Saxo Bank registers drop in net profit in 2022

Multi-asset investment specialist Saxo Bank Group today reported its financial results for 2022.

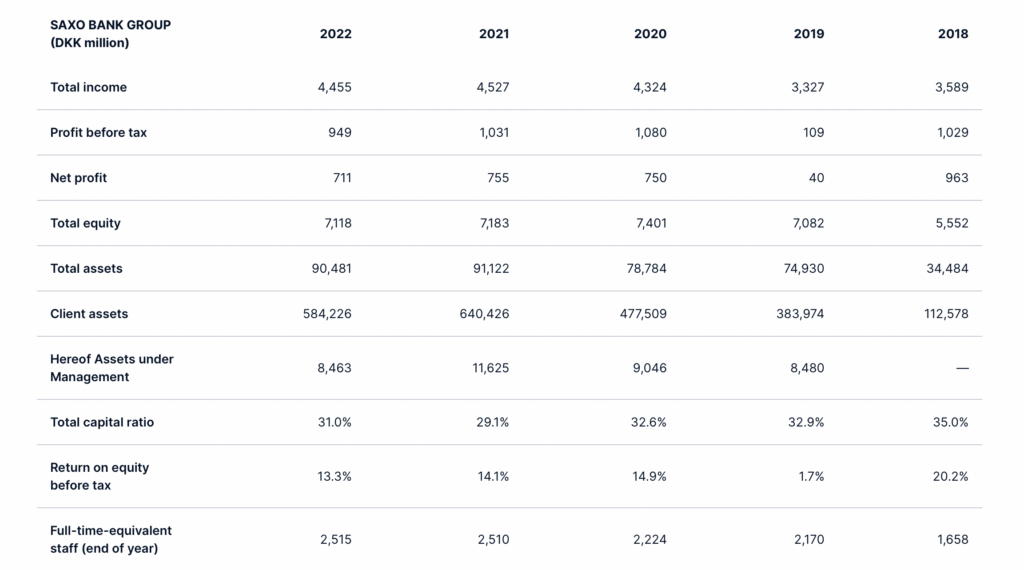

Saxo reported a net profit of DKK 711 million for 2022, compared to DKK 755 million for 2021 and ended above the half-year guidance of DKK 600 million.

Several significant macro factors impacted our 2022 results. On the positive side, rising interest rates contributed to a higher interest income, while declining equity markets meant Investors acted more cautiously, dampening our revenue growth. Total income for the Group amounted to DKK 4,455 million in 2022 compared to DKK 4,527 million in 2021.

Despite challenging market circumstances, Saxo welcomed 157,000 new clients during 2022 and the positive inflow of new clients led to a record high number of 876,000 clients per 31 December 2022.

Total client assets by the end of 2022 amounted to DKK 584 billion, versus DKK 640 billion in 2021, and has in 2022 been negatively affected by the declining equity markets, though partly offset by positive net funding from clients of DKK 47 billion.

During 2022, the Saxo Bank Group continued the high level of investments in platforms, new products and services as well as further digitisation to continue to improve the client experience.

Furthermore, the migration of clients from the BinckBank acquisition in 2019 was finalised in 2022. More than 400,000 clients across four different jurisdictions have now been migrated to Saxo Bank and all Saxo clients are now served through one technology infrastructure.

2022 key figures at a glance (2021):

- Total income: DKK 4,455 million (DKK 4,527 million)

- Net profit: DKK 711 million (DKK 755 million)

- Total equity: DKK 7.1 billion (DKK 7.2 billion)

- Total client assets: DKK 584 billion (DKK 640 billion)

- Total number of clients: 876,000 (820,000)

Commenting on the results, Kim Fournais, CEO and Founder of Saxo Bank, said:

“2022 was a year where we witnessed geopolitical and market events that were both devastating and remarkable. Saxo’s ability to navigate the world circumstances, helping our clients and partners navigate the markets and be invested throughout the macro cycles, is why we are here. Our 2022 result highlights the resilience of our business model in terms of client and product mix as well as geographical presence, as it reduces our vulnerability to the impact from macroeconomic and country-specific conditions.

Our strategic focus remains unchanged with a continued emphasis on growing our client and client asset base, and on enhancing the product and platform offering to the benefit of our clients. The market conditions for 2023 remain highly uncertain with regards to market volatility, inflation, and interest rates, and as a result, Saxo Bank Group expects a Net profit in the range of DKK 650-800 million in 2023”.

All of Saxo’s product groups saw a decrease in volumes for December 2022, with its core FX trading volume off 12%, to $121.3 billion for the month.

Last year was a challenging one for the company. Saxo Bank attempted to go public on the Euronext Amsterdam exchange via a SPAC merger, but ultimately cancelled those plans late in 2022.