IG sees shift in investing habits among its clients

Electronic trading major IG has started to see a shift in investing habits amongst its clients this year due to the current risk-off sentiment as a result of interest rate hikes, rising inflation levels and the ongoing conflict in Ukraine.

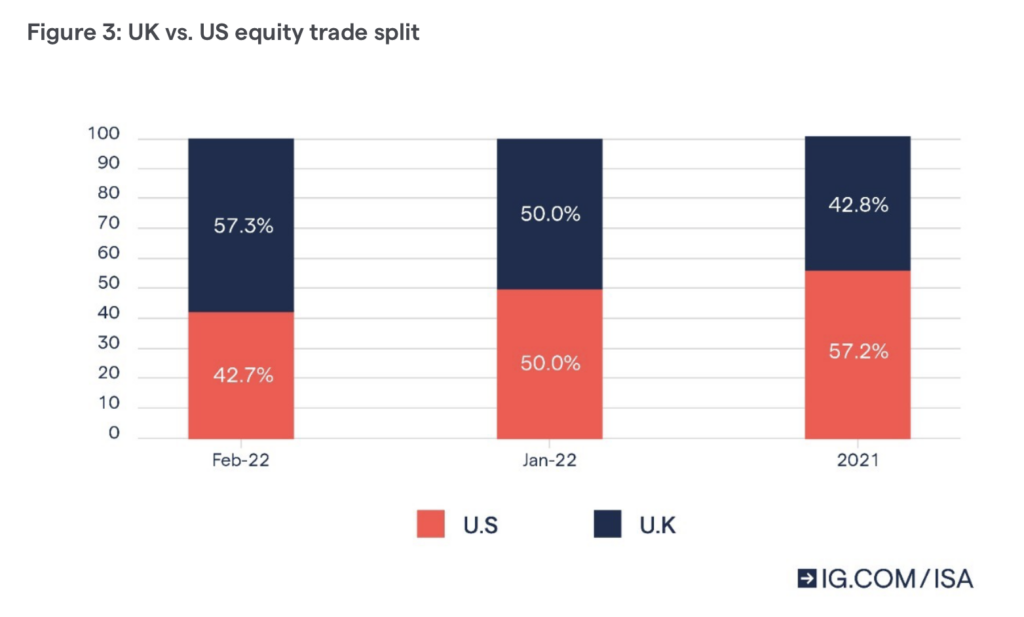

In response this, one of the key changes the broker has started to see is a significant increase in popularity of UK stocks at the expense of US equities. As of February, UK equities accounted for the majority of new trades amongst IG investors and the trade split versus US stocks has been steadily increasing in favour of UK shares.

The trade split last month was 57.3% for UK stocks whereas in the whole of 2021 it was essentially the opposite with US equities capturing 57.2% of trades.

The growing popularity of UK stocks has occurred due to its recent outperformance in comparison to US shares. Since the start of this year the FTSE 100 has returned +8.4% more than the S&P 500, as of the end of February. This overperformance is mostly down to the FTSE 100’s larger exposure to value stocks, which have historically performed better in the current environment of rising interest rates.

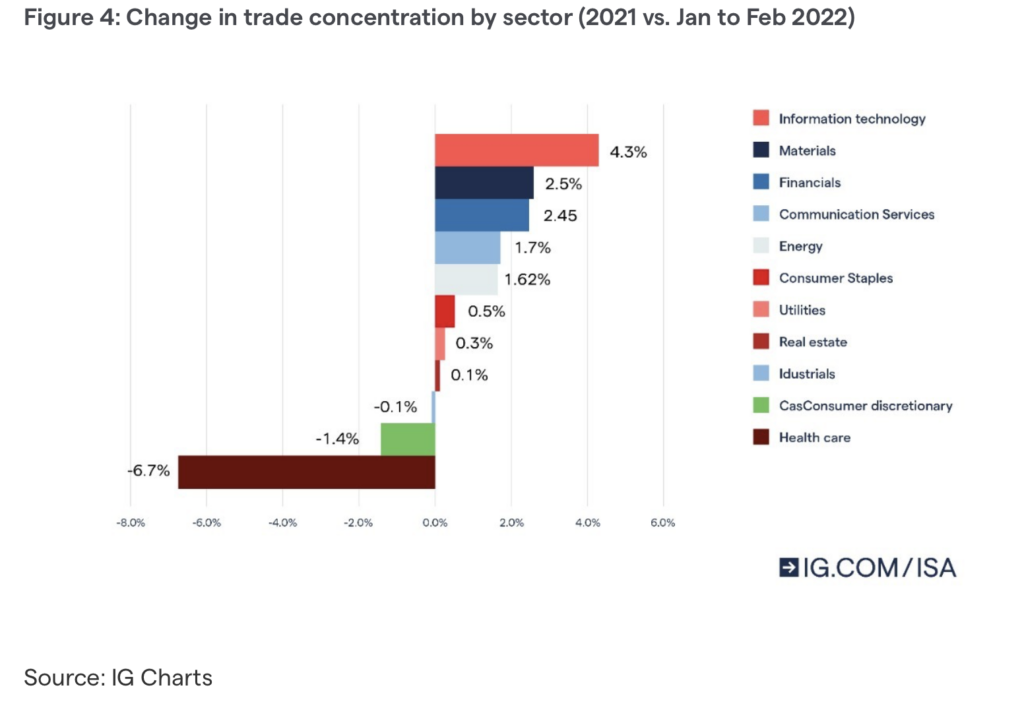

Also, in recent months IG has started to see a shift towards value stocks more broadly as IG investors have started to tilt away from riskier assets. IG clients have, proportionally, invested less in health care and consumer discretionary stocks over the first two months of 2022. This has been in favour of investing in traditional value sectors such as materials and financials which have seen growth of 2.5% and 2.4% respectively.

Technology stocks, widely recognised as a growth sector, is an outlier here and did in fact see the largest positive change in terms of trade concentration over this period at +4.3%. However, this can be explained as several large technology firms reported earnings in the first two months of 2022.

As expected, this resulted in heightened interest and is why trades on technology stocks were inflated compared to the full year of 2021. For context, these were some of the most popular technology firms amongst IG ISA clients who reported in January and February this year: Nvidia, Palantir, Microsoft, PayPal, Apple, Advanced Micro Devices.