Public introduces new phase of its AI vision: Agentic Brokerage

Public started its AI efforts in 2023 and today, it is introducing the next phase of that vision: the Agentic Brokerage — agents that manage investor’s entire portfolio.

The vision is based on three pillars that represent an entirely new way to research, create, and act on your investing ideas on the Public platform.

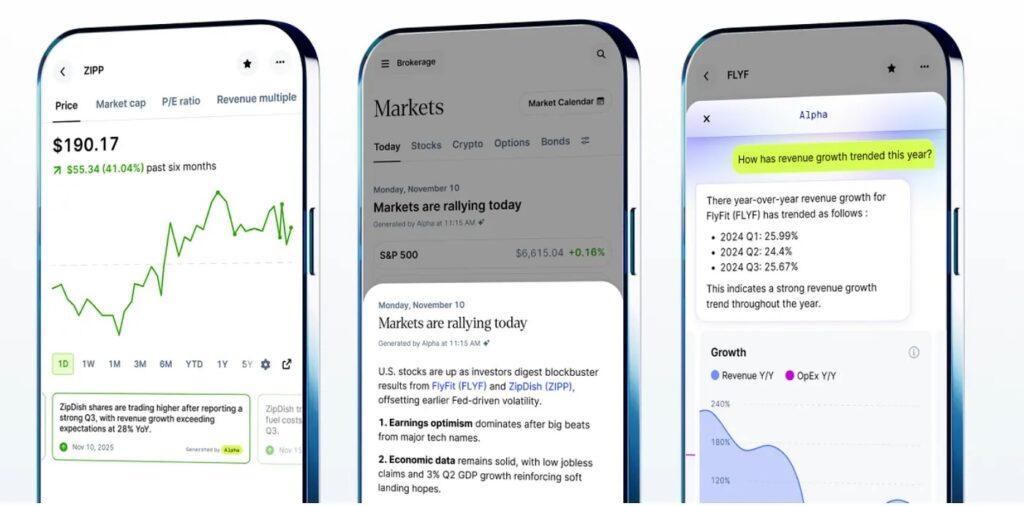

- Pillar 1: Research

For decades, the investing playing field was uneven. Institutions had entire teams of analysts and endless time. Individual investors had jobs, families, and limited hours in the day. Public’s AI research tools are designed to change that.

It started with its research assistant that can answer any question about any stock. From there, it evolved — proactively scanning the market, analyzing earnings calls, and surfacing insights before you even have to ask. Today, investors on Public can access institutional-grade research, made radically more accessible with AI.

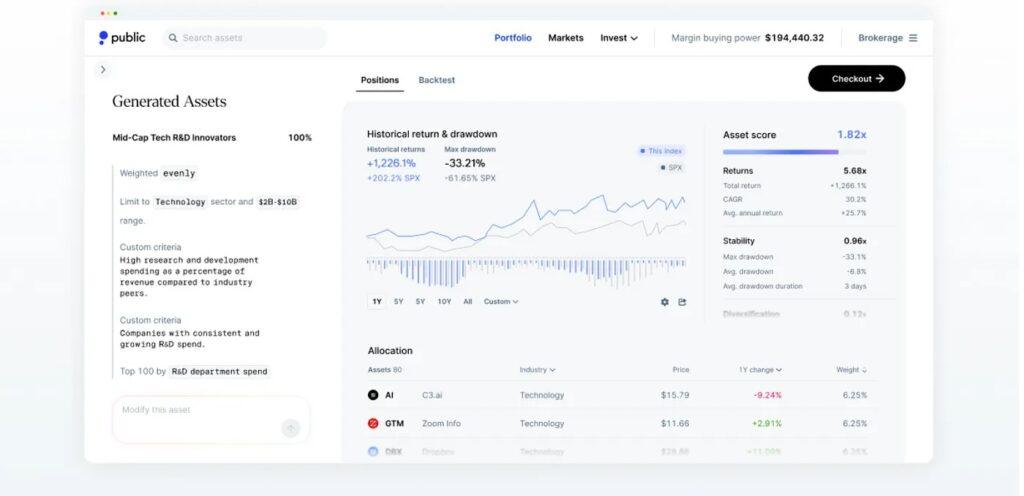

- Pillar 2: Creation

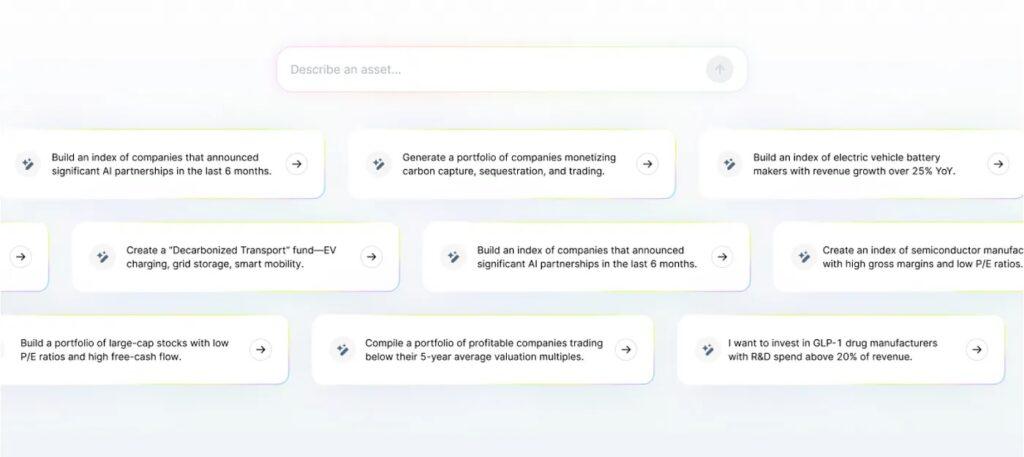

The next phase of AI at Public starts rolling out today: Generated Assets. This new type of asset lets users co-create an investable index with AI. You can start with literally any thesis, whether it’s “Companies with large customer bases and high top-line revenue but low profit margins that could improve with AI,” or “Top-quartile stocks from QQQ and SPY, with 2x exposure to AI companies, and excluding companies with shrinking revenues.”

Generated Assets is the evolution of the ETF — made possible by AI and Public’s fractional investing engine. For the first time, anyone can build an index around their own ideas, and that opens up practically infinite possibilities of new financial products.

To put it in perspective: since ETFs were invented, fewer than 4,000 have ever been created. In the past month alone, investors on Public have built over 2,500 Generated Assets.

- Pillar 3: Action

Research and Creation are powerful on their own, but the real transformation happens when they lead to intelligent action. That’s the final pillar of the Agentic Brokerage. Public envisages that soon, AI will replace the workflows of a traditional wealth manager, helping users take action across every aspect of their portfolio.

As part of the next phase, you’ll be able to:

- Manage risk — e.g.: “Trim 10% of my bank stocks and rotate into high-growth tech, but only if the Fed announces a rate cut.”

- Automate cash flows — e.g.: “Automatically sweep any cash over $2,000 from my checking account into my high-yield cash account”.

- Run trading strategies, like setting up a plan to “buy the close and sell the open” every day.

Each of these actions will be handled by AI, based on real-time market conditions and your personal investing goals.

This is where the Agentic Brokerage is headed on Public in early 2026.