Plus500 expects FY 2021 earnings to beat analysts’ consensus forecasts

Online trading company Plus500 Ltd (LON:PLUS) today issued a trading update for the period ended 30 September 2021.

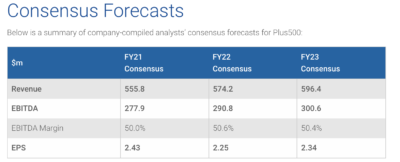

The company says it delivered further positive momentum during Q3 2021, despite more stable market conditions when compared to recent quarters. Consequently, the Board now expects FY 2021 revenue and EBITDA to be ahead of current compiled analysts’ consensus forecasts.

This positive momentum was highlighted by the consistent strength of Customer Income, a key underlying growth metric for Plus500, which has supported a strong revenue performance during the year to date.

Plus500’s Active Customer base has grown significantly during the last few years, with the Group achieving on-going success in onboarding New Customers during the year to date. This has been delivered as a result of significant investment in the Company’s marketing technology to drive attractive return-on-investment, which will continue to be made, in order to drive further platform engagement in the future.

During the period, Plus500 made further progress in establishing its position as a global multi-asset fintech group. This progress has been driven by further investment in Plus500’s market-leading proprietary CFD technology platform, its acquisition of Cunningham Commodities LLC, a regulated Futures Commission Merchant, and Cunningham Trading Systems LLC., a technology trading platform provider in the US, and through the launch of ‘Plus500 Invest‘, the company’s new share dealing platform.

Let’s recall that, for the first half of 2021, the Group generated total revenue of $346.2 million, down from $564.2 million, generated in the year-ago period.

EBITDA for H1 2021 was $187.6 million, down from $361.8 million registered in the first half of 2020.

Net profit in H1 2021 was $165.1 million, compared to $320.0 million registered in the equivalent period in 2020.