FX week in review: FXJet closes, Tickmill’s new CMO, LMAX £40M loan

What’s behind the closure of CySEC-licensed Retail FX broker FXJet.com?

Who did Tickmill turn to for its new CMO, and to rebuild its marketing team?

Who is Leverate’s new CFO?

Where did TopFX launch its “onshore” retail FX site for EU clients?

Whose technology did Infinox white-label for its new social trading product IX Social?

Who will be providing FXCM with auto-trading tools?

Who is lending LMAX £40 million to facilitate expansion?

Answers to these questions and a whole lot more appeared first or exclusively this week on FNG. Some of the top forex industry news items to appear on FNG this week included:

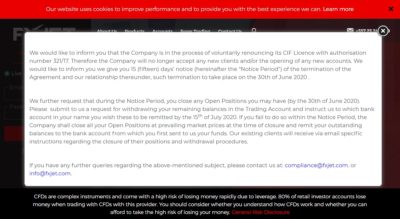

Exclusive: FXJet shutting after renouncing CySEC license. FNG Exclusive… FNG has learned that Retail FX broker FXJet, operating website fxjet.com, is shutting after renouncing its CySEC CIF license. FXJet was originally known as Bogofinance Capital Markets, which rebranded to FXJet in 2017 when the company first received its CySEC license. (The parent company which was formally licensed by CySEC remained Bogofinance Capital Markets Ltd). Bogofinance began life in Lebanon in 2006 as a Central Bank of Lebanon licensed Retail FX broker. The company was founded by Lebanese businessman Joseph Boghos, and the CySEC entity was run by his former Head of Operations in Lebanon Mirella Mansour.

Exclusive: FXJet shutting after renouncing CySEC license. FNG Exclusive… FNG has learned that Retail FX broker FXJet, operating website fxjet.com, is shutting after renouncing its CySEC CIF license. FXJet was originally known as Bogofinance Capital Markets, which rebranded to FXJet in 2017 when the company first received its CySEC license. (The parent company which was formally licensed by CySEC remained Bogofinance Capital Markets Ltd). Bogofinance began life in Lebanon in 2006 as a Central Bank of Lebanon licensed Retail FX broker. The company was founded by Lebanese businessman Joseph Boghos, and the CySEC entity was run by his former Head of Operations in Lebanon Mirella Mansour.

Exclusive: TopFX goes live with EU Retail FX site. FNG Exclusive… FNG has learned that Forex broker platform and liquidity solutions provider TopFX has gone live with its own EU-focused Retail FX and CFD brokerage site, at topfx.com. We reported exclusively last week that TopFX had launched the offshore version of its Retail FX site for non-EU clients. That offering is being made via Seychelles licensed subsidiary Fondex Limited, at website topfx.com.sc. At the time, we reported that TopFX was also soon going to launch “onshore” for EU domiciled clients, which it now has. TopFX Ltd has been licensed in Cyprus by regulator CySEC since 2011, and now in addition to the company’s turnkey and white label solutions for FX brokers it will be using its license for its own retail offering.

Exclusive: TopFX goes live with EU Retail FX site. FNG Exclusive… FNG has learned that Forex broker platform and liquidity solutions provider TopFX has gone live with its own EU-focused Retail FX and CFD brokerage site, at topfx.com. We reported exclusively last week that TopFX had launched the offshore version of its Retail FX site for non-EU clients. That offering is being made via Seychelles licensed subsidiary Fondex Limited, at website topfx.com.sc. At the time, we reported that TopFX was also soon going to launch “onshore” for EU domiciled clients, which it now has. TopFX Ltd has been licensed in Cyprus by regulator CySEC since 2011, and now in addition to the company’s turnkey and white label solutions for FX brokers it will be using its license for its own retail offering.

Exclusive: Infinox launches IX Social trading app. FNG Exclusive… FNG has learned that Retail FX broker Infinox has joined the “social revolution”, and launched its own social trading service call IX Social. Like several of the recent social trading offerings unveiled by Retail FX and CFD brokers, the focus here also seems to be younger traders who trend to use mobile devices (more so than desktops or laptops), and as such the company is offering IX Social on both the Apple AppStore and Google Play as a mobile trading app. Infinox’s IX Social is a white label of Pelican Trading, which has become a leading supplier of social trading platforms and technology to Retail FX market participants. Other Pelican clients include AvaTrade and its AvaSocial service, the recently sold ETX Capital, forex broker solutions provider Advanced Markets, and liquidity solutions firm IS Prime.

Exclusive: Infinox launches IX Social trading app. FNG Exclusive… FNG has learned that Retail FX broker Infinox has joined the “social revolution”, and launched its own social trading service call IX Social. Like several of the recent social trading offerings unveiled by Retail FX and CFD brokers, the focus here also seems to be younger traders who trend to use mobile devices (more so than desktops or laptops), and as such the company is offering IX Social on both the Apple AppStore and Google Play as a mobile trading app. Infinox’s IX Social is a white label of Pelican Trading, which has become a leading supplier of social trading platforms and technology to Retail FX market participants. Other Pelican clients include AvaTrade and its AvaSocial service, the recently sold ETX Capital, forex broker solutions provider Advanced Markets, and liquidity solutions firm IS Prime.

FXCM offers auto trading tools via Capitalise.ai. Trading automation platform provider Capitalise.ai and Retail FX broker FXCM Group have announced a strategic partnership, that will offer FXCM’s clients access to Capitalise.ai’s automated trading experience tools. Capitalise.ai enables brokers to complement their existing offering by further empowering, retaining and engaging with their traders while simultaneously generating new revenue streams. The Capitalise.ai platform provides robust capabilities through its cutting-edge proprietary AI, machine learning and NLP technologies, which are being utilised by leading brokers around the world today.

FXCM offers auto trading tools via Capitalise.ai. Trading automation platform provider Capitalise.ai and Retail FX broker FXCM Group have announced a strategic partnership, that will offer FXCM’s clients access to Capitalise.ai’s automated trading experience tools. Capitalise.ai enables brokers to complement their existing offering by further empowering, retaining and engaging with their traders while simultaneously generating new revenue streams. The Capitalise.ai platform provides robust capabilities through its cutting-edge proprietary AI, machine learning and NLP technologies, which are being utilised by leading brokers around the world today.

LMAX doubles loan agreement with SVB to £40M. First at FNG… Institutional FX and crypto execution specialist LMAX Group today announces that the company has entered into an agreement with Silicon Valley Bank (SVB) to increase its total Credit Facility from £20 million up to a potential £40 million. This new borrowing facility provides committed funding for a four-year tenor on investment grade terms. LMAX originally entered into a £20 million loan agreement with SVB in early 2018, to fund a management buyout of outside investor Paddy Power Betfair plc (now Flutter Entertainment plc) and its 33% stake in the company. That transaction seems to have worked out well for both parties, with LMAX significantly increasing its revenues and profits in the ensuing three years (despite a slight dip in 1H-2020) while becoming a major player in both FX and crypto liquidity.

LMAX doubles loan agreement with SVB to £40M. First at FNG… Institutional FX and crypto execution specialist LMAX Group today announces that the company has entered into an agreement with Silicon Valley Bank (SVB) to increase its total Credit Facility from £20 million up to a potential £40 million. This new borrowing facility provides committed funding for a four-year tenor on investment grade terms. LMAX originally entered into a £20 million loan agreement with SVB in early 2018, to fund a management buyout of outside investor Paddy Power Betfair plc (now Flutter Entertainment plc) and its 33% stake in the company. That transaction seems to have worked out well for both parties, with LMAX significantly increasing its revenues and profits in the ensuing three years (despite a slight dip in 1H-2020) while becoming a major player in both FX and crypto liquidity.

FX industry executive moves reported this week at FNG include:

❑ Exclusive: Tickmill hires BDSwiss marketing alum Nicholas Baumer as CMO.

❑ Exclusive: Leverate hires former anyoption executive Eran Gorodezky as CFO.

❑ Exclusive: Edgewater Markets hires EBS exec James Oliver for Precious Metals Sales.

❑ HSBC appoints Nuno Matos as Chief Executive of Wealth and Personal Banking.