IG Group registers 12% Y/Y increase in revenues in Q3 FY25

Electronic trading major IG Group Holdings plc (LON:IGG) today issues its revenue update for the three months to 28 February 2025 (“Q3 FY25”), representing the third quarter of the financial year ending 31 May 2025.

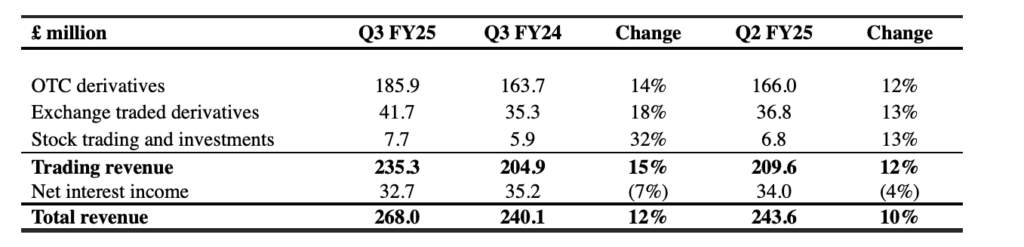

Total revenue of £268.0 million increased 12% on the year-ago quarter and 10% on the prior quarter. Within this, trading revenue of £235.3 million increased 15% on the prior year and 12% on the prior quarter. Growth was driven by higher revenue per client as a result of stronger market conditions.

Active clients across the Group increased 2% on the prior year and 5% on the prior quarter to 272,700 (Q3 FY24: 266,800; Q2 FY25: 261,000).

First trades increased across all products when compared to the prior year and prior quarter. This growth resulted from stronger market conditions, improved product offerings, effective promotions and increased marketing investment which will continue in Q4.

Within exchange traded derivatives, tastytrade trading revenue increased 30% on the prior year and 18% on the prior quarter to a record $50.9 million (Q3 FY24: $39.2 million; Q2 FY25: $43.3 million). On a reported GBP basis, trading revenue increased 32% on the prior year and 22% on the prior quarter to £40.8 million (Q3 FY24: £30.9 million; Q2 FY25: £33.4 million).

Spectrum contributed exchange traded derivatives trading revenue of £4.4 million in the prior year and £3.2 million in the prior quarter. IG Group exited Spectrum shortly following the end of H1 FY25 and there was no material revenue contribution in Q3 FY25.

Stock trading and investments trading revenue increased 32% on the prior year and 13% on the prior quarter reflecting enhancements to our proposition.

Net interest income of £32.7 million declined 7% on the prior year and 4% on the prior quarter reflecting lower interest rates and stable client money balances. Net interest income is driven by client money held off the Group balance sheet which was £3.8 billion as at 28 February 2025 (29 February 2024: £3.7 billion; 30 November 2024: £3.8 billion).

Freetrade has continued to trade well with performance tracking in line with the Group’s expectations.

The Group is pleased to announce that it has received key antitrust and change in control approvals for the acquisition of Freetrade which is now expected to close in April 2025, sooner than originally guided.

In January 2025, the Group extended the current share buyback programme by £50 million to £200 million which will be completed in FY25. As of 11 March, 2.3 million shares had been repurchased at a cost of £21.7 million.

In the coming months, the Group plans to seek shareholder and regulatory approval to reduce IG Group Holdings plc’s share premium account and merger reserve, with a corresponding increase in retained earnings.

Based on Q3 results and continuing stronger market conditions in Q4, the Group remains confident of meeting FY25 consensus total revenue and adjusted profit before tax expectations.