Interactive Brokers marks drop in revenues in Q2 2022

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has reported its financial results for the second quarter of 2022.

Reported diluted earnings per share were $0.72 for the three months to end-June 2022 and $0.84 as adjusted. For the year-ago quarter, reported diluted earnings per share were $1.00 and $0.82 as adjusted.

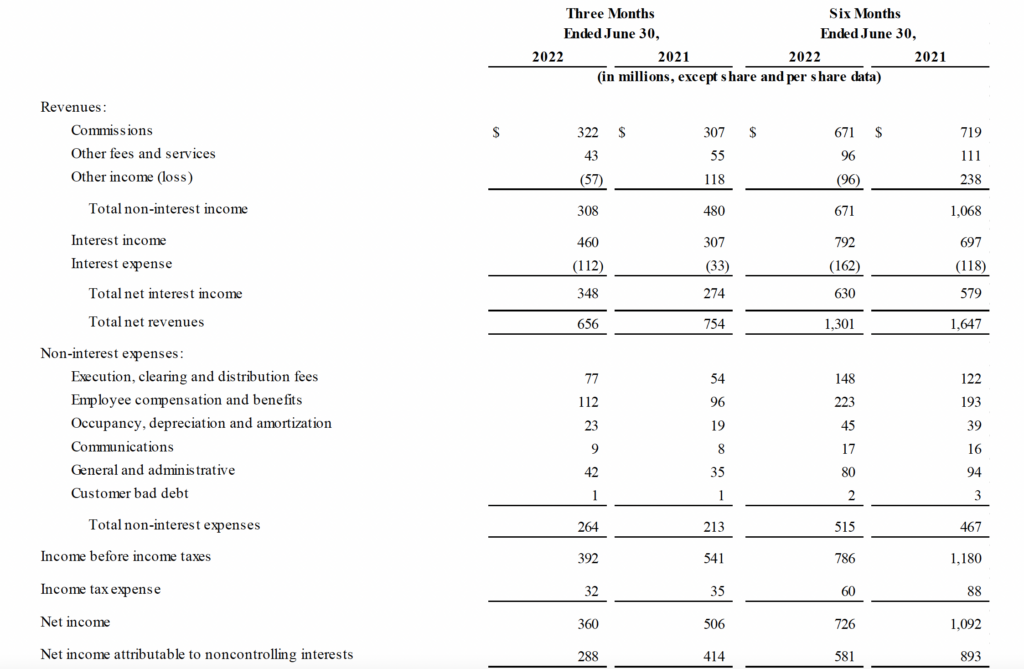

Reported net revenues were $656 million for the second quarter of 2022 and $717 million as adjusted. For the year-ago quarter, reported net revenues were $754 million and $650 million as adjusted. The result, however, was better than the $645 million in net revenues registered in the first quarter of 2022.

Reported income before income taxes was $392 million for the second quarter of 2022 and $453 million as adjusted. For the year-ago quarter, reported income before income taxes was $541 million and $437 million as adjusted.

Commission revenue increased 5% to $322 million on higher customer options and futures trading volume tempered by lower stock volume.

Net interest income increased 27% to $348 million on higher benchmark interest rates and customer balances, partially offset by a decline in securities lending activity.

Other income decreased $175 million to a loss of $57 million. This decrease was mainly comprised of the non-recurrence of a $113 million gain related to Interactive Brokers’ strategic investment in Up Fintech Holding Limited (“Tiger Brokers”), $44 million related to IBKR’s currency diversification strategy, and $7 million related to its U.S. government securities portfolio.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on September 14, 2022, to shareholders of record as of September 1, 2022.

Customer accounts increased 36% year-on-year to 1.92 million.

Customer equity decreased 19% to $294.8 billion, including approximately 3% due to an omnibus broker that is now using a trust company for custody.

Total daily average revenue trades (DARTs) decreased 6% to 2.17 million, whereas cleared DARTs decreased 7% to 1.93 million.

Customer margin loans decreased 13% to $42.6 billion.