Plus500 forecasts FY22 revenue and EBITDA ahead of market expectations

Online trading company Plus500 Ltd (LON:PLUS) today issued a trading update, noting that trading in Q2 2022 to date has continued to be very strong, supported by current market conditions.

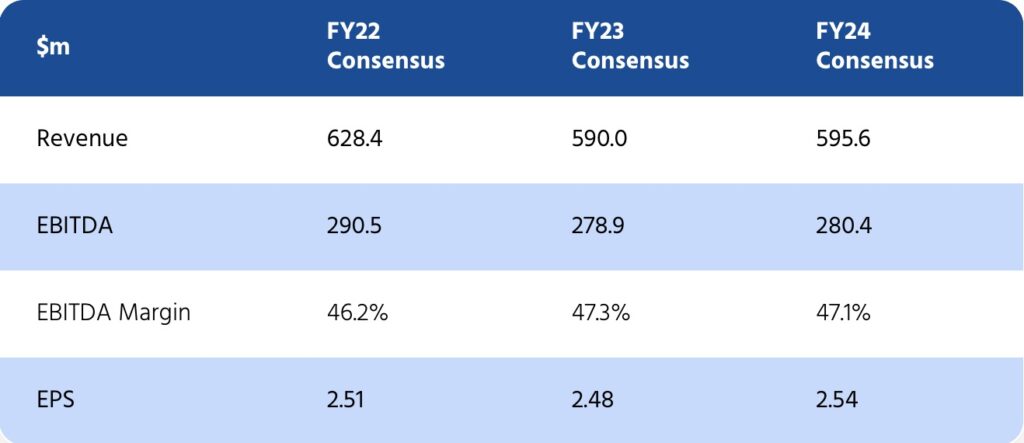

Consequently, the Board has increasing confidence around the Group’s performance for FY 2022, and therefore anticipates that Plus500’s revenue and EBITDA for this year will be significantly ahead of current market expectations.

The Group’s strong performance so far in FY 2022 has also been driven by the development of new proprietary technologies and product offerings, which will deliver growth and drive expansion and diversification across new geographies.

Furthermore, Plus500 says it will continue to build its strategic position as a global multi-asset fintech group, through organic investments and by actively targeting acquisitions, to help deliver sustainable growth over the medium to long term.

Plus500’s financial position remains very robust and the Group continues to be debt-free, with healthy cash balances driven by consistently high levels of cash generation.

Revenue in Q1 2022 was $270.9m (Q4 2021: $161.1m, Q1 2021: $203.2m).

Customer Income, a key measure of the Group’s underlying performance, was again robust at $188.0m in the quarter (Q4 2021: $166.7m, Q1 2021: $221.5m).

Customer Trading Performance during Q1 2022 stood at $82.9m, (Q4 2021: ($5.6m), Q1 2021: ($18.3m)). The Company continues to expect that the contribution from Customer Trading Performance will be broadly neutral over time.

EBITDA in Q1 2022 was $161.6m (Q4 2021: $70.9m, Q1 2021: $121.7m) with EBITDA margin of 60% (Q4 2021: 44%, Q1 2021: 60%). This EBITDA performance was supported by the Company’s lean, flexible cost base and efficient business model.