StoneX recognizes $81.8M bargain purchase gain on acquisition of Gain Capital in Q4 FY20

StoneX Group Inc (NASDAQ:SNEX), a diversified global brokerage and financial services firm has announced its financial results for the fiscal year 2020 fourth quarter ended September 30, 2020. StoneX, formerly known as INTL FCStone, also provided an update on its deal with GAIN Capital.

On July 31, 2020, StoneX completed the acquisition of GAIN, an online provider of retail foreign exchange trading and related services. StoneX used the net proceeds from the sale of $350 million in aggregate principal amount of 8.625% Senior Secured Notes due 2025 (the “Notes”) at the offering price of 98.5% to fund the cash consideration for the acquisition, to pay certain related transaction-related fees and expenses, and together with cash on hand, to fund the September 2020 repayment of $91.5 million of Gain’s 5.00% Convertible Senior Notes due 2022.

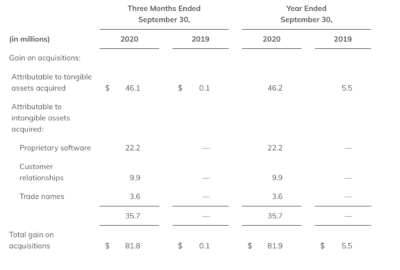

During the fourth quarter, StoneX recognized a $81.8 million bargain purchase gain on the acquisition of GAIN Capital. The bargain purchase gain is non-taxable, and accordingly there is no corresponding income tax provision amount recorded related to this gain.

When evaluating the acquisition of GAIN, along with the bargain purchase gain recorded, management also considers the $9.6 million of acquisition related investment banking and legal fees incurred in fiscal 2020 and an impairment charge of $5.7 million related to capitalized software not yet placed into service, which is expected to be replaced with a system acquired as part of the GAIN transaction.

The acquisition of Gain added a significant amount of incremental business from a new client type for StoneX – retail. Prior to the acquisition, Gain was a publicly traded corporation in the United States, and reported its performance along two reportable segments: retail and futures, in its periodic reporting with the SEC. StoneX has existing businesses with activities similar to GAIN’s futures business. GAIN’s retail business however, represents a fundamental change in StoneX’s business strategy.

Sean M. O’Connor, CEO of StoneX Group Inc., stated,

“Despite the unprecedented pandemic and its impact on the economy and markets in general, fiscal 2020 was a year of significant milestones and accomplishments for our company. We achieved record results on a consolidated basis and in nearly every business area, completed several transactions, including the major strategic acquisition of Gain Capital Holdings, Inc. (“Gain”) and rebranded the company with an eye toward our future.

In addition to record annual earnings from our on-going operations, we realized a significant amount of non-operating income during the quarter, primarily resulting from the gain on acquisition relating to the Gain transaction. We are well placed to take advantage of the continued consolidation of our industry with greater scale and earnings power and more diversity in terms of products and customers.”