Interactive Brokers places certain stock option trading into liquidation only

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has placed certain stock option trading into liquidation only. The reason – the market volatility.

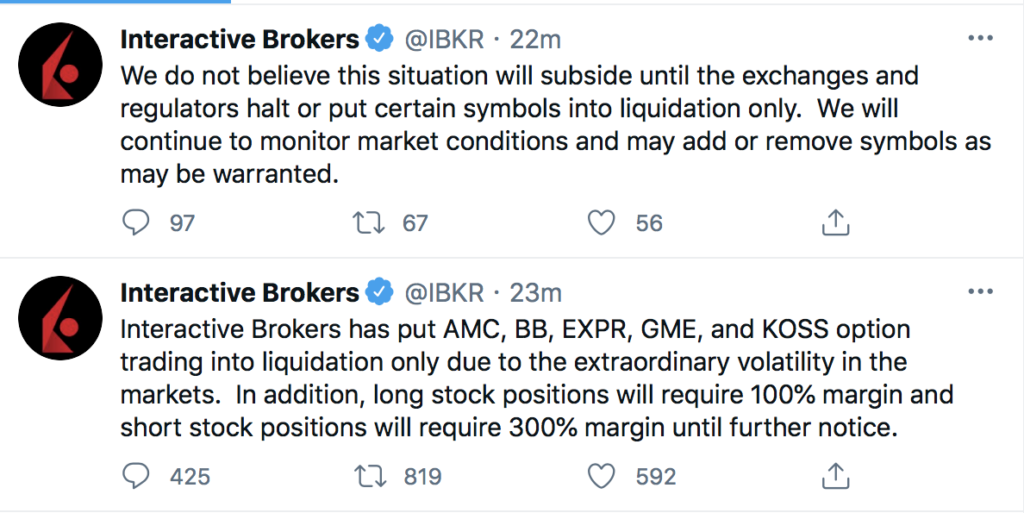

The company has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation only due to the extraordinary volatility in the markets. In addition, long stock positions will require 100% margin and short stock positions will require 300% margin until further notice.

Interactive Brokers says it does not believe that the situation will stabilize until the regulators and exchanges intervene. The company notes that it will continue to monitor the market conditions.

Other online trading firms, such as Robinhood, have also restricted trading in certain securities amid the intense market volatility.

The United States Securities and Exchange Commission (SEC) issued the following statement regarding market volatility on January 27, 2021:

“We are aware of and actively monitoring the on-going market volatility in the options and equities markets and, consistent with our mission to protect investors and maintain fair, orderly, and efficient markets, we are working with our fellow regulators to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants”.