was principally due to a 26% increase in listed derivative contract volumes, partially offset by a 13% decline in the average rate per contract compared to the three months ended December 31, 2022.

Operating revenues derived from OTC derivatives increased $2.0 million, or 5%, to $44.5 million in the three months ended December 31, 2023 compared to $42.5 million in the three months ended December 31, 2022. The increase was the result of a 14% increase in OTC derivative contract volumes, partially offset by a 9% decline in the average rate per contract compared to the three months ended December 31, 2022.

Operating revenues from payments increased $5.2 million, or 10%, to $59.4 million in the three months ended December 31, 2023 compared to $54.2million in the three months ended December 31, 2022, principally driven by a 10% increase in the RPM, compared to the three months ended December31, 2022.

Operating revenues derived from physical contracts declined $8.3 million, or 14%, to $51.4 million in the three months ended December 31, 2023compared to $59.7 million in the three months ended December 31, 2022. This decrease was driven by declines in both our physical agricultural and energy and retail precious metals businesses, compared to the three months ended December 31, 2022.

Across all segments, operating revenues increased $129.4 million, or 20%, to $784.2 million in the three months ended December 31, 2023 compared to $654.8 million in the three months ended December 31, 2022.

Sean M. O’Connor, CEO of StoneX, stated:

“We had a very strong start to fiscal 2024, with net income of $69.1 million representing a 19.3% return on equity, a 20.5% return on tangible book value, and diluted EPS of $2.13. The comparable prior year period included a $23.5 million gain on acquisition, which contributed $0.74 of diluted EPS. Excluding this gain on acquisition, diluted EPS increased by 28.0% over the prior year. We continue to see a constructive market environment with good client engagement, and increased interest earnings on our client float. We are pleased to see that our business continues to deliver what we believe to be superior returns to our shareholders.”