NAGA Group borrows $6 million to repay Convertible Notes due Oct 30

Hamburg based, social trading focused online brokerage NAGA Group AG (ETR:N4G) has announced that it has taken out a loan (without conversion rights) from an unnamed institutional investor with a term of 12 months.

While NAGA didn’t specify the exact amount of the loan, it did state that the proceeds were to be used in partial repayment of the $8.2 million, 6-month loan it took out in April 2023, via an issue of convertible bonds made by NAGA, as was exclusively reported at the time here at FNG. NAGA stated that it negotiated an adjustment in terms on the convertible bonds (which become due with interest on October 30), such that $6 million will be repaid on time next week, and a further $2.7 million (including accrued interest) will be repaid on January 30, 2024.

NAGA also stated that the convertible bond holder will not exercise its conversion right so that there will be no dilution for NAGA shareholders. However that seemed fairly obvious, in that NAGA shares at the time the bond was issued were trading at about €1.75 (with the conversion price set at about that level), but have fallen by about 36% since then to €1.12. A conversion would result in a heavy loss for the bondholder.

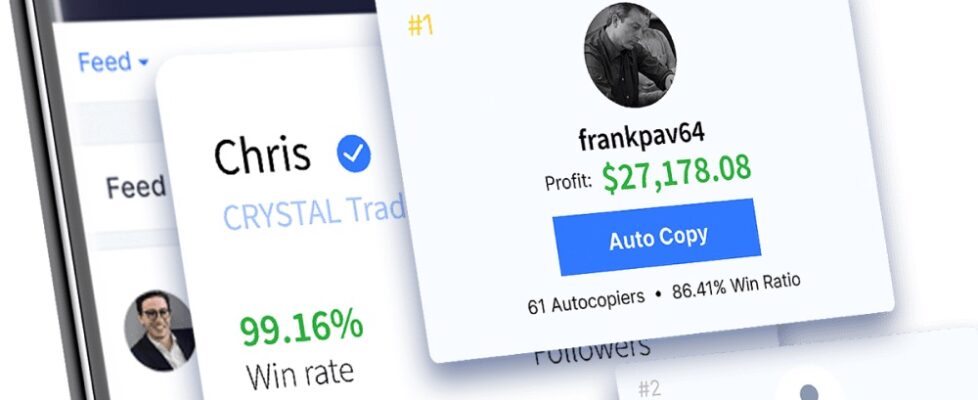

In a separate announcement, NAGA stated that it is soon launching its first ever White Label partnership with a regulated online-brokerage from Kuwait, and that it has developed a unique “Communities” feature allowing certain super-influencers, trading educators and partners to run and promote their very own social trading community with a fully custom and branded version of the NAGA Platform. The communities platform went live in Mexico on October 20th.

NAGA founder and CIO Benjamin Bilski said:

NAGA founder and CIO Benjamin Bilski said:

“In the course of our R&D and engineering efforts, we have identified a problem for our existing super influencers and partners who manage their communities using ordinary Social Media apps such as Instagram, Facebook or Telegram where communication and trading activity is disconnected. With the NAGA communities feature, Influencers can utilize all our social media features which are instantly connected with the trading platform and run their very own community branded as their own platform. This will drive more personalized engagement and identification of the community as a whole.”

NAGA Group operates offshore (Seychelles) site naga.com and CySEC-licensed nagamarkets.com.

October 25, 2023 @ 9:43 am

sure sounds like Naga has too much debt, can’t pay back the debt on time and is just trying to survive by taking out a new loan to repay an old loan come due. stock keeps dropping. stay away folks