FX week in review: TigerWit sold, My Forex Funds closed, Zenfinex CEO leaves, CCCUK funds missing

Before we get to this week’s top headlines…

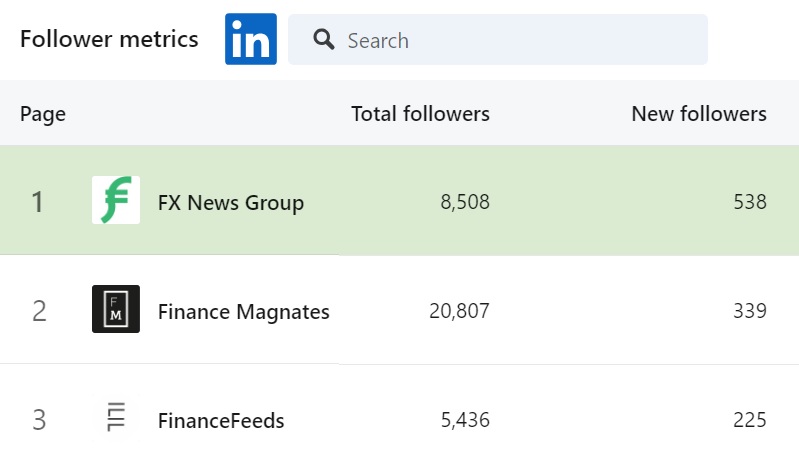

It isn’t even close.

It isn’t even close.

As LinkedIn’s own “Competitor” data shows, there is only one FX & CFDs industry news site followed actively by traders and senior executives alike, and only one site taken seriously by readers – FNG.

While other sites are busy copying our recent article titles or posting promotional content or giving out “awards”, FNG is the only site delivering original, objective, exclusive content to our readers, giving a behind-the-scenes look at what is really happening in the business – and thus delivering real value, day after day, to our advertisers.

And this past week was no exception…

As we left summer break behind it was one of the busiest news weeks of the year in the FX and CFDs world, with all the top stories reported first or exclusively at FNG.

Who has stepped up to acquire FCA licensed Retail FX and CFDs broker TigerWit, from former IG Group UK Managing Director Tim Hughes?

What led US and Canadian regulators to step in and shut down Toronto based prop trading firm My Forex Funds, which is now suspected of running a $300 million fraud on retail traders?

Where did Zenfinex Group CEO Matthew Wright move to?

How much client money is missing (probably offshore) from bankrupt UK CFDs broker City Credit Capital?

Some of the most read and commented-on FX industry news stories to appear over the past seven days on FNG included:

Exclusive: TigerWit sold, rebranding as Calico. FNG Exclusive… FNG has learned that London based, FCA licensed Retail FX and CFDs broker TigerWit is planning to relaunch under a new name, Calico Capital. The rebranding and relaunch comes following a failed sale of the company in 2022, a successful sale now (to a different buyer) bringing in fresh capital, and a breakup with the company’s now-former Chinese partners who ran the offshore TigerWit brand out of Saint Vincent and the Grenadines for the past five years.

Exclusive: TigerWit sold, rebranding as Calico. FNG Exclusive… FNG has learned that London based, FCA licensed Retail FX and CFDs broker TigerWit is planning to relaunch under a new name, Calico Capital. The rebranding and relaunch comes following a failed sale of the company in 2022, a successful sale now (to a different buyer) bringing in fresh capital, and a breakup with the company’s now-former Chinese partners who ran the offshore TigerWit brand out of Saint Vincent and the Grenadines for the past five years.

Regulators shut My Forex Funds charging $300 million fraud. U.S. and Canadian financial regulators have shut down Toronto based prop trading firm My Forex Funds (operating at website myforexfunds.com), charging the company and its operator Murtuza Kazmi with running a $300 million+ fraud on retail traders. The complaint alleges Kazmi used proceeds from the fraud to purchase luxury homes and automobiles, and make tens of millions of dollars in transfers to his personal accounts.

Regulators shut My Forex Funds charging $300 million fraud. U.S. and Canadian financial regulators have shut down Toronto based prop trading firm My Forex Funds (operating at website myforexfunds.com), charging the company and its operator Murtuza Kazmi with running a $300 million+ fraud on retail traders. The complaint alleges Kazmi used proceeds from the fraud to purchase luxury homes and automobiles, and make tens of millions of dollars in transfers to his personal accounts.

Exclusive: £10M in trader funds missing offshore from bankrupt CFDs broker City Credit Capital. FNG Exclusive… Further to our Reported First at FNG article from early July that FCA regulated CFDs broker City Credit Capital (UK) Ltd has been placed in administration, FNG has learned via regulatory filings that about £10 million in Professional Client money at CCCUK is missing offshore, and may not be recovered.

Exclusive: £10M in trader funds missing offshore from bankrupt CFDs broker City Credit Capital. FNG Exclusive… Further to our Reported First at FNG article from early July that FCA regulated CFDs broker City Credit Capital (UK) Ltd has been placed in administration, FNG has learned via regulatory filings that about £10 million in Professional Client money at CCCUK is missing offshore, and may not be recovered.

Exness client trading volumes top $4.5 trillion in August 2023. Cyprus based multi asset broker Exness has continued its amazing growth trajectory into the second half of 2023, topping a best-ever month in July 2023 ($3.91 trillion) by posting a record $4.521 trillion in client trading volumes in August 2023. The $4.521T figure marks a remarkable 36% rise in volumes from its previous record in July. The result also sets a new all-time record for any Retail FX and CFDs broker, the first time any such broker has topped $4 trillion in monthly volume.

Exness client trading volumes top $4.5 trillion in August 2023. Cyprus based multi asset broker Exness has continued its amazing growth trajectory into the second half of 2023, topping a best-ever month in July 2023 ($3.91 trillion) by posting a record $4.521 trillion in client trading volumes in August 2023. The $4.521T figure marks a remarkable 36% rise in volumes from its previous record in July. The result also sets a new all-time record for any Retail FX and CFDs broker, the first time any such broker has topped $4 trillion in monthly volume.

Top FX industry executive moves reported at FNG this week included:

❑ Exclusive: Zenfinex CEO Matthew Wright leaves, for COO role at Exinity.

❑ Exclusive: oneZero BizDev director Louay Amhaz departs.

❑ Capital.com hires IG/EncoreFX alum Kyle Rodda as Senior Analyst in Australia.

❑ Exclusive: Finalto hires Ivan Wong as Head of Sales Asia.

❑ Hantec hires INFINOX CTO Michael O’Sullivan to head tech strategy.

❑ CMC Markets appoints Albert Soleiman as Chief Financial Officer.

❑ Exclusive: IQ Option hires Pawel Cichowski as Head of Dealing Department.