IG Group reports 5% Y/Y rise in FY23 revenues

Electronic trading major IG Group Holdings plc (LON:IGG) today posted its financial results for the financial year to end-May 2023.

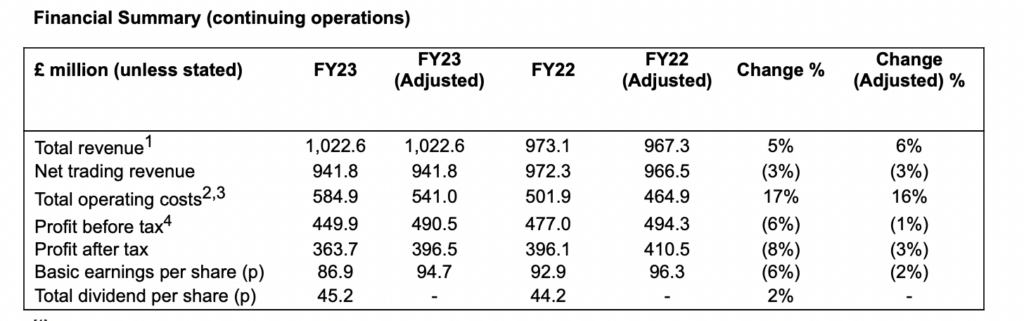

Total revenue of £1,022.6 million was up 5% on prior year. IG’s performance reflected two important factors. First, the company broadly maintained its levels of trading revenue and avoided the sharp decline following the pandemic as seen by many others in the industry. Second, it capitalised on the interest rate cycle and drove significant increases in interest income.

OTC derivatives net trading revenue of £782.0 million, was down 4%, reflecting a 5% reduction in active clients (FY23: 189,500) as client activity moderated against a more difficult macroeconomic backdrop year over year, particularly in Q3. Net trading revenue per client increased 2% on the FY22 average, reflecting the high quality of IG’s client base.

Net trading revenue from stock trading and investments was £22.7 million, down 33%, reflecting a 31% reduction in average net trading revenue per client as trade frequency per client reduced. The number of active clients reduced slightly and assets under management at the end of the period remained in line with FY22 at £3.3 billion.

As projected last year, interest income was the principal revenue growth driver in FY23, generating £80.8 million in FY23, compared to just £0.8 million in FY22. The increase in interest rates has also meant that IG’s net finance line was positive, as the return from its corporate cash outweighed the cost of the small level of issued debt and its revolving credit facility, which remained undrawn as at 31 May 2023.

Disciplined cost management remained a priority, even with the challenges of translational foreign exchange headwinds and high levels of inflation across many regions.

IG’s adjusted profit margin for the year was 48%, down slightly on prior year margin of 51% but well within the mid-to-high 40’s range that IG is managing to.

Earnings per share of 94.7p were down slightly year on year reflecting lower profit after tax, partially offset by a reduction in the number of shares in issue as a result of the on-going share buyback programme, which is now being enlarged for FY24. IG expects the share count to continue to reduce, as the full impact of the buyback programmes are reflected.

The final dividend for FY23 of 31.94 pence per share was proposed by the Board. This will be paid on 19 October 2023, following approval at the Company’s Annual General Meeting, to those shareholders on the register at the close of business on 22 September 2023. This represents a total FY23 dividend paid of 45.2 pence per share (FY22: 44.2 pence per share).

Charlie Rozes, Acting Chief Executive Officer, commented:

“We’ve performed well in the much more difficult market conditions that persisted through most of the past year, maintaining our leadership position in OTC derivatives while building further momentum in our product and geographic expansion. Total revenue exceeded £1 billion for the first time in IG’s history, more than double our revenue in FY19 when we launched the strategy, while consistently achieving strong profit margins. A notable highlight has been our progress in the US, with the strong growth of tastytrade driving total revenue of £191.3 million, also an all-time high for IG.

“This combination of our operating performance and capital strength enabled us to return £363.4 million to shareholders during FY23 and we’re pleased to announce today an increased cash dividend and a new £250 million share buyback programme.

“Our clients and our people remain at the heart of our success. IG’s commitment to offering a first-class trading experience has resulted in a loyal, high quality global client base, demonstrated by active client numbers remaining significantly above the levels of just a few years ago. Our unique client base is the foundation of our resilient growth profile.

“Looking ahead, we’re well positioned to continue investing for growth given the strength and consistency of our cash flow and balance sheet. We keep a close watch on profit margins and in FY24 will continue to look for opportunities to achieve even greater cost efficiency. We’re the home of active traders worldwide, and we are building a more sustainable, long-term business that delivers for all stakeholders.”