Interactive Brokers registers rise in revenues in Q4 2025

Interactive Brokers Group, Inc. (NASDAQ:IBKR), an automated global electronic broker, has announced its financial results for the quarter ended December 31, 2025.

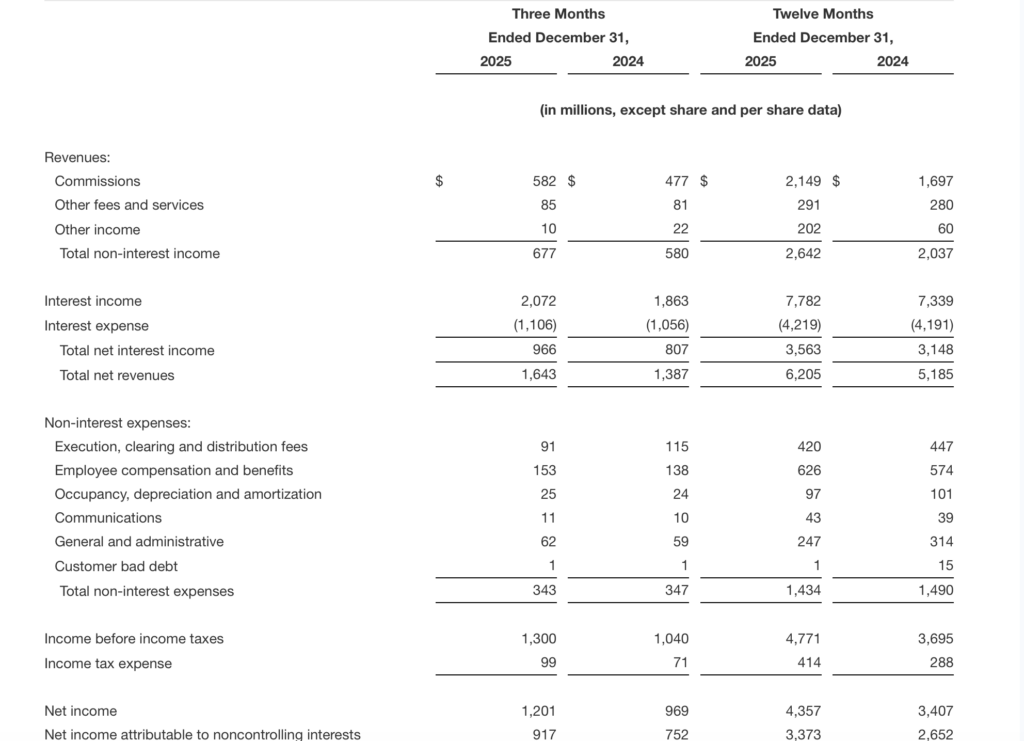

Reported diluted earnings per share were $0.63 for the current quarter and $0.65 as adjusted. For the year-ago quarter, reported diluted earnings per share were $0.50 and $0.51 as adjusted.

Reported net revenues were $1.64 billion for the current quarter and $1.67 billion as adjusted. For the year-ago quarter, reported net revenues were $1.39 billion and $1.42 billion as adjusted.

Commission revenue increased 22% to $582 million on the back of higher customer trading volumes. Customer trading volume in options, futures and stocks increased 27%, 22% and 16%, respectively.

Reported income before income taxes was $1.30 billion for the current quarter and $1.33 billion as adjusted. For the year-ago quarter, reported income before income taxes was $1.04 billion and $1.08 billion as adjusted.

Net interest income increased 20% to $966 million thanks to higher average customer margin loans and customer credit balances and stronger securities lending activity.

Other fees and services increased 5% to $85 million, led by increases of $5 million in payments for order flow from exchange-mandated programs, $2 million in FDIC sweep fees and $2 million in market data fees, partially offset by a decrease of $9 million in risk exposure fees.

Execution, clearing and distribution fees decreased 21% to $91 million, driven by lower regulatory fees, as the SEC Section 31 transaction fee rate was reduced to zero on May 14, 2025, and greater capture of liquidity rebates from certain exchanges due to higher trading volumes in stocks and options.

Pretax profit margin for the current quarter was 79% both as reported and as adjusted. For the year-ago quarter, pretax margin was 75% as reported and 76% as adjusted.

Total equity amounted to $20.5 billion.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.08 per share. This dividend is payable on March 13, 2026, to shareholders of record as of February 27, 2026.

- Customer accounts increased 32% year-on-year to 4.40 million.

- Customer equity increased 37% to $779.9 billion.

- Total daily average revenue trades (DARTs) increased 30% to 4.04 million.

- Customer credits increased 34% to $160.1 billion.

- Customer margin loans increased 40% to $90.2 billion.