FXCM UK turns $4.9M profit in 2020

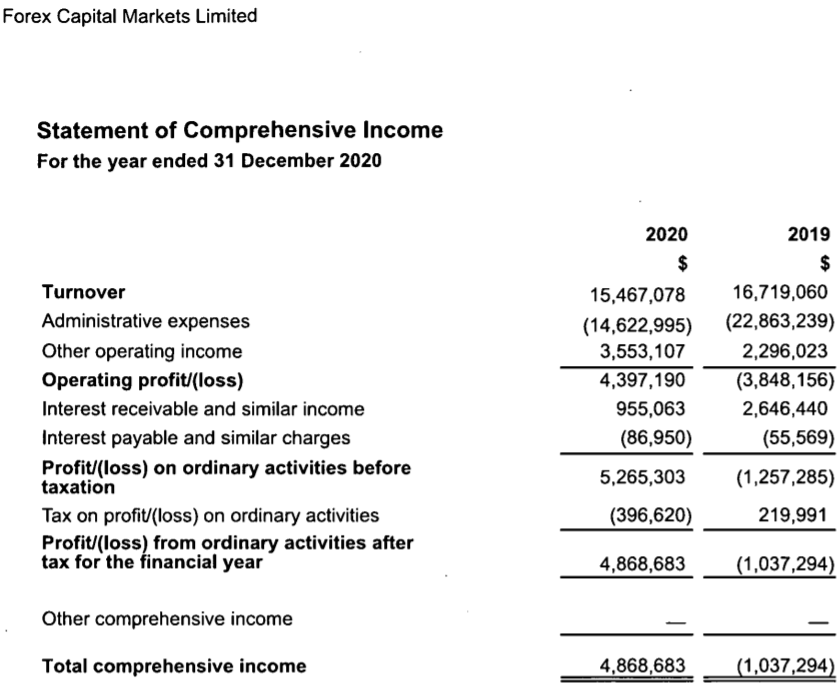

After posting a $1 million loss in 2019, Forex Capital Markets Limited – the FCA regulated UK arm of global Retail FX broker FXCM – completed its turnaround and turned a profit of $4.9 million in 2020.

FXCM UK, based in London and the FXCM Group’s central operating entity, did continue to see an erosion of revenue, down 7.5% YoY from $16.7 million to $15.5 million, but significant cost cutting efforts bore fruit with the effects seen on the bottom line. Administrative expenses fell by $8.2 million to $14.6 million in 2020 compared to 2019 ($22.9 million). Much of this was a reduction in inter-group expenses but there were also savings in professional, regulatory and prime brokerage fees.

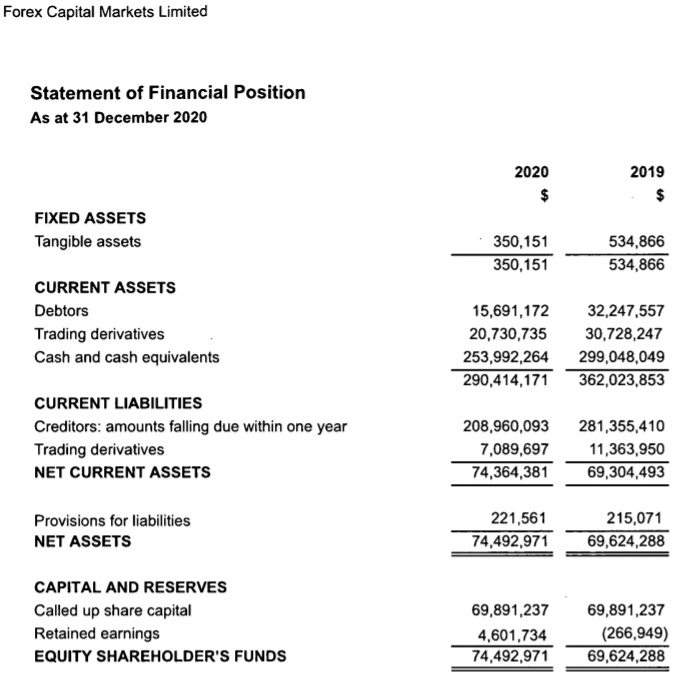

Client cash held also declined, from $232 million in 2019 to $174 million as at year-end 2020, mostly due to some higher value clients reducing cash held with the company during the period.

Retail trading volumes at FXCM UK increased by 11% YoY thanks to heightened volatility in 2020, averaging $50 billion monthly (2019: $45 billion).

FXCM UK offers online FX and CFD trading to its retail and professional clients utilising the online trading platforms of affiliated companies. The company offsets all of its FX and CFD trades with affiliate entities and is compensated for selling this risk on a commission basis. In this capacity, the company is acting as a referring broker to these entities and is the principal counterparty to the client transaction. The profit or loss for the company is dependent on the trading volume of its clients.

Looking forward, FXCM UK said that it will continue to pursue key initiatives to retain and grow its client base in 2021. The company’s objectives for 2021 are to optimise revenues from current and new business, while strengthening the FXCM Group brand. To optimise revenues, the company aims to improve conversion rates of new account applicants and decrease the time it takes between applying for a new account and placing a first trade. FXCM UK said that it is re-evaluating how client trade flows are managed, relying less on a small number of metrics and more on technologies which provide a holistic view into client trading patterns.

In addition, the introduction of a significant number of new tradeable products are expected to generate renewed interest from the FX and CFD industry (e.g. proprietary stock basket lines).

FXCM is a Leucadia Company, part of Jefferies Financial (NYSE:JEF).

FXCM UK’s income statement and balance sheet for 2020 follow: