IG Group shares drop 13% since announcing $1B tastytrade acquisition

While it is impossible to measure the success of a major corporate move after just two days (especially when that “move” won’t actually take place for a few more months), the markets don’t seem to like IG Group’s expansion into the US online trading market by virtue of a $1 billion takeover of tastytrade.

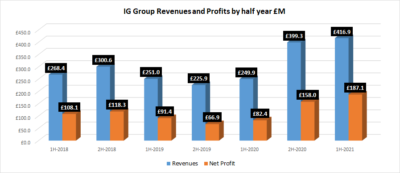

IG announced the tastytrade deal on Thursday morning, at the same time as it released its fiscal 2021 first half results. The results, as far as we can tell, were ahead of expectations. IG not only didn’t see a drop-off from its record results in the previous six months (as have a number of other leading UK and European online brokers such as Plus500 and Swissquote), but actually exceeded those numbers.

IG announced the tastytrade deal on Thursday morning, at the same time as it released its fiscal 2021 first half results. The results, as far as we can tell, were ahead of expectations. IG not only didn’t see a drop-off from its record results in the previous six months (as have a number of other leading UK and European online brokers such as Plus500 and Swissquote), but actually exceeded those numbers.

And immediately after both of those announcements (the results release was expected by the market, but tastytrade was a surprise), IG’s share price didn’t move too much. However given some time to crunch the numbers and digest the news, IG’s shares started moving downhill Thursday and didn’t stop Friday, ending up down 13.3% over the two days – from Wednesday’s close of 907.50p to Friday’s price of 787p.

IG Group share price chart past 6 months. Source: Google Finance.

It seems that this move in IG’s shares was due mainly to the tastytrade deal, as opposed to the better-than-expected results.

In a number of conversations we have had with industry participants on both sides of the ocean since the deal was announced, the consensus seems to be that this is a smart strategic move by IG. The US is the one major online trading market where IG doesn’t really have a large presence, and it is a very active, growing, and lucrative market. The sector in the US has already seen some consolidation, with TD Ameritrade (bought by Charles Schwab) and E*Trade (Morgan Stanley) both being acquired in 2020.

However there was some consternation regarding the high price that IG paid.

tastytrade brought in revenue of $116.2 million and turned a profit of $49.0 million in 2020, meaning that IG paid about 9x revenues and 20x profits for tastytrade. IG itself trades at about 3.5x revenue and 8.5x trailing profits – multiples well below what IG is paying for tastytrade – such that the deal will be dilutive to IG, at least in the near term. IG’s entire market cap pre-deal is about USD $4.0 billion, so a $1 billion acquisition which includes the issuing of shares worth about $700 million is indeed a “big deal”.

IG doesn’t expect the acquisition to close until the summer of 2021 (IG tagged it as likely in its fiscal 2022 first quarter, which means at some point between June and August 2021), so any effect on IG or its financials is still several quarters away. But for now, IG shareholders seem to be quite wary of the transaction, and have been dumping IG shares as a result.