Russian c-bank depicts typical retail investors

The Central Bank of Russia has published the key findings of an analysis of the market of services offered by Russian brokers.

According to the data, Russian brokers have 7.6 million individual clients. About 70% of these investors are male. They hold approximately 75% of all funds.

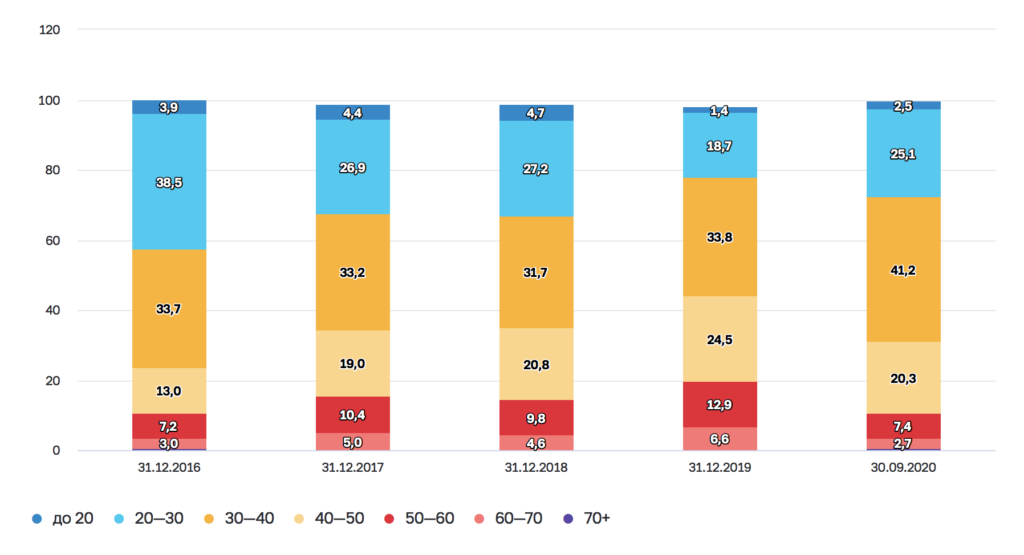

The age of the vast majority of the clients of Russian brokers is between 30 and 40 years. However, the bulk of the assets is concentrated among clients from 40 to 60 years of age. They hold about 50% of all funds.

The regulator explains that market entrants include young people with small sums to invest and check out new products, as well as elderly customers, with a rather conservative approach to investments. Previously, most of the accounts belonged to broker clients aged 25-35, but now the majority of accounts belongs to investors from 30 to 40 years of age.

The regulator has also assessed the allocation of funds among individuals and businesses. Out of 12.7 trillion rubles currently under management by Russian brokers, about 53% belongs to individual investors, and the rest (47%) to businesses/institutions.

During the first nine months of 2020, Russian brokers’ funds increased by RUB 1.8 trillion, with the funds of individuals staging a rise of RUB 1.2 trillion.