Exclusive: FxPro UK sees volumes halved in 2019

FNG Exclusive…. FNG has learned from regulatory filings that FxPro UK Limited, the FCA licensed arm of global Retail FX and CFDs broker FxPro, saw a significant decline in activity last year as ESMA and FCA initiated reforms took hold.

However, we understand after speaking with FxPro officials, that trading volumes in the UK entity, as well as elsewhere within the FxPro group, have significantly recovered in 2020 and surpassed the levels seen in 2019 – a phenomenon we’ve witnessed at a number of other leading FX and CFD brokers, enjoying a significant bump in trading volumes around 2020’s wild financial market volatility.

FxPro UK reported that client trading activity declined from about $12 billion monthly in 2018 to just $4.6 billion monthly last year – a decline of 61%. (Total annual volume decline from $142 billion in 2018 to $55 billion in 2019). The company said that the decrease in the volumes was mainly due to the impact of the measures imposed by the European financial regulator ESMA, which include the restriction on the marketing, distribution or sale of CFDs to retail clients. Those measures, which also include a reduction in the leverage brokers like FxPro can offer to retail traders to 30x, came into effect in August 2018 and significantly reduced trading volumes at FxPro as well as at a number of other leading FX brokers in the UK and EU.

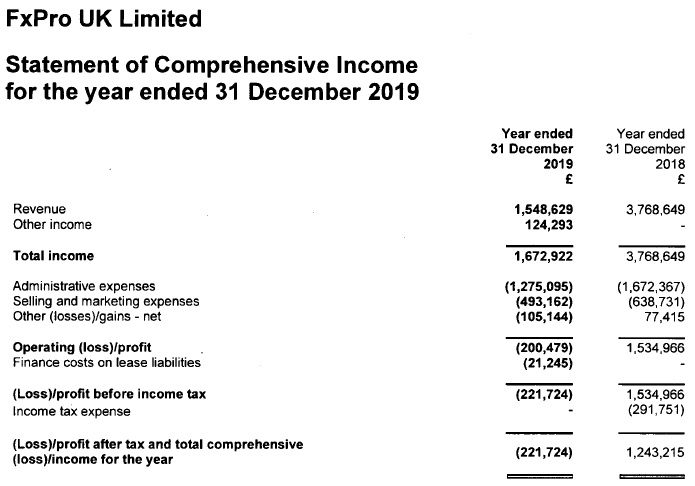

As a result, revenue decreased by 59% in 2019 at FxPro UK to £1.55 million. Compensating however was a 23% decrease in total expenses, due to a decrease in staff costs and commissions to introducing brokers, such that the net loss of the company for the year was just £221,724 after a profit of £1.2 million in 2019. We’d note that the revenue of the company derives from commission income received from the affiliated Cyprus-regulated entity FxPro Financial Services Limited, such that the “real” measure to look at is client trading volumes in determining the actual levels of activity at FxPro UK.

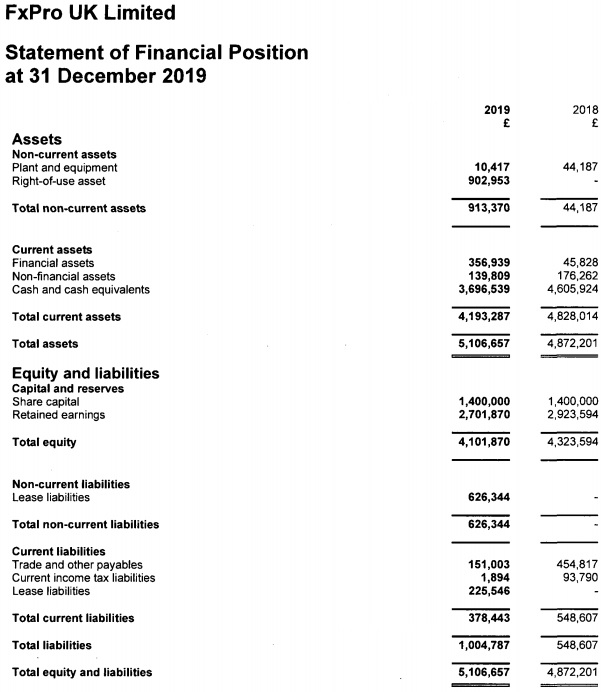

Client cash balances held at FxPro UK actually went up during 2019, totaling £13.8 million at Dec 31, 2019, up from £10.9 million the previous year.

FxPro UK remains well capitalized, with more than £4.1 million of equity capital on the books at year-end 2019.

As far as Brexit goes, the management of the company stated that it does not believe that the UK’s exit from the European Union will affect its ability to operate going forward. In any event, FxPro has both the UK licensed company and as noted an EU-licensed entity in Cyprus, such that if UK-EU passporting becomes an issue for financial institutions the company is covered on both sides.

FxPro UK’s income statement and balance sheet for 2019 follow: