Record client trading activity, addition of TD Ameritrade fuel Schwab’s revenues in Q4 2020

The Charles Schwab Corporation today posted its financial report for the final quarter of 2020, with the recently closed acquisition of TD Ameritrade contributing to a steep rise in trading revenues.

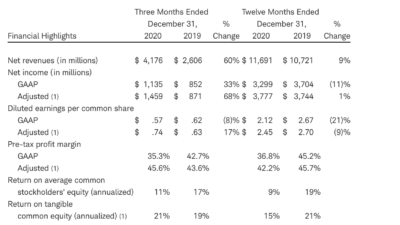

Schwab reported net income for the fourth quarter of 2020 of $1.1 billion, compared with $698 million for the third quarter of 2020, and $852 million for the fourth quarter of 2019. Net income for the twelve months ended December 31, 2020 was $3.3 billion, compared with $3.7 billion for the year-earlier period.

The company’s financial results include TD Ameritrade from closing on October 6, 2020 forward, as well as certain acquisition and integration-related costs and the amortization of acquired intangibles. Together these transaction-related expenses totaled $429 million and $632 million on a pre-tax basis, for the fourth quarter and full-year 2020, respectively.

CEO Walt Bettinger said:

“Producing record operating performance and closing the largest brokerage acquisition in history during the fourth quarter of 2020 was an extraordinary capstone to an extraordinary year. Schwab’s unrelenting commitment to seeing through clients’ eyes helped us not only stand tall throughout the events of the past twelve months, but also enabled us to enter 2021 larger, stronger, and more capable of serving clients than ever.”

CFO Peter Crawford commented,

“Schwab’s 2020 financial results, which include TD Ameritrade from October 6 forward, demonstrate our ongoing success with clients and the benefits of our diversified revenue model in the face of environmental headwinds. Strong growth in interest-earning assets via client asset inflows and allocation decisions, as well as our TD Ameritrade acquisition, helped limit the resulting year-over-year decline in net interest revenue to just 6% to $6.1 billion.

“Record client trading activity, and the addition of TD Ameritrade, led to an 88% increase in trading revenue to $1.4 billion – even as we absorbed a full-year impact of the commission reductions we implemented late in 2019. With the TD Ameritrade acquisition, our fourth quarter results included bank deposit account (BDA) fee revenue for the first time, which totaled $355 million for the period from close to year-end”, Mt Crawford said.

“Overall, while both Schwab and TD Ameritrade were performing well independently, we believe our first reported results as a combined firm help support the case that we’re creating an even more resilient business, producing fourth quarter revenues that were up 60% relative to standalone Schwab on a year-over-year basis,” he noted.

Mr Crawford added that Schwab’s consolidated balance sheet grew 87% to end the year at $549 billion, reflecting both Schwab’s substantial organic growth and the absorption of TD Ameritrade’s margin book and other interest-earning assets. Schwab ended the year with a preliminary consolidated Tier 1 Leverage Ratio of 6.3%, which reflects the impact of that acquisition as well as the issuance of an additional $2.5 billion of preferred equity in early December.

Let’s recall that Schwab completed its acquisition of TD Ameritrade on October 6, 2020. As a result of the acquisition, TDA Holding became a wholly-owned subsidiary of Schwab. TD Ameritrade provides securities brokerage services, including trade execution, clearing services, and margin lending, through its broker-dealer subsidiaries, and futures and foreign exchange trade execution services through its FCM and FDM subsidiary. TD Ameritrade also provides cash sweep and deposit account products through the IDA agreement, as well as bank deposit account agreements with other third-party depository institutions.

In exchange for each share of TD Ameritrade common stock, TD Ameritrade stockholders received 1.0837 shares of CSC common stock, except for TD Bank and its affiliates which received a portion in nonvoting common stock.

At the time of acquisition, TD Ameritrade had approximately 10,000 employees. This, however, has changed, thanks to something called (in a very diplomatic way) “integration activities”.

In October, The Charles Schwab Corporation began efforts to reduce overlapping or redundant roles across the two firms and to rationalize branch locations of Schwab and TDA. These and other integration activities continue throughout the integration process.