Saxo Bank trading volumes tank in April, FX down 27%

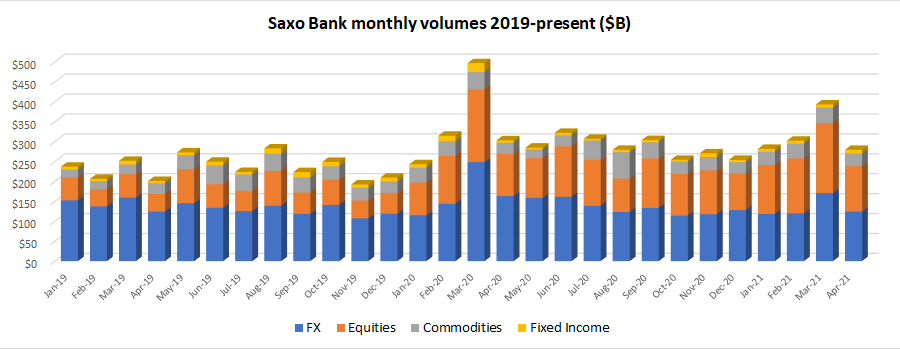

Copenhagen based Retail FX and CFDs broker Saxo Bank has released its client trading volumes for April 2021, indicating a sharp decline in trading activity across most of its traded product groups.

Overall, trading volumes were off by 29% as compared to March, $279 billion versus $393 billion the previous month. Saxo’s core FX trading volumes were down by 27%, $124.2 billion versus $170.5 billion in March. Equities were off by 35% ($114 billion versus $176 billion in March).

By comparison, Saxo Bank averaged $302.9 billion in multi-asset trading volumes during 2020, and $326 billion during the first quarter of 2021, with April now coming in as the slowest month of the year.

Saxo has plans to soon launch crypto CFD trading in certain jurisdictions where it operates (crypto CFDs are not allowed in the UK for retail traders), as was exclusively reported by FNG last month. It will be interesting to see how Saxo decides to account for those volumes, and if it will add an additional reporting category once those ramp up.

Saxo Bank is controlled by China’s Geely Group, which bought a majority interest in the company in 2018.