Hargreaves Lansdown registers 16% Y/Y rise in revenues in H1 FY21

UK direct-to-investor investment and online trading firm Hargreaves Lansdown PLC (LON:HL) today posted its financial report for the first half of fiscal year 2021 (that is, the six months to end-December 2020).

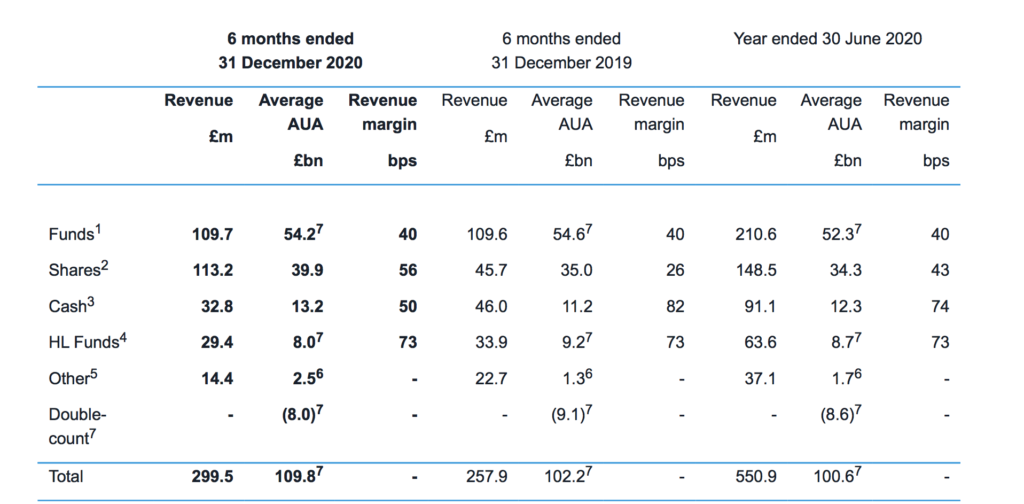

Revenue for the period was up 16% from a year earlier to £299.5 million (H1 2020: £257.9m), driven by higher average asset levels and higher share dealing volumes. Let’s note that the company marked a similar rise in revenues in FY2020.

Operating costs increased by 27% to £111.6 million (H1 2020: £87.5m) to support higher client activity levels, maintain client service and invest in the significant growth opportunities. Focusing on these areas and controlling costs elsewhere has resulted in costs before the FSCS levy being slightly below their H2 2020 equivalent.

Key drivers of the cost growth were marketing and distribution. These rose by £4.5 million this period as the company capitalised on the opportunity to accelerate new client acquisition. At current revenue margins and activity levels, the £8.6 billion of NNB that Hargreaves Lansdown has added across 2020 is equivalent to circa £46 million of future annual revenues.

The Group has grown profit before tax by 10% to £188.4 million (H1 2020: £171.1m).

Diluted EPS increased by 9% from 29.3 pence to 32.1 pence, reflecting the Group’s positive trading performance. The Group’s basic EPS was 32.1 pence, compared with 29.3 pence in H1 2020.

Hargreaves Lansdown has a progressive ordinary dividend policy. The Board considers the dividend on a total basis, with the intention of maintaining the ordinary payout ratio at around 65% across the market cycle and looking to return excess cash to shareholders in the form of a special dividend after the year-end.

The Board voiced its confidence that Hargreaves Lansdown has sufficiently strong financial, liquidity and capital positions to execute its strategy without constraints and can operate a sustainable and progressive ordinary dividend policy going forward.

Given the Group’s dividend policy, the Board has declared an increased interim dividend of 11.9 pence per share (H1 2020: 11.2 pence per share). The interim dividend will be paid on 8 March 2021 to all shareholders on the register at 12 February 2021.