FX week in review: No new clients at IG, United Fintech acquires, XTB Q4 disappoints

Much of the FX industry news stories this past week at FNG were dominated by action and reaction by brokers surrounding the continued global retail trader surge. Many FX brokers have been faced with what we’d call a dream-nightmare scenario: retail traders signing up in droves, but too many to handle all at once. And, too much one-sided trading volume to deal with.

Why did IG Group shut down its platform to new clients?

What (drastic) changes did Admiral Markets make to its Equity CFDs lineup?

Also this week at FNG there were a number of FX broker results reports including XTB.com’s Q4 which sent the company’s stock down 18%, and Trading.com’s 2019 Revenue decline of 78%.

Some of the top FX industry news stories to appear this past week on FNG included:

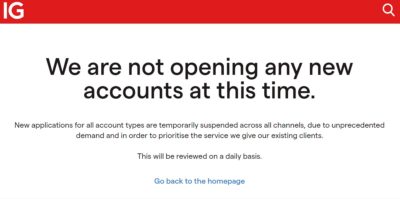

IG Group stops new account opening in the UK due to retail trader frenzy. UK online trading firm IG Group (LON:IGG) has indicated on its website that it is not taking on any new clients, as “unprecedented demand” has hit the broker amid the past week’s retail trading frenzy. To slow the tide of retail traders looking to cash in on the short-squeeze activity happening around a number of heavily shorted US stocks, IG earlier introduced more strict margin requirements around a number of specific CFDs and equities, and also halted the opening of any new positions in the two most heavily traded names, GameStop and AMC Entertainment. But those measures had not fully accomplished the goal of keeping new client signups at bay, and IG has been faced with the dream-nightmare scenario of just too many new clients looking to set up accounts and trade.

IG Group stops new account opening in the UK due to retail trader frenzy. UK online trading firm IG Group (LON:IGG) has indicated on its website that it is not taking on any new clients, as “unprecedented demand” has hit the broker amid the past week’s retail trading frenzy. To slow the tide of retail traders looking to cash in on the short-squeeze activity happening around a number of heavily shorted US stocks, IG earlier introduced more strict margin requirements around a number of specific CFDs and equities, and also halted the opening of any new positions in the two most heavily traded names, GameStop and AMC Entertainment. But those measures had not fully accomplished the goal of keeping new client signups at bay, and IG has been faced with the dream-nightmare scenario of just too many new clients looking to set up accounts and trade.

Exclusive: Admiral Markets cuts small-cap stock CFDs, nixes zero commissions. FNG Exclusive… FNG has learned that global Retail FX and CFDs broker Admiral Markets is making some drastic changes to the Equities portion of its online trading offering. The changes cover a range of terms in the company’s stock CFDs and equity ETFs offering, including type of instrument offered, portfolio size limits, leverage, and commissions. Admiral Markets has sent a note to clients indicating that it will not be offering any trading in small-cap stock CFDs. As of today, Admiral Markets will switch to close-only mode any client positions in share CFDs where the market price of the share traded is below a certain level (roughly USD $5 / €5 / £5). As of February 7, it will only offer trading in equity CFDs of companies that have a market cap of USD $1 billion or greater.

Exclusive: Admiral Markets cuts small-cap stock CFDs, nixes zero commissions. FNG Exclusive… FNG has learned that global Retail FX and CFDs broker Admiral Markets is making some drastic changes to the Equities portion of its online trading offering. The changes cover a range of terms in the company’s stock CFDs and equity ETFs offering, including type of instrument offered, portfolio size limits, leverage, and commissions. Admiral Markets has sent a note to clients indicating that it will not be offering any trading in small-cap stock CFDs. As of today, Admiral Markets will switch to close-only mode any client positions in share CFDs where the market price of the share traded is below a certain level (roughly USD $5 / €5 / £5). As of February 7, it will only offer trading in equity CFDs of companies that have a market cap of USD $1 billion or greater.

United Fintech enters RegTech acquiring TTMzero. Christian Frahm’s new fintech startup United Fintech has made its second acquisition, announcing this morning the purchase of German market data and RegTech provider TTMzero. United Fintech has initially taken a 25% stake in TTMzero, with the intention of increasing to 80% over the next three years. The company said that the acquisition is in line with its strategy of acquiring and scaling innovative fintechs in capital markets and creating a fintech one-stop-shop which banks and financial institutions can benefit from to accelerate their transition to a digital world. Founded in 2013, TTMzero develops fully digitized RegTech and Capital Markets Tech solutions.

