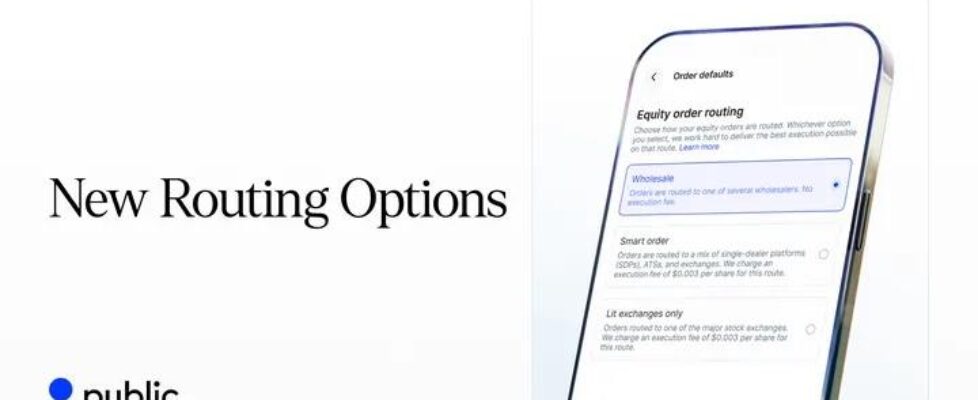

Public.com rolls out update giving traders more visibility over routing of stock and ETF orders

Public.com has rolled out an update that gives traders more visibility — and more control — over how their stock and ETF orders are routed.

These changes allow Public.com clients to choose their routing preference, while Public.com continues to prioritize best execution on every trade.

Now Public.com members can choose between three routes for their trades for US-listed stocks and ETFs: wholesale, smart, and lit.

- Wholesale route (no fee)

Orders are routed to wholesalers for execution, the standard routing method used by most retail brokerages. There is no execution fee for this option.

- Smart order route ($0.003/share)

Orders are routed to a wide array of national stock exchanges, alternative trading systems (ATS), and single dealer platforms (SDP). Because Public.com often pays fees to the venues on this route, it charges a fee of $0.003 per share for orders executed on this route.

- Coming soon: Lit exchange route ($0.003/share)

Orders are routed only to “lit” exchanges, such as the NYSE and Nasdaq. As with smart routing, Public.com pays execution fees to the exchanges on most orders. As a result, Public.com charges a fee of $0.003 per share for orders executed on this route.

To compete with the exchanges, the wholesalers on the wholesale route pay us “payment for order flow” or “PFOF”. Public.com says it does not receive PFOF from wholesalers on the two other routes, though it may receive exchange or venue rebates.