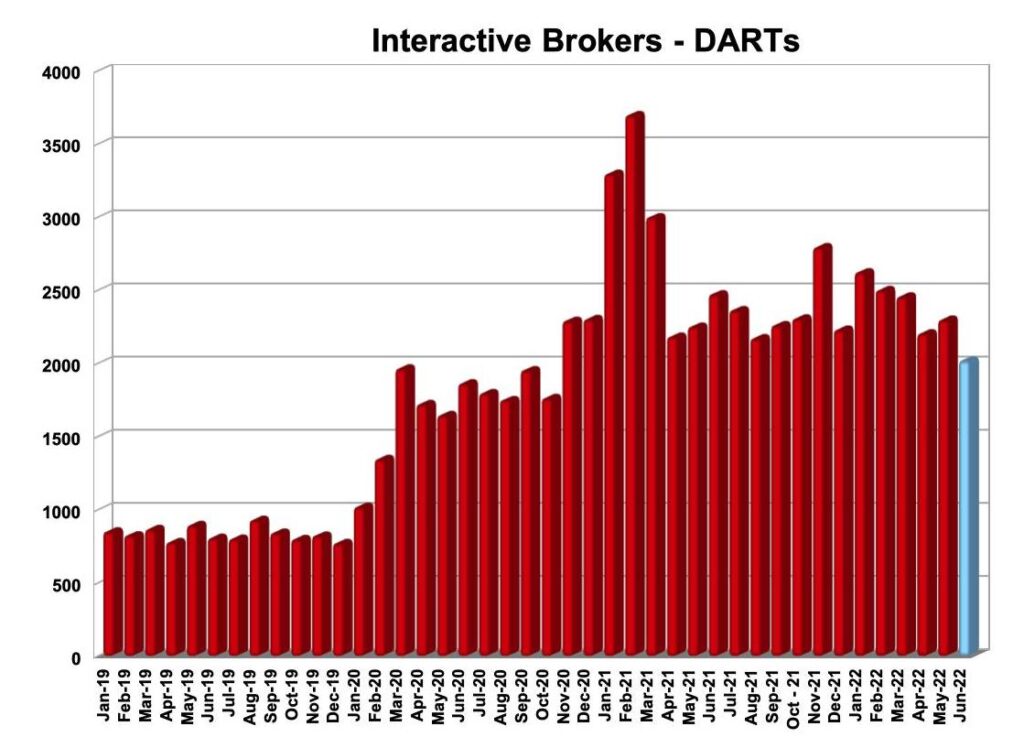

Interactive Brokers registers 18% Y/Y drop in DARTs in June 2022

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just published its key operating metrics for June 2022.

Interactive Brokers registered 2.019 million Daily Average Revenue Trades (DARTs), 18% lower than prior year and 12% lower than the level of 2.297 million reported in May 2022.

The brokerage reported ending client equity of $294.8 billion, 19% lower than prior year and 6% lower than prior month. The number of client accounts reached 1.92 million, 36% higher than prior year and 2% higher than prior month.

The average commission per cleared Commissionable Order was $2.96 including exchange, clearing and regulatory fees.

For the first quarter of 2022, Interactive Brokers reported diluted earnings per share of $0.74 and $0.82 as adjusted. For the year-ago quarter, reported diluted earnings per share were $1.16 and $0.98 as adjusted.

Reported net revenues were $645 million for the first quarter of 2022 and $692 million as adjusted. For the year-ago quarter, reported net revenues were $893 million and $796 million as adjusted. The result for the first three months of 2022 was better than the one recorded in the final quarter of 2021.

Reported income before income taxes was $394 million for the first three months of 2022 and $441 million as adjusted. For the year-ago quarter, reported income before income taxes was $639 million and $542 million as adjusted.

Commission revenue decreased 15% to $349 million in the first quarter of 2022 due to customer stock volume that dropped from an unusually active trading period last year, but was aided by higher customer options and futures trading volumes.

Net interest income decreased 8% to $282 million on a decline in securities lending activity, partially offset by gains on margin lending and segregated cash balances.