Jefferies now owns 100% of outstanding interests of FXCM

Jefferies Financial Group, Inc. (NYSE:JEF) has posted its SEC filing for the quarter to end-August 2023, with the document revealing details about Jefferies’ relationship with FXCM.

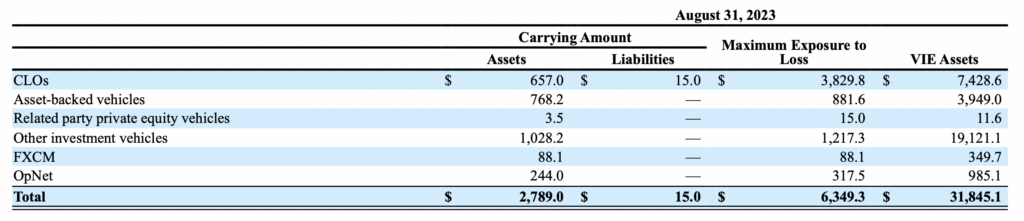

Jefferies has equity interests in FXCM of $48.9 million and $59.7 million at August 31, 2023 and November 30, 2022, respectively, consisting of a 49.9% voting interest in FXCM and rights to a majority of all distributions in respect of the equity of FXCM.

Jefferies also has a senior secured term loan to FXCM, which is accounted for at a fair value of $39.2 million and $35.1 million, at August 31, 2023 and November 30, 2022, respectively.

The assets of FXCM primarily consist of brokerage receivables and other financial instruments and operating assets as part of FXCM’s foreign exchange trading business.

During the three and nine months ended August 31, 2023, Jefferies contributed additional capital of $10.0 million and $20.0 million, respectively.

In March 2023, certain noteholders of Global Brokerage Inc. (“GLBR”) filed an involuntary bankruptcy petition against GLBR and its subsidiary, Global Brokerage Holdings LLC (“Holdings”), which holds a 50.1% voting equity interest in FXCM.

On September 14, 2023, Jefferies completed a foreclosure on the collateral that GLBR had pledged to secure its obligations under a credit facility, which consisted of GLBR’s equity interest in FXCM. As a result of the foreclosure, Jefferies now owns 100% of the outstanding interests of FXCM; and FXCM has become a consolidated subsidiary.

The acquisition of the additional 50.1% interests in FXCM will be accounted for as a business combination and, accordingly, Jefferies will remeasure its previously existing 49.9% interest at fair value and recognize the fair value of 100% of the identifiable assets and assumed liabilities of FXCM as of the date of the acquisition.

Jefferies has begun the process of measuring, as of the acquisition date, the acquired assets and assumed liabilities. The initial allocation of the purchase price for the acquisition is pending the completion of Jefferies’ analysis.