IG Group registers increase in revenue in H1 FY23

Electronic trading major IG Group Holdings plc (LON:IGG) today announced its results for the six months ended 30 November 2022 (H1 FY23).

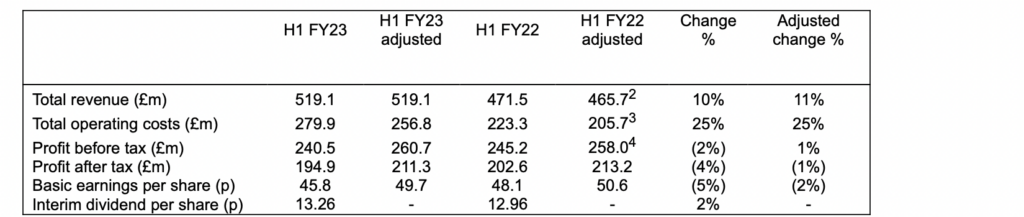

On a statutory basis, net trading revenue from continuing operations was £494.9 million, up 5% on H1 FY22. The Group’s total revenue, which includes interest income, was £519.1 million, up 10%, reflecting the increasing interest rates during the period.

Statutory operating costs were £279.9 million, 25% higher than H1 FY22. The Group’s statutory profit before tax for H1 FY23 was £240.5 million, down 2% on H1 FY22.

Net trading revenue from OTC derivatives in H1 FY23 was £416.5 million and increased by 6% on H1 FY22. Within the half, Q2 revenue increased 11% on Q1.

Active clients remained in line with H1 FY22, with 159,100 clients trading in the period, while average revenue per client increased by 6% to £2,618 reflecting the continued strength and quality of our client base. In the period an additional 24,300 new clients were onboarded and active, down 17% on H1 FY22.

UK and EU OTC derivatives revenue was £209.3 million, in line with H1 FY22 (H1 FY22: £208.3 million). Active clients reduced by 3%, offset by a 3% increase in the average revenue per client. Revenue in Q2 was 9% higher than Q1, due to a higher revenue per client in the second quarter.

Japan revenue increased by 25% to £55.8 million, with active clients increasing 28%, and average revenue per client down 2%. H1 FY23 represented a record half for revenue and active clients for Japan, with Q2 revenue being 6% higher than Q1. Client onboarding continues to be strong, however first trades in the period reduced 18% from the exceptionally high levels experienced in H1 FY22.

Australia revenue of £49.3 million increased 9% on H1 FY22, with Q2 revenue increasing 15% on Q1, the highest revenue quarter since the Australian Securities & Investments Commission (ASIC) leverage restrictions were introduced in Q4 FY21. A 12% reduction in active clients in the half was more than offset by a 24% increase in revenue per client.

Profit before tax was £240.5 million in H1 FY23, and £260.7 million on an adjusted basis, 1% higher than H1 FY22.

Profit after tax was 4% lower than H1 FY22 and 1% lower on an adjusted basis. Basic EPS was 5% lower than H1 FY22 and 2% lower on an adjusted basis due to lower profits.

The proposed interim dividend for FY23 of 13.26 pence per share totalling £55.1 million was approved by the Board on 25 January 2023 and has not been included as a liability at 30 November 2022. This dividend will be paid on 3 March 2023 to those members on the register at the close of business on 3 February 2023.

June Felix, Chief Executive, commented:

“I’m extremely proud of our achievements in the period, having delivered on two critical elements of our strategy: diversified business growth and the return of excess capital to shareholders. Non-OTC products now make a meaningful contribution of nearly 20% to our total revenue, and by the end of the half we had returned nearly £250 million to shareholders. We have also announced an extension to our share buyback today.

“Despite a softening in trading demand due to the global economic environment, our high-quality clients have continued to find opportunities to trade, demonstrating the resilience of the business model. This is the result of our unwavering focus on investing in and prioritising the delivery of best-in-class technology and platforms, innovation, client service and marketing. All achieved while delivering significant profit margins and consistently generating healthy levels of cash and capital.

“Underpinning this strong performance are our ambitious, passionate and talented people around the world, who are driven by our purpose to create the pre-eminent solution for active traders.”