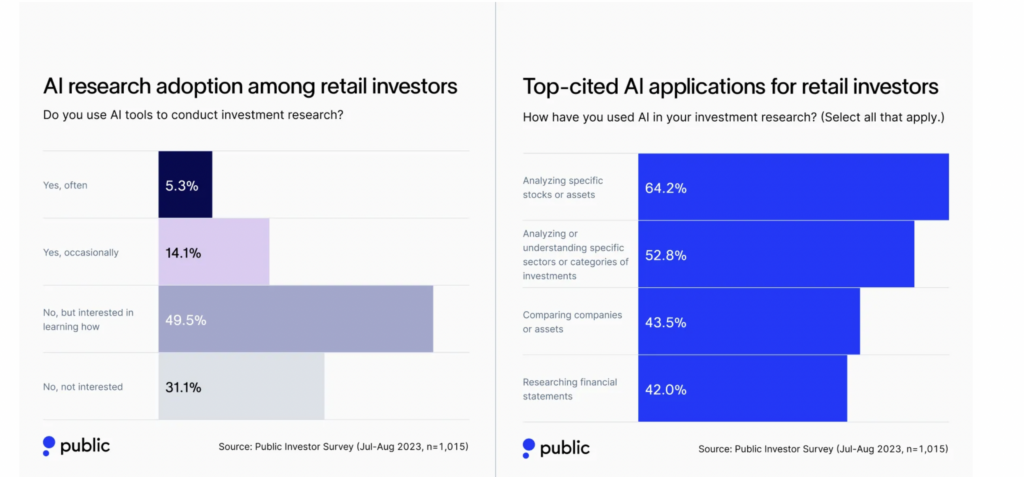

Public.com survey: 19% of retail investors use AI for investment research

Nearly one-fifth of retail investors say they are already using AI for investment research, a survey by Public.com reveals.

Public’s latest Retail Investing Report is qualitative research via Public verified investor surveys fielded Jul/Aug-23 (n=1,015), Jun-23 (1,005), and Jan-23 (n=1,036). All surveys reflect the responses of individuals with approved/funded accounts on the Public platform, U.S. adults 18+.

The survey shows that when prioritizing sources for financial information, 69.4% of retail investors say trust and credibility are more important in 2023 vs. 2022. A majority say that these factors are “significantly” more important.

19% of retail investors already use AI for investment research, with most holdouts being investors interested in learning how to leverage AI to inform their portfolio strategies.

The growing role of AI in investment research is balancing social media as a primary channel for decision-making. 16.4% of investors say social buzz is an “important signal” in their decision-making.

Investors continue diversifying across asset classes, with megatrends and cultural moments sparking the discovery of new investment strategies and opportunities. Increased adoption of fixed-income strategies in 2023 balanced out growth plays that tracked trending technologies and companies.

Investors on the Public platform have increased the number of distinct asset classes (e.g. stocks, ETFs, T-bills, cryptos, and alts) owned by 25% year-over-year.

ETFs’ share of portfolio AUM on Public increased 4.4X year-over-year.

AI thematic ETFs saw a 34% YoY increase in net new investors, with Nvidia (NVDA) emerging as one of the most high-interest stocks on the platform by pageviews and trading volume.

Cultural buzz, positive and negative, translated into retail investor trades in specific companies. The total number of Public investors in Mattel (MAT) increased 6.6X following the success of “Barbie,” and the total number of investors in Bud Light’s parent company AB InBev (BUD) total investors on Public increased 1.5X amid controversy beginning in April 2023.

Economic outlook is mixed: 59.9% of retail investors are optimistic or neutral about the economy and 40.1% are pessimistic. That said, a majority of retail investors are confident in their portfolio strategies despite economic uncertainty.

Finally, 31.1% of investors say their risk appetite increased by the end of 1H 2023, compared to 16.7% who reported an increased appetite for risk at the start of the year.