StoneX registers 38% Y/Y drop in revenues from FX/CFD contracts in Q2 FY23

StoneX Group Inc. (NASDAQ:SNEX), a global financial services company that owns Forex brands such as City Index and FOREX.com, has announced its financial results for the fiscal year 2023 second quarter ended March 31, 2023.

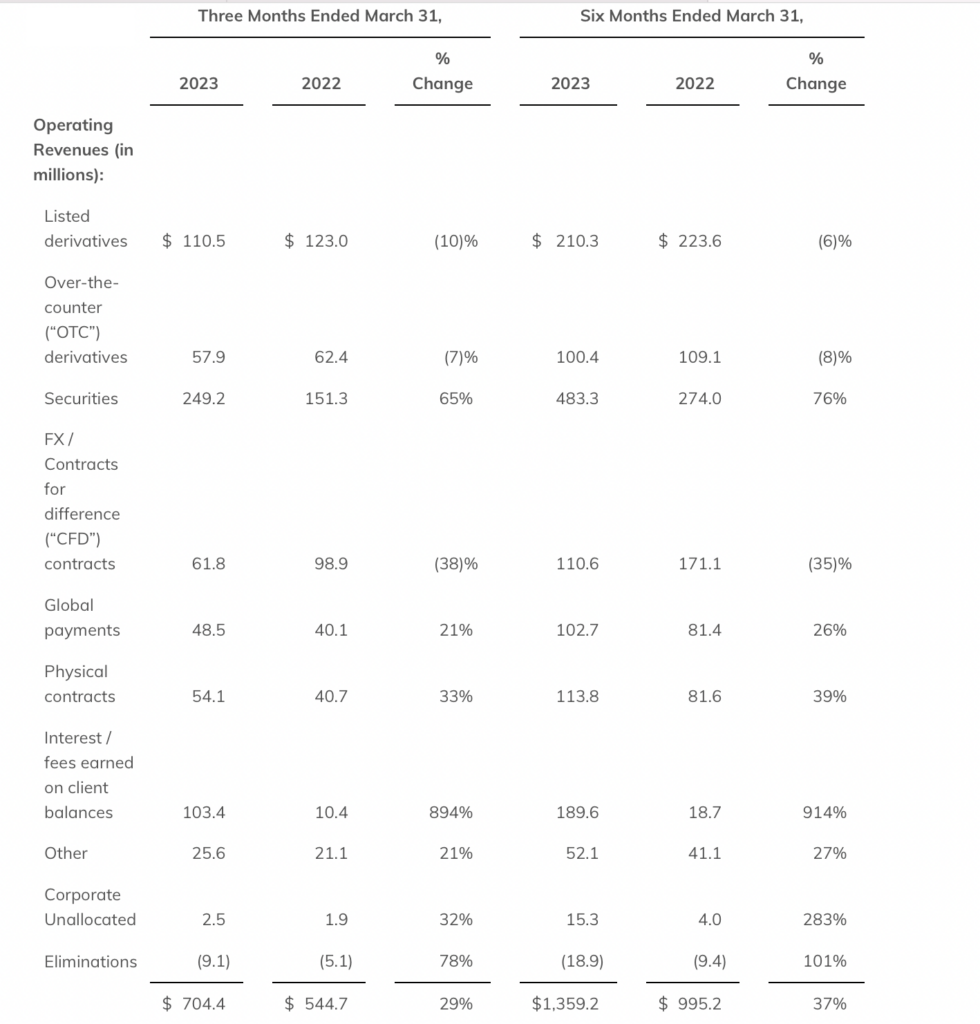

Operating revenues derived from FX/CFD contracts declined $37.1 million, or 38%, to $61.8 million in the three months ended March 31, 2023 compared to $98.9 million registered a year earlier. The result is principally due to a 31% decline in FX/CFD RPM and a 10% decline in FX/CFD contracts ADV.

Operating revenues derived from listed derivatives declined $12.5 million, or 10%, to $110.5 million in the three months ended March 31, 2023 compared to $123.0 million in the three months ended March 31, 2022. This decline was principally due to 8% and 1% declines in the average rate per contract and listed derivative contract volumes, respectively, compared to the three months ended March 31, 2022.

Operating revenues derived from OTC derivatives declined $4.5 million, or 7%, to $57.9 million in the three months ended March 31, 2023 compared to $62.4 million in the three months ended March 31, 2022. This was the result of a 20% decline in the average rate per contract, which was partially offset by a 16% increase in OTC derivative contract volumes, compared to the three months ended March 31, 2022.

Quarterly Net Income amounted to $41.7 million, whereas quarterly Diluted EPS were $1.95 per share.

Sean M. O’Connor, the Company’s CEO, stated:

“We achieved another set of solid results in the fiscal second quarter 2023, delivering diluted EPS of $1.95 and an ROE of 13.8% for the quarter. These results include fixed compensation expenses related to retirements and reorganizations of $14.6 million, on a pre-tax basis, which will lower our go-forward variable compensation expense run rate, with most of this cost being recovered in the next two years. These charges equate to a reduction of approximately $0.50 in diluted EPS and a 3.4% reduction in ROE for the quarter. Trading conditions moderated during the quarter, but were offset by higher interest and fee earnings on our client float. We believe that macro conditions remain generally favorable for us, which should put us in a favorable position to continue to deliver shareholder value in the near future.”