United Fintech enters RegTech acquiring TTMzero. Christian Frahm’s new fintech startup United Fintech has made its second acquisition, announcing this morning the purchase of German market data and RegTech provider TTMzero. United Fintech has initially taken a 25% stake in TTMzero, with the intention of increasing to 80% over the next three years. The company said that the acquisition is in line with its strategy of acquiring and scaling innovative fintechs in capital markets and creating a fintech one-stop-shop which banks and financial institutions can benefit from to accelerate their transition to a digital world. Founded in 2013, TTMzero develops fully digitized RegTech and Capital Markets Tech solutions.

XTB.com revenues hold steady in Q4-2020, but profits fall. Poland based Retail FX and CFDs brokerage house X Trade Brokers Dom Maklerski SA – operator of the XTB.com and X Open Hub brands – has released preliminary financial results for Q4 and full year 2020, showing that activity held steady in Q4 (after a slowdown in Q3 at XTB.com), but quarterly profits dropped to their lowest levels since 2019. Looking forward, XTB said that it is seeking to expand internationally in 2021. At the end of November 2020 XTB received preliminary approval of the DFSA regulator to conduct brokerage activities in the United Arab Emirates. The intention of the Management Board is to start operating activities in United Arab Emirates in the first half of 2021.

XTB.com revenues hold steady in Q4-2020, but profits fall. Poland based Retail FX and CFDs brokerage house X Trade Brokers Dom Maklerski SA – operator of the XTB.com and X Open Hub brands – has released preliminary financial results for Q4 and full year 2020, showing that activity held steady in Q4 (after a slowdown in Q3 at XTB.com), but quarterly profits dropped to their lowest levels since 2019. Looking forward, XTB said that it is seeking to expand internationally in 2021. At the end of November 2020 XTB received preliminary approval of the DFSA regulator to conduct brokerage activities in the United Arab Emirates. The intention of the Management Board is to start operating activities in United Arab Emirates in the first half of 2021.

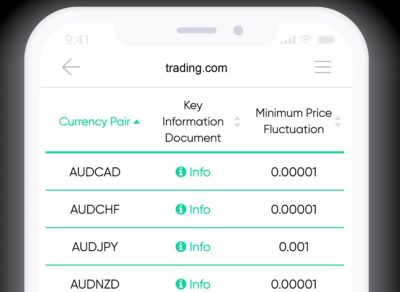

Exclusive: Trading.com parent Trading Point sees Revenues down 78% in 2019. FNG Exclusive… FNG has learned via regulatory filings that FCA licensed Retail FX broker operator Trading Point of Financial Instruments UK Limited has seen a steep 78% decline in Revenues in 2019. Revenues for Trading Point UK totaled £666,522 in 2019, down from £3.1 million the previous year. The company posted a loss of £1.3 million in 2019, versus a profit of £1.7 million in 2018. The decrease in the revenue figure is as a result of a decrease in the number of active clients to 4,718 in 2019 (2018: 15,074), and lower trading volumes from those clients. In July 2019, the company rebranded its trading name in the UK from “XM.com” to “trading.com”.

Exclusive: Trading.com parent Trading Point sees Revenues down 78% in 2019. FNG Exclusive… FNG has learned via regulatory filings that FCA licensed Retail FX broker operator Trading Point of Financial Instruments UK Limited has seen a steep 78% decline in Revenues in 2019. Revenues for Trading Point UK totaled £666,522 in 2019, down from £3.1 million the previous year. The company posted a loss of £1.3 million in 2019, versus a profit of £1.7 million in 2018. The decrease in the revenue figure is as a result of a decrease in the number of active clients to 4,718 in 2019 (2018: 15,074), and lower trading volumes from those clients. In July 2019, the company rebranded its trading name in the UK from “XM.com” to “trading.com”.

Among the top FX industry executive moves reported at FNG this week were:

❑ Exclusive: Bloomberg’s Joshua Green and Emilia Meredith join United Fintech.

❑ Exclusive: Longtime analyst Richard Perry leaves Hantec Markets.

❑ ACY Securities promotes Ashley Jessen to COO.

❑ Exness hires Saxo Bank CCO Damian Bunce to head trading.

❑ Plus500 appoints Sigalia Heifetz as Non-Exec Director.

❑ Danske Bank promotes Saxo Bank alum Jakob Beck Thomsen.