Monex retail investor survey shows high expectations for US stocks

Online trading company Monex, Inc has conducted the twenty-ninth Monex Global Retail Investor Survey in collaboration with Group companies TradeStation Securities, Inc. and Monex Boom Securities (H.K.) Limited from November 19 to November 28, 2021. Today, the broker posted the key results from the survey.

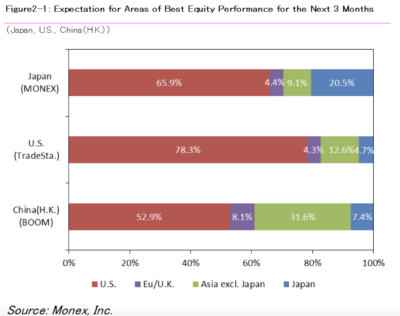

Expectations for U.S. stocks were the highest among retail investors in all three regions. Retail investors in all three regions answered that the U.S. is the region with the greatest likelihood of stock price appreciation in the coming three months. Many investors appear to expect stock prices to continue to rise in the U.S., which is propelling the world economy.

The broker asked retail investors in each region about their views on the world stock market for the coming three months. The response is measured via DI (diffusion index): The percentage of respondents who answered, “will rise or improve” minus the percentage of respondents who answered “will fall or deteriorate.”

Among retail investors in Japan, the DI rose significantly from the previous survey (conducted in December 2020). However, the DI fell among retail investors in both the U.S. and China.

Further, the broker asked investors about the 2022 U.S. market outlook: In Japan and China (Hong Kong), most retail investors expect that the Dow Jones high will be USD34,000 to USD38,000. Looking at the outlook for 2022 lows, most investors in both regions expect that the low will be between USD27,000 and USD31,000. At the end of November, the New York Dow Jones Industrial Average was USD34,483.

Investors in all countries appear to be concerned about market corrections to a certain degree.

Finally, Monex asked retail investors about much discussed cryptocurrency such as Bitcoin, with respect to their experience with it and their willingness to invest in it. The percentage of retail investors replying that they had already invested in cryptocurrency was 19.6% in Japan, 33.1% in the U.S. and 18.4% in China (Hong Kong), the highest level in each country since this question was introduced.

Investment in cryptocurrency among retail investors appears to be becoming more widespread globally.