FX week in review: City Index rebrand, Robinhood troubles, Plus500 campaign, Finalto sale

It was a very busy week of Forex and CFD industry news, with all the top stories appearing first or exclusively at FNG.

What was City Index’s rebranding all about?

Why are Robinhood shares plummeting, and why is the uber-neobroker facing an uncertain future regarding the main way it makes money?

Who is the new face of Plus500’s global ad campaign, as the leading CFD broker makes a major shift in its marketing strategy?

When is the sale of Finalto (and Markets.com) now scheduled to close?

Answers to these questions, and a whole lot more, appeared first or exclusively this past week at FNG. Some of the most read and commented-on FX industry news stories to appear over the past seven days on FNG included:

Refreshed, rebranded City Index UK is now live. Yellow and black is no more, the newly refreshed, rebranded FX and CFD broker City Index UK is now live. The company made the following comment on its rebranding: “But this is more than just a rebrand: this is our commitment to deliver more features, products and services. Introducing new markets, extended trading hours, exclusive new tools and more”. The rebranding has already been implemented in other regions, including Singapore and Australia.

Refreshed, rebranded City Index UK is now live. Yellow and black is no more, the newly refreshed, rebranded FX and CFD broker City Index UK is now live. The company made the following comment on its rebranding: “But this is more than just a rebrand: this is our commitment to deliver more features, products and services. Introducing new markets, extended trading hours, exclusive new tools and more”. The rebranding has already been implemented in other regions, including Singapore and Australia.

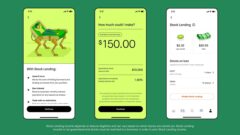

Robinhood shares see 14% one-week drop in wake of coming PFOF ban. Shares of next-gen online broker Robinhood (NASDAQ:HOOD) shed 14% of their value last week, as U.S. Securities & Exchange Commission (SEC) Chair Gary Gensler made a mid-week speech outlining some proposed changes to the way retail brokers make money. Specifically, the SEC is looking to ban payment-for-order-flow (or PFOF, as it is known in the industry). PFOF is already banned in Australia, while the EU considers PFOF outside the parameters of its MiFID rules, although it has not explicitly been banned.

Robinhood shares see 14% one-week drop in wake of coming PFOF ban. Shares of next-gen online broker Robinhood (NASDAQ:HOOD) shed 14% of their value last week, as U.S. Securities & Exchange Commission (SEC) Chair Gary Gensler made a mid-week speech outlining some proposed changes to the way retail brokers make money. Specifically, the SEC is looking to ban payment-for-order-flow (or PFOF, as it is known in the industry). PFOF is already banned in Australia, while the EU considers PFOF outside the parameters of its MiFID rules, although it has not explicitly been banned.

Exclusive: Plus500 launching new branding and video ad campaign starring Kiefer Sutherland. FNG Exclusive… FNG has learned that CFDs broker Plus500 (LON:PLUS) is launching a new global, multi-language advertising and branding campaign under the general title “It’s trading with a Plus”. The company plans to roll out a series of prime-time TV ad spots in several markets worldwide in the coming weeks, alongside a large push online, in social media, as well as real-world billboards in certain locations, initially London, Milan and Sydney.

Exclusive: Plus500 launching new branding and video ad campaign starring Kiefer Sutherland. FNG Exclusive… FNG has learned that CFDs broker Plus500 (LON:PLUS) is launching a new global, multi-language advertising and branding campaign under the general title “It’s trading with a Plus”. The company plans to roll out a series of prime-time TV ad spots in several markets worldwide in the coming weeks, alongside a large push online, in social media, as well as real-world billboards in certain locations, initially London, Milan and Sydney.

Playtech to close Finalto sale on June 30 after finalizing regulatory approvals. Online gaming and financial services concern Playtech plc (LON:PTEC) has announced that it has received all required regulatory approvals related to the all-cash $250 million sale of its financial trading division Finalto, to Gopher Investments. The Transaction was already approved by Playtech shareholders during the General Meeting held on 1 December 2021. In line with the sale and purchase agreement with Gopher Investments, the company now expects completion of the sale to occur on 30 June 2022.

Playtech to close Finalto sale on June 30 after finalizing regulatory approvals. Online gaming and financial services concern Playtech plc (LON:PTEC) has announced that it has received all required regulatory approvals related to the all-cash $250 million sale of its financial trading division Finalto, to Gopher Investments. The Transaction was already approved by Playtech shareholders during the General Meeting held on 1 December 2021. In line with the sale and purchase agreement with Gopher Investments, the company now expects completion of the sale to occur on 30 June 2022.

Top FX industry executive moves reported at FNG this week included:

❑ Exclusive: Marketing exec Themis Christou leaves M4Markets.

❑ Daniel King steps down from Plus500 BoD.

❑ Michelle Mizzi Buontempo named MFSA Acting CEO.

❑ Hargreaves Lansdown appoints Darren Pope to Group Board.

❑ Michael Summersgill to succeed Andy Bell as CEO of AJ Bell.