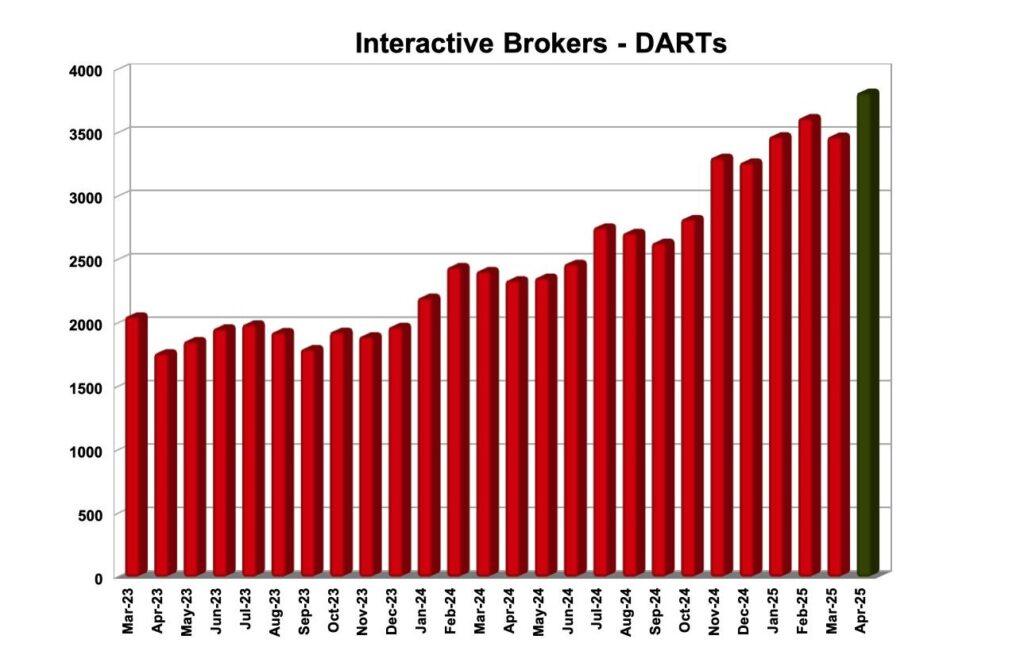

Interactive Brokers reports 63% Y/Y jump in DARTs in April 2025

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just posted its key operating metrics for April 2025.

The brokerage registered 3.818 million Daily Average Revenue Trades (DARTs), 63% higher than in April 2024 and 10% higher than in March 2025.

Ending client equity amounted to $588.1 billion, 28% higher than prior year and 3% higher than prior month.

Ending client margin loan balances were $58.2 billion, 15% higher than prior year and 9% lower than prior month.

Ending client credit balances totalled $132.8 billion, including $5.0 billion in insured bank deposit sweeps, 26% higher than prior year and 6% higher than prior month.

Interactive Brokers reported 3.71 million client accounts, 32% higher than prior year and 3% higher than prior month.

The average commission per cleared Commissionable Order was $2.75 including exchange, clearing and regulatory fees.

Speaking of Interactive Brokers’ performance, let’s note that the company has recently posted its financial results for the first quarter of 2025.

Reported net revenues were $1,427 million for the first quarter of 2025 and $1,396 million as adjusted. For the year-ago quarter, reported net revenues were $1,203 million and $1,216 million as adjusted.

Commission revenue increased 36% to $514 million on higher customer trading volumes. Customer trading volume in stocks, options and futures increased 47%, 25% and 16%, respectively.

Reported income before income taxes was $1,055 million for the first three months of 2025 and $1,024 million as adjusted. For the year-ago quarter, reported income before income taxes was $866 million and $879 million as adjusted.

Net interest income increased 3% to $770 million on higher average customer margin loans and customer credit balances.