NAGA Group shares up 7% on record May volumes, US OTC listing

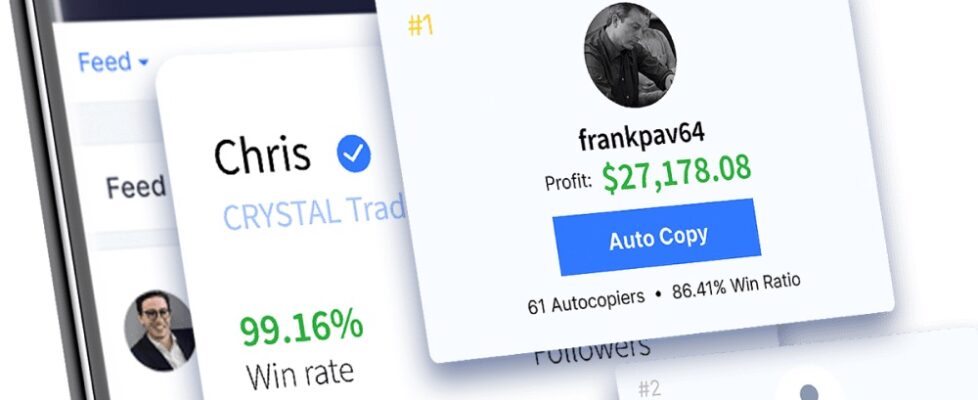

Shares of Hamburg, Germany based social trading focused Retail FX and CFD broker NAGA Group AG traded up 7% on Monday after the company released news of yet another month of trading volume records, an increase in Revenues, and plans to have the company’s shares traded on the US OTCQX Venture Market.

The company reported year-to-date (to the end of May 2021) unaudited group sales of lose to €20 million, an increase of +90% compared to €10.1 million in 2020 in the same period. Trading volume crossed €100 billion for the year, with a new monthly record of €24 billion (USD $28.5 billion) traded in May, an increase of +167% compared to the same period in 2020 and about 10% up MoM from April’s €22 billion.

More than 155,000 new accounts joined NAGA.com in 2021 which is already more than the entire year of 2020 (122,000) and a growth of more than +316% in the same period compared to 2020. Finally, transactions crossed 5 million in 2021, which is an increase of 127% compared to the same period in 2020 (2.2 million).

“This trading update marks 2 years since our management restructure, whereby I have had the opportunity to take over as CEO alongside my Executive Board colleague Michalis Mylonas to execute our growth strategy. It is exciting to see that compared to the same period in 2019, where revenue stood at EUR 0.9 million, we are now able to report a growth in revenue by more man twenty times. We will remain focused on growing our brand authority further and increase user base. Together with our new product launches such as NAGA Pay, our expanded crypto offering and improved platform experience, we are on track to hit the projections for 2021 becoming based on revenue, one of the strongest FinTech companies in Germany”, said NAGA CEO Benjamin Bilski.

NAGA added that the company’s shares are now cross-traded publicly on the OTCQX Venture Market which makes NAGA shares widely available to North American investors. Trading on the US OTCQX does not have an impact on existing NAGA’s ordinary shares and no new ordinary shares were issued as part of the cross-trade. NAGA said that it continues to rely on the announcements and disclosures it makes to Scale and does not have SEC reporting requirements. OTC Markets operates the world’s largest electronic interdealer quotation system for US broker dealers and offers multiple media channels to increase the visibility of OTC-traded companies.

“We are truly excited to see The NAGA Group AG on the US Markets enhancing our visibility in North America. We expect increased liquidity and new investors participating to trade NAGA shares”, adds Bilski.