IG Group updates on progress of Independent Reserve acquisition, Freetrade delivers continued strong growth

Electronic trading major IG Group Holdings plc (LON:IGG) today provided its scheduled trading update for the three months ended 30 November 2025.

Let’s note that IG announced on 4 November 2025 a change to its financial year end, moving from 31 May to 31 December with immediate effect.

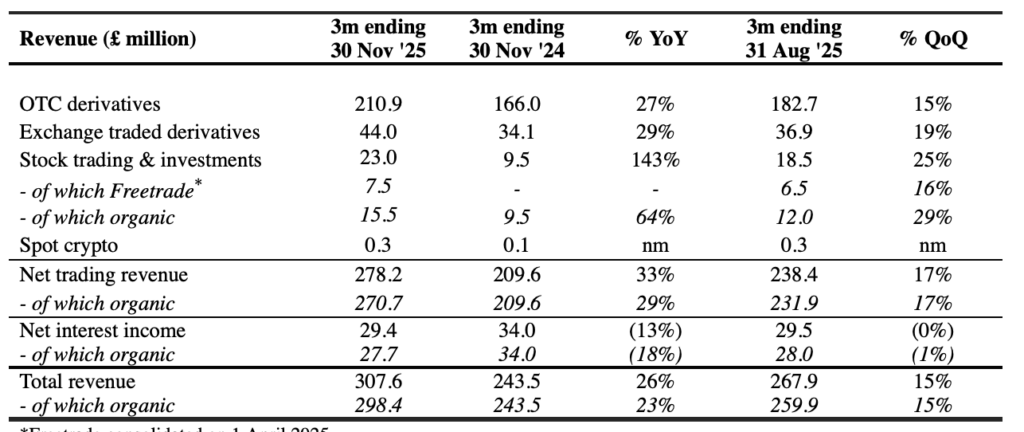

During the three months to end-November 2025, IG’s net trading revenue amounted to £270.7 million, an increase of 29% on the prior year and 17% on the prior quarter benefiting from softer comparators and continued execution of IG’s strategy, including enhanced propositions and increased customer income retention.

Growth was broad-based across all major product categories. The United States remains IG’s fastest growing market, with tastytrade delivering total net trading revenue of $65.3 million, up 51% on the prior year and 19% on the prior quarter.

New customer acquisition accelerated, with first trades up 64% on the prior year and 18% on the prior quarter supported by new products and increased marketing investment and effectiveness. Strong customer growth and stable retention resulted in active customers up 8% on the prior year and 4% on the prior quarter.

Net interest income of £27.7 million declined 18% on the prior year and 1% on the prior quarter, as expected, reflecting higher cash balances, lower interest rates and greater pass-through to customers. Customer cash balances of £4.9 billion increased 13% on the prior year and 5% on the prior quarter, of which £450 million was held on IG’s balance sheet (30 November 2024: £490 million; 31 August 2025: £433 million).

Strong OTC derivatives net trading revenue growth reflected enhanced product velocity, including the launch of 24/5 trading, pre-IPO markets and an improved professional client offering, alongside actions to improve customer income retention which increased compared with the prior year and the 12 months ended 31 May 2025.

Within exchange traded derivatives, tastytrade net trading revenue of $58.2 million increased 46% on the prior year and 18% on the prior quarter (three months to 30 November 2024: $39.8 million; three months to 31 August 2025: $49.3 million). A new divisional leadership team is now in position to strengthen IG’s propositions and accelerate growth in North America, a region expected to play an increasingly important role in the Group’s future expansion.

Stock trading & investments net trading revenue grew strongly on the prior year and prior quarter, driven by IG’s zero commission UK proposition launched in April 2025. This offering has since been expanded to Ireland in October and to both Singapore and France in November. In the three months ended 30 November 2025, organic share dealing volumes in IG’s UK and Ireland business increased 99% on the prior year and 20% on the prior quarter to over 775k trades, with overseas volumes representing 42% of the total.

IG secured a cryptoasset license from the UK Financial Conduct Authority on 30 September 2025 and a licence in the EU under the Markets in Crypto-Assets Regulation (MiCA) on 20 November 2025. These licences will enable IG to significantly expand its spot crypto offerings in calendar year 2026, with new propositions planned for APAC, the Middle East and Europe, complementing the Group’s existing UK and North America offerings.

Freetrade has continued to deliver strong performance since the acquisition completed on 1 April 2025, supported by the rollout of new products and features, including a comprehensive range of mutual funds, alongside increased marketing activity and effectiveness.

As at 30 November 2025, Freetrade’s assets under administration (AuA) reached £3.3 billion, up 36% on the prior year and 11% since 31 August 2025. The number of customers holding at least £10k in AuA grew to 46.9k, an increase of 16% year-on-year and 5% since 31 August 2025. These higher-value customers hold an average of approximately £65k on the platform.

Net trading revenue of £7.5 million increased 16% on the prior quarter and 32% on the prior year on a pro forma basis, assuming the acquisition took place on 1 June 2024 and therefore including Freetrade for the entire comparative period. Net interest income of £1.7 million increased 11% on the prior quarter and 25% on the prior year on a pro forma basis as strong growth in customer cash balances more than offset lower interest rates.

Total revenue of £9.2 million increased 15% on the prior quarter and 31% on the prior year on a pro forma basis.

The proposed acquisition of Independent Reserve, announced on 19 September 2025, is progressing well and remains on track to complete in early 2026.

Independent Reserve continues to perform strongly, with calendar year-to-date results tracking ahead of internal expectations. IG sees significant opportunities to deploy its product capabilities across the APAC region.

IG announced a new share buyback program of £125 million on 24 July 2025. This began on 4 September 2025 and is expected to complete by 30 January 2026. As of 12 December 2025, 7.6 million shares had been repurchased at a cost of £84.0 million. Given the Group’s continued strong capital position and cash generation, IG is today extending this programme by £75 million to £200 million, with completion now expected by 31 March 2026.

The Board will consider a further share buyback programme alongside the Group’s full year results, subject to share price performance and other demands on capital.

Following the change to IG’s financial year end from 31 May to 31 December, announced on 4 November, the Group today issued guidance for the transitional seven-month financial year ending 31 December 2025.

For this seven-month period, IG expects to report total revenue of approximately £630 million, up around 3% on the prior year. This assumes softer trading conditions experienced in early December 2025 continue through year end. Net trading revenue is forecast at approximately £565 million, up around 7%, and interest income is expected to be slightly over £65 million, down around 21% on the prior year, consistent with IG’s expectations and reflecting the impact of lower interest rates and increased pass-through to customers.

For the 12 months ending 31 December 2025, IG expects to report total revenue of approximately £1,100 million, an increase of around 5% on the prior year. This includes Freetrade, consolidated since 1 April 2025, which is not reflected in the comparative period. Group net trading revenue is forecast at approximately £980 million, up around 8%, while net interest income is expected to be slightly under £120 million, down just over 15%. For the nine months since consolidation, Freetrade is expected to contribute net trading revenue of approximately £19 million and net interest income of approximately £5 million.

IG enters calendar year 2026 with strong momentum. Enhanced product velocity and stronger marketing capability are driving strong double-digit growth in new user acquisition, with actions to improve customer income retention supporting revenue growth.

In July 2025, IG guided to mid-to-high single-digit percentage annual organic total revenue growth (excluding Freetrade) beyond the 12 months ending 31 May 2026, accelerating within this range over time. Following strong strategic progress, IG now expects organic total revenue growth (excluding Freetrade and Independent Reserve) around the mid-point of this range in calendar year 2026, from a base of approximately £1,075 million in calendar year 2025.

This outlook is underpinned by growth in new customer acquisition and active customers, an extensive product pipeline, enhanced marketing capabilities, the full-year benefit of customer income retention initiatives launched in calendar year 2025, and market expectations for interest rates. Organic total revenue in the six months ended 30 November 2025 was £558 million, up 7% on the prior year. Group revenue and costs in calendar year 2026 will also reflect the full-year consolidation of Freetrade and the pending acquisition of Independent Reserve.

To capitalise on strong momentum and planned new product launches, IG intends to increase marketing investment in calendar year 2026 to accelerate long-term growth. The Group is confident of meeting market expectations for EBITDA and cash EPS in calendar year 2026, based on market conditions broadly consistent with calendar year 2025.