IG Group shares pop 7% despite 19% drop in Q1 Revenue

It isn’t often that a company, particularly in the financial space, reports a large drop in quarterly revenues yet sees its shareholders cheer and bid up the stock.

But that seems to be just what happened this morning at IG Group.

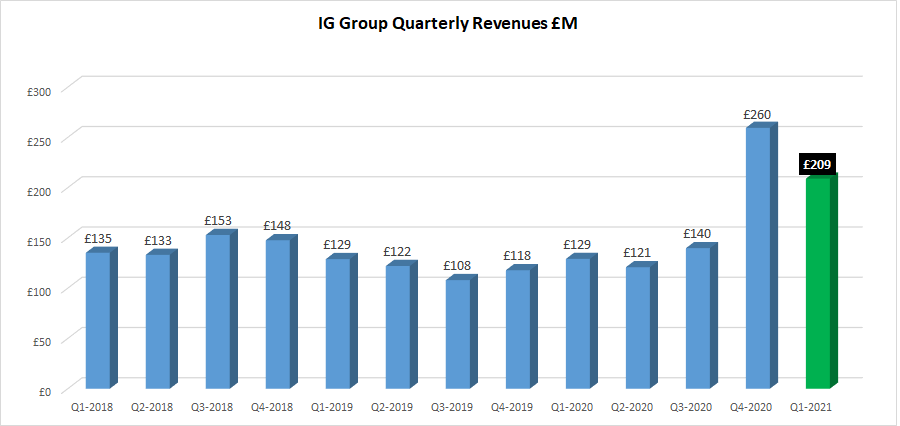

IG, the largest of the UK based online retail brokerages, reported top-line Q1-2021 results today (IG has a May 31 fiscal year end, so Q1-2021 is really calendar June-July-August 2020) which included net trading revenue of £209 million.

Historically, that’s a great result for IG and one of its best quarters ever, at least revenue-wise. However that is down by 19% from the previous quarter, Q4-2020, which saw record Revenues at IG of £260 million driven by outsized market volatility at the outset of the COVID-19 crisis in the March-April-May period.

It seems as though the market understood going in that Q1-2021 was not going to be as good as Q4-2020, but was somewhat nervous that activity might have been subdued back to “normal” levels. When that didn’t happen, the market reacted positively and IG shares (at time of writing) are performing nicely, up 7% to 847p, and are closing in on IG’s 52-week high of 873p.

IG Group one year share price graph. Source: Google Finance.

IG Group has been busy making internal changes at the company, which have included a rebranding of IG and its logo and website as was exclusively reported at FNG back in June, and the launch of a new series of ads focused on mobile trading.

The full announcement this morning by IG, including the company’s outlook, customer acquisition stats, and a comment from IG CEO June Felix follows:

17 September 2020

IG GROUP HOLDINGS PLC

First Quarter Revenue Update

IG Group Holdings plc (“IG”, “the Group”, “the Company”), a global leader in online trading, today issues its scheduled update on its revenue for the three months to 31 August 2020 (“Q1 FY21”), representing the first quarter of the financial year ending 31 May 2021 (“FY21”).

Business performance

The business performed very strongly throughout the first quarter, delivering net trading revenue of £209 million, 62% higher than the same period in the prior year (Q1 FY20: £129.1 million). Performance was driven by a combination of continued high levels of trading activity from existing clients and growth in the active client base, with 201,500 total active clients, up 50% on the prior year (Q1 FY20: 134,100); 134,800 clients traded OTC leveraged products in the quarter (Q1 FY20: 92,300).

· Q1 FY21 revenue in the Core Markets was £170.8 million, up 56% on the prior year (Q1 FY20: £109.4 million). Performance of the Retail client base in UK and Europe was particularly strong, with growth delivered in both revenue per client and number of active clients.

· Q1 FY21 revenue in the Significant Opportunities portfolio was £38.2 million, up 94% on the prior year (Q1 FY20: £19.7 million) and is on track to deliver the medium-term target of £100 million in revenue growth from this portfolio by the end of FY22.

|

Revenue by product (£m) |

Q1 FY21 |

Q1 FY20 |

% Change |

|

OTC leveraged |

195.1 |

123.0 |

59% |

|

Exchange traded derivatives |

6.3 |

3.8 |

64% |

|

Stock trading and investments |

7.6 |

2.3 |

235% |

|

Group |

209.0 |

129.1 |

62% |

New client acquisition remained strong as a result of continued demand and improved marketing effectiveness across multiple channels, with 34,600 new clients placing a first trade in the quarter, 129% higher than the prior year, with 23,500 of these representing new OTC leveraged clients. To date, new client retention rates, including the Q4 FY20 cohort, are following similar trajectories to historical averages.

June Felix, Chief Executive Officer, commented:

June Felix, Chief Executive Officer, commented:

“I am excited by the outstanding performance we delivered in the first quarter as we enter the second year of our three-year growth strategy.

This was a great start to the year, and although there was some moderation from the exceptional performance in Q4, our first quarter results demonstrate IG’s continued strength across the Core Markets, while also highlighting the growth potential in the Significant Opportunities.

Our focus remains on providing a first-class experience to sophisticated clients looking to trade across a range of global financial markets. We continue to invest in our people, platform and technology, to deliver the functionality and capabilities demanded by our loyal, high quality client base, while maintaining our differentiated business model.”