Robinhood responds to allegations about illegal spam texts

Online trading company Robinhood Financial LLC has responded to a complaint about allegedly spam text messages that formed part of a referral program.

Robinhood intends to file a motion to dismiss, as per documents filed by the company in the California Northern District Court earlier this week.

First, let’s recall that this case was brought by Cooper Moore, a citizen of Washington State, over a refer-a-friend text message.

The plaintiff notes that, in order to market its products and services, Robinhood created a referral program called “Refer a Friend.” Robinhood encourages users to refer their contacts to the service by offering free stock for each successful referral. As soon as the user’s contact signs up for Robinhood and links his or her bank account, Robinhood credits both the referring user and the referred contact with reward stock—sometimes offering more than one free stock for each successful referral.

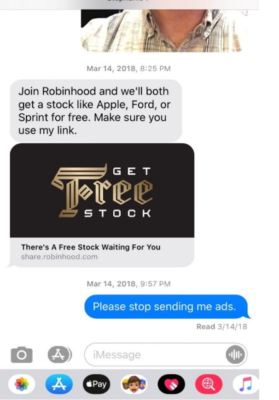

On March 14, 2018, the plaintiff received an unsolicited commercial electronic text message inviting him to sign up for Defendant’s online brokerage services. The text, which included formulaic language and stock images, stated: “Join Robinhood and we’ll both get a stock like Apple, Ford, or Sprint for free. Make sure you use my link.”

The Complaint alleges that Robinhood initiated and/or assisted in sending to the plaintiff a refer-a-friend text message while the plaintiff was a Washington resident.

Robinhood’s conduct allegedly violated the Washington Consumer Electronic Mail Act (“CEMA”), RCW 19.190.010 et seq., which makes it illegal for a person to “initiate or assist in the transmission of an electronic commercial text message to a telephone number assigned to a Washington resident for cellular telephone or pager service…” RCW 19.190.060.

Moore’s requested relief includes an injunction to end these practices, an award to plaintiff and class members of statutory and exemplary damages for each illegal text, and an award of attorneys’ fees and costs.

As per Robinhood’s reply, seen by FX News Group, the Complaint fails to plausibly allege the element of Plaintiff’s CEMA claim that Robinhood “initiated” the at-issue text messages. According to Robinhood, the plaintiff cannot allege sufficient facts to meet the statutory definition of “initiate” because his Complaint admits that Robinhood was not the “original sender” of the text messages.

According to the company, the allegations contradict the plaintiff’s admissions that Robinhood users – not Robinhood – decided whether to send referral text messages, to whom among their personal contacts to send such text messages, and when to send the text messages through their own mobile devices.

Further, Robinhood says that the plaintiff also fails to plausibly allege, in the alternative, that Robinhood provided “substantial assistance” to anyone it knew or consciously avoided knowing was violating the CPA. Robinhood also argues that Moore fails to allege any facts whatsoever that Robinhood knew or consciously avoided knowing that Robinhood users sent text messages in violation of the CPA as CEMA requires.

Finally, Robinhood argues that the Complaint fails to allege facts to support the plaintiff’s allegation that the text message he received constituted a “commercial electronic text message.” CEMA limits the definition of such a message to those “sent to promote real property, goods, or services for sale or lease.” But the plaintiff does not allege that the message he received was sent to promote the sale or lease of any real property, goods, or services.

Robinhood notes that this is an offer of free stock to sign up for Robinhood’s commission-free investment services. Hence it cannot constitute a “commercial electronic text message” under CEMA.