Robinhood challenger Public.com adds Tony Hawk to shareholder list, raises $65M

App based brokerage and social trading startup Public.com has announced that it has raised $65 million in new money, in a Series C financing round led by venture capital firm Accel. This news comes just days after comp Robinhood was reported to be looking at a $20 billion IPO.

The company said that all of its other existing major investors are also participating in the round including Lakestar, Greycroft, Brianne Kimmel’s Worklife, and Shari Redstone’s Advancit Capital. Joining as new investors in Public.com are Dick Parsons, The Chainsmokers’ Mantis VC, and skateboarding legend Tony Hawk.

Founded less than two years ago and co-run by well-known FX industry executive Jannick Malling (ex Saxo Bank, CFH Group, Tradable) and serial web entrepreneur Leif Abraham, Public.com is an app-only online broker, targeting younger traders with a social-trading bent. Its roster of investors and backers includes celebrities such as actor/rapper Will Smith, NFL star JJ Watt, popular Youtuber Casey Neistat, and now Tony Hawk.

Before the current round we had reported in August that Public.com had received a “seven figure investment” from well-known NYU business professor Scott Galloway.

Public.com has stated that one of its missions is changing the culture around the stock market. The company said that the stock market seems scary because its culture is. The communities that have sprung up around it are mostly for traders and therefore tend to be male-dominated, not welcoming of new investors, and short-term focused. This has the effect that they can feel closer to gambling culture than to investing culture.

To truly democratize the stock market, the company said that we have to change its culture. Public.com said that it has built a community from the ground up, one that is more welcoming of new investors, is diverse in thoughts and backgrounds, and is made up of 40% women.

The difference in culture shows. On Public, it’s being smart, thoughtful, and considered that drives engagement — not recklessness.

As far as “playing a different game,” the company said that instead of just launching another debit card, it is rethinking how people experience the stock market. It is doing this through innovation in technology, UX, and community.

Throughout the year, Public.com has launched features like Messages, Long-Term Portfolio, and Safety Labels. It said that it is focusing on features that help people build their financial literacy, think long-term, and learn what stocks could be riskier while they browse.

Public.com said that it will use these funds to expand on this strategy and can’t wait to share the next wave of features.

Interestingly, Public.com stated that when the markets dropped in March, and the lockdowns started, most major brokerages saw a massive spike in sign-ups as a result of it. But it didn’t. The reason was simple: the company wasn’t showing up in search results yet and didn’t have the brand awareness required to capture the traffic.

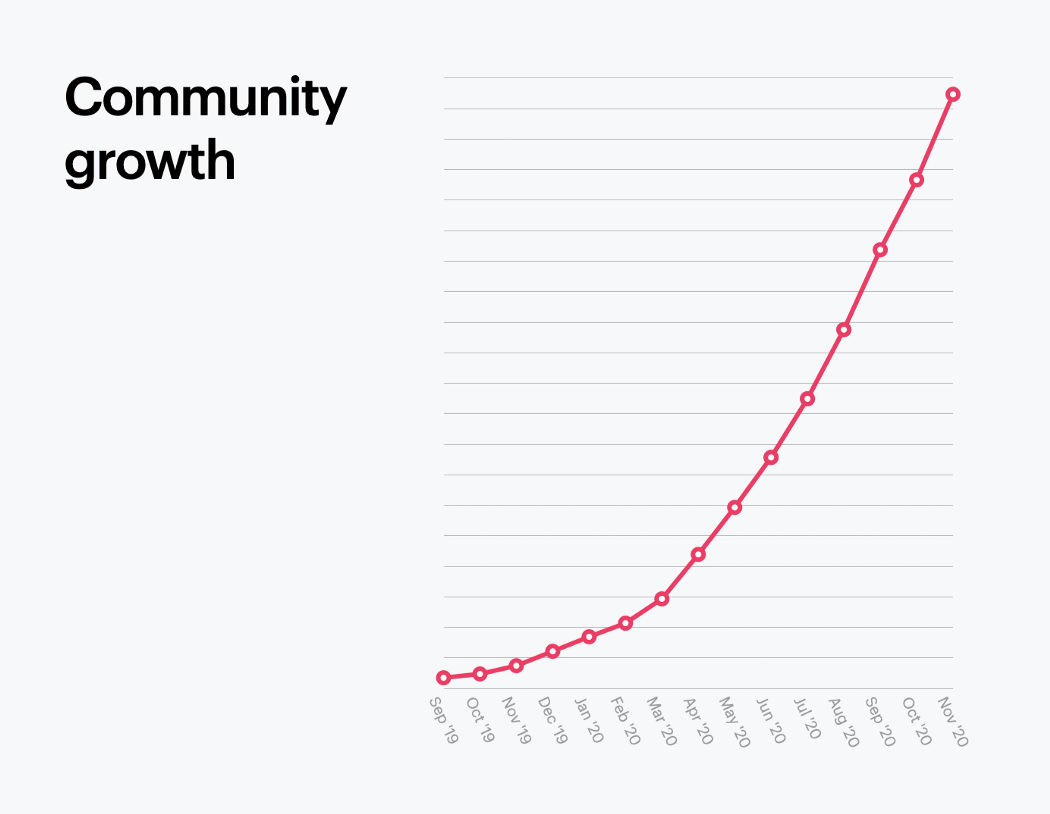

Instead of harvesting a big influx of users from search engines, Public.com kept focusing on community. As a result, the company said that it didn’t see spiky signup patterns, but rather steady growth, averaging 30% MoM, with the majority of users joining through their friends.

As the community grew, so did engagement, leading to a DAU/MAU ratio of 50%. The company noted that 75% of its community are long-term investors, and less than 3% are speculative. Despite being longer-term investors, people still want to learn about their portfolio every day and stay in-the-know of what other people are doing.

Public.com shared the following chart of community growth, however without attaching specific figures:

Public’s CEO Jannick Malling went on CNBC’s Power Lunch program to discuss the financing, and how they plan to compete with firms such as Robinhood: