Plus500 registers steep rise in revenue in H1 2022

Online trading company Plus500 Ltd (LON:PLUS) today issued a trading update for the six months ended 30 June 2022.

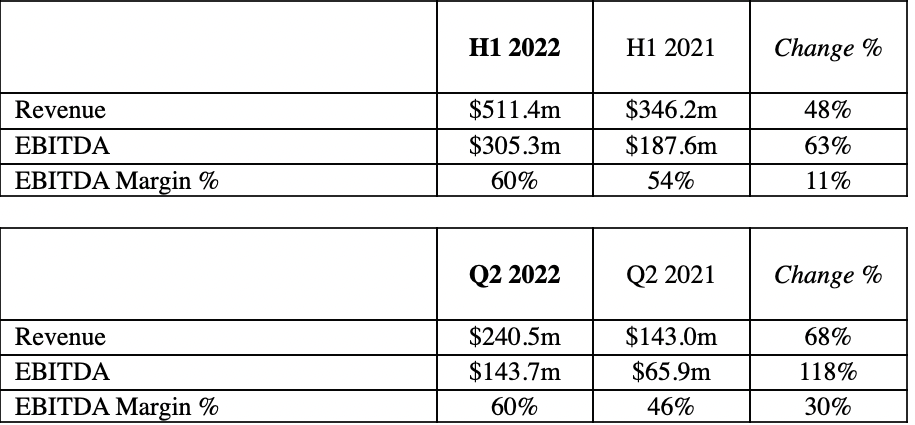

Plus500 reported revenue of $511.4 million for the first six months of 2022, up 48% from the equivalent period a year earlier. Higher Group revenue reflects Customer Trading Performance of $171.6m in H1 2022 (H1 2021: $(33.0m)), including $88.7m in Q2 2022 (Q2 2021: $(14.7m)).

Customer Income, a key measure of the Group’s underlying performance, was at a level of $339.8m in H1 2022 (H1 2021: $379.2) including $151.8m in Q2 2022 (Q2 2021: $157.7m).

The Group onboarded 57,275 New Customers during H1 2022 (H1 2021: 136,980), including 23,535 in Q2 2022 (Q2 2021: 47,574).

Given this strong performance, the Board of Directors of the Company expects that Plus500’s revenue and EBITDA for the current financial year will be ahead of current market expectations.

Plus500 launched a new global advertising campaign during the period to drive brand awareness in key strategic markets, thereby ensuring the Group remains well positioned to attract and retain a higher level of customers over the medium to long term.

During the period, Plus500 made substantial progress in the significant and fast-growing U.S. futures market.

Firstly, the Group has built a new strategic position as a market infrastructure provider in the significantly growing U.S. futures market, supporting institutional clients in their trading, clearing and settlement activities.

Secondly, Plus500 has developed, and is expected to launch in H2 2022, an intuitive, user-friendly new trading platform for the substantial retail futures market in the U.S., to capitalise on the recent initiatives and product launches which were originated by the various exchanges operating in the U.S. futures market to increase the market accessibility to the applicable retail audience.

The Group is seeking to maximise these opportunities by deploying its technological expertise and infrastructure and by utilising its financial strength and key market partnerships. Accordingly, the Group will allocate substantial on-going financial and personnel resources to maximise these opportunities in the medium term.

Plus500’s financial position remains robust and the Group continues to be debt-free since inception, with healthy cash balances of more than $950m as of 30 June 2022 and consistently high levels of cash generation.

With the Group’s strong financial position in mind, and reflecting the Board’s confidence in the future prospects of Plus500 and its view of the current value of the Company’s shares, the Company has announced share buybacks totalling approximately $105.0m since the start of FY 2022.

During the first half of the year, the Company has repurchased 2,670,651 shares, at an average price of £14.98, for a total cash consideration of $51.7m.

The Board remains highly confident about the Group’s performance for FY 2022, and therefore anticipates that Plus500’s revenue and EBITDA for the current financial year will be ahead of current market expectations.

Plus500 will continue to pursue several major growth opportunities, through organic investments and by actively targeting acquisitions, with entry planned in a number of new markets including the substantial retail market in Japan. Therefore, the Group remains well-positioned to deliver sustainable growth over the medium and long term as a global multi-asset fintech group.

During the period, Daniel King completed his maximum nine-year tenure as an Independent Non-Executive Director and External Director of the Board. Anne Grim, Senior Independent Non-Executive Director and External Director, has taken Daniel King’s place as a member of the Board’s Nomination Committee and as Chair of the Remuneration Committee, and Steve Baldwin, Independent Non-Executive Director, has taken Daniel King’s place as Chair of the ESG Committee.

David Zruia, Chief Executive Officer, commented:

“Plus500 continued to outperform in the first half of 2022, supported by positive momentum achieved in recent years and by the power of our market-leading proprietary technology. We made significant progress in delivering against our strategic priorities, in particular the major growth opportunities in the U.S., where we continue to make substantial investment.

“In addition, the Group continued to deliver outstanding levels of returns to shareholders during the period, through both recent $60.0m dividend payments and our most recent $105.0m aggregate share buyback programmes, which emphasise the Board’s view of the current value of the Company’s shares. Our continued strategic, operational and financial momentum will ensure Plus500 delivers sustainable growth in the medium to long term, enabling the Group to deliver further shareholder value in the future.”

Professor Jacob A. Frenkel, Chairman, commented on the Board changes:

“On behalf of the Board, I would like to thank Daniel King for his valuable contribution to the success of Plus500 since his appointment to the Board at the time of the Company’s IPO in 2013. His expertise working with international technology businesses, has been invaluable in helping to optimise the many opportunities that have arisen for the business during his tenure. In addition, his leadership, contribution and commitment as Chair of the Remuneration and ESG Committees has been extremely appreciated. We wish Daniel all the best for the future.”