IG offers its clients to trade Robinhood ahead of listing via ‘grey market’

Online trading major IG is offering its clients to trade Robinhood ahead of its listing via its exclusive ‘grey market’.

Grey markets enable traders to get exposure to a company before it lists on a stock exchange. When you decide to trade the grey market, you’re trading on the estimated market valuation of a company. The final valuation will only be known after the first day of trading – and it is based on the demand shown by the market that day.

With the Robinhood grey market, traders would:

- ‘Buy’ if they think the market cap will be higher than the price indicated;

- ‘Sell’ if they think the market cap will be lower than the price indicated.

There is a difference between trading in Robinhood shares and investing in Robinhood shares.

When trading Robinhood shares with IG, you’ll use spread bets or CFDs to speculate on the stock’s future price movements. You will not take ownership of the underlying assets when trading, which means you can speculate on both rising and falling prices, and get various tax benefits.

When investing in Robinhood shares via IG, you’ll use a share dealing account or tax-efficient ISA. You’ll pay the full value of your investment upfront, taking ownership of the underlying asset. You’ll profit if the share price goes up or if the company chooses to pay dividends.

The Robinhood IPO could take places as early as the first quarter of 2021, as it has been reported that the company is seeking bank advisors.

However, the company has not yet publicly confirmed its timeline or presented a public filing. Given the number of issues the company has faced recently – power outages and fraud investigations – Robinhood could choose not to list yet.

The market Settles basis the market capitalisation of Robinhood at the official close of the primary exchange on the first day of unconditional trading excluding any outstanding and optional shares. All OPEN trades will be voided if there is no floatation by December 31, 2023.

Market info:

- Trading hours: Around the clock : bar 2115 Fri – 0800 Sat

- Deposit factor: 25%

- Lot size: $10

- Min bet: £1 or $1 for CFD

- Max online size per clip: £50 (at this early stage)

- IG is not offering working orders or non-guaranteed stops/ limits.

- CR stops are available with a stop distance of 5pts. Max size of £50 (for now) at any one level with 1 pt. spacings. CR premium has been set as 0.5pts.

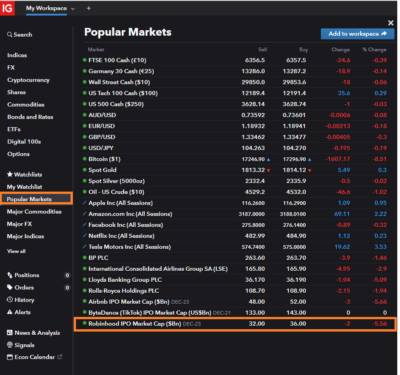

The market can found in the Popular Markets watchlist on Puredeal, WTP and mobile apps and the specific IPO Grey markets watchlist if available. It will not appear in the WTP search function.

This market is available to clients in the UK, Australia, and most European sites (France, Spain and Portugal excluded). It is not available for clients based in Dubai, Japan, and Singapore.