Public enables clients to invest fractionally in corporate and Treasury bonds

Investing platform Public is rolling out access for members to invest fractionally in corporate and Treasury bonds on desktop and mobile.

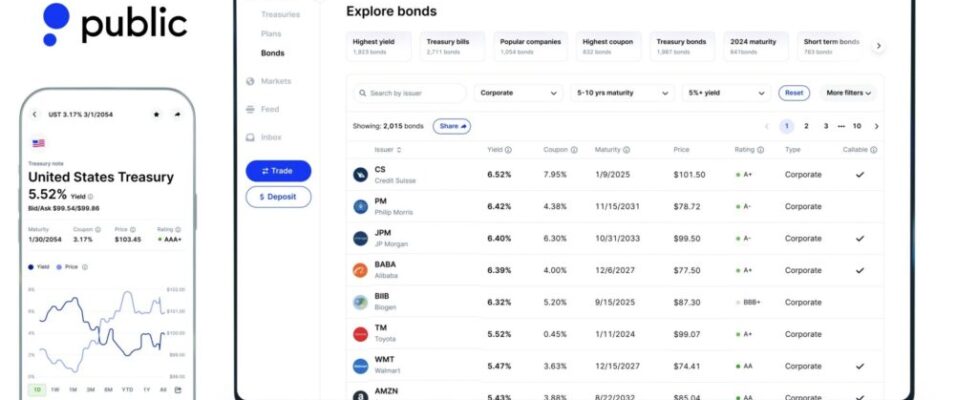

Retail investors will have access to an expansive suite of treasury and corporate bonds, where they can sift through an advanced screener tool with thousands of bonds at different rates and maturities and access advanced financial metrics that allow them to evaluate.

Bonds have traditionally been more readily available to institutional investors, but recently, with interest rates rising, they have started to become favored by modern retail investors. Nevertheless, they are still difficult to buy, as evidenced by the approximately one percent of retail investors directly owning corporate bonds. Public’s launch of bonds comes with a new layer of context to help inventors understand the lifecycle of these securities, including relevant financial metrics and reference data associated with a bond to ensure investors make educated decisions through an easy-to-use experience.

“For the last 15 years, the bond markets have been largely irrelevant for retail investors, but after an unprecedented set of rate hikes, retail demand for fixed income products has exploded, and investors are experiencing friction with existing offerings being archaic and having high minimums,” said Jannick Malling, co-CEO and co-founder of Public. “Public pioneered fractionalization for equities, and we always wanted to broaden that feature to more asset-classes. After launching treasury bills earlier this year, we’re now doubling down by reimagining the entire user experience of how retail finds, evaluates and invests in the full universe of corporate and treasury bonds.”

“Historically, direct bond access has been limited to institutions and high-networth investors,” said Sam Nofzinger, GM of Brokerage at Public. “Providing our members with the tools and information to invest in these securities will help them to continue to diversify their portfolios and construct unique bond strategies that fit their needs – just like institutional investors.”

Today at launch, investors can view the bond screener page, start a watchlist, and be the first to gain access to investing fractionally in corporate and treasury bonds, which will be live to all members soon.

The most popular corporate and Treasury bonds will be available to buy fractionally, as bond minimums often exceed thousands of dollars. Public will be adding municipal bonds to the platform in early 2024.