Interactive Brokers registers rise in revenue in Q1 2024

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has reported its results for the quarter ended March 31, 2024.

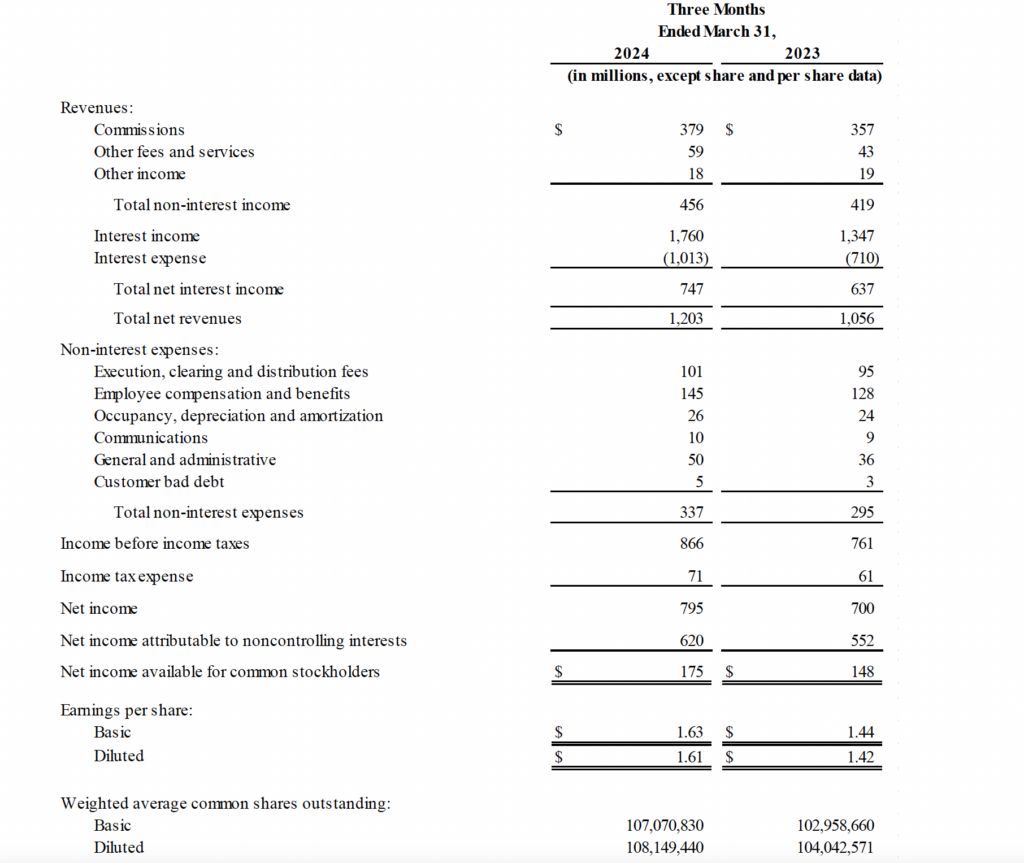

Reported diluted earnings per share were $1.61 for the first quarter of 2024 and $1.64 as adjusted. For the year-ago quarter, reported diluted earnings per share were $1.42 and $1.35 as adjusted.

Reported net revenues were $1,203 million for the first quarter of 2024 and $1,216 million as adjusted. For the year-ago quarter, reported net revenues were $1,056 million and $1,015 million as adjusted.

Reported income before income taxes was $866 million for the current quarter and $879 million as adjusted. For the year-ago quarter, reported income before income taxes was $761 million and $720 million as adjusted.

Commission revenue increased 6% to $379 million.

Customer trading volume was mixed across product types with options contract volume up 24%, while futures contract and stock share volumes were down 3% and 16%, respectively.

Net interest income increased 17% to $747 million on higher benchmark interest rates, customer margin loans and customer credit balances.

Execution, clearing and distribution fees expenses increased 6% to $101 million, driven by higher customer trading volume in options.

Pretax profit margin for the first quarter of 2024 was 72% both as reported and as adjusted. For the year-ago quarter, reported pretax margin was 72% and 71% as adjusted.

The Interactive Brokers Group, Inc. Board of Directors declared an increase in the quarterly cash dividend from $0.10 per share to $0.25 per share. This dividend is payable on June 14, 2024, to shareholders of record as of May 31, 2024.