Forex.com battle heats up as two more directors oppose FCStone deal

The battle for control of retail forex broker Forex.com (and its UK sister brand City Index) took an interesting turn, with parent company Gain Capital Holdings Inc revealing that two additional independent directors changed sides and have decided to advise against the acquisition of the company by INTL FCStone – at least on the terms offered.

With longtime Gain directors Peter Quick and Chris Sugden now saying that they no longer supported the deal, Gain said that a board vote yesterday was 5-3 in favor of the merger – with Quick and Sugden joining Alex Goor on the “nay” side.

The vote comes well ahead of Gain’s June 5 virtual shareholders meeting to vote on the deal, which as currently constituted has FCStone offering $6 in cash for each Gain Capital share, for a total deal value of about $236 million.

The agreement with FCStone, still backed by Gain’s largest shareholder VantagePoint Ventures, is not at all a “done deal” with just 44% of the shares locked into the agreement – including VantagePoint’s shares and those of Gain’s other large shareholders such as CEO Glenn Stevens.

A real interesting barometer of the battle is Gain’s share price, which continues to rise higher. GCAP shares closed at $6.72 yesterday, well above the noted $6-in-cash being offered by FCStone. The market is clearly expecting either a better offer, or the deal to be called off altogether.

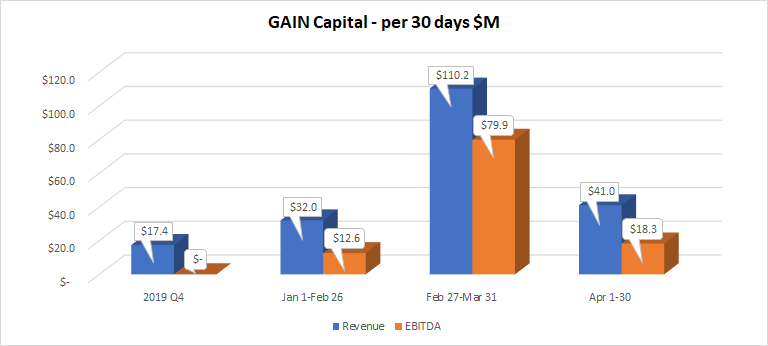

As we noted in an earlier article, the reason behind the dissenting board views (as well as Gain’s share price rise) is a marked improvement in Gain Capital’s fortunes since the agreement with FCStone was struck in late February. The market volatility brought on by the Covid-19 pandemic has driven trading volumes at Gain (as well as at many other retail fx brokers) leading to some superb financial results.

Gain brought in $110 million in Revenue and generated $80 million in EBITDA (normalized for a 30-day month) in late February through March. Why sell a company for $236 million if it can generate that much cash in just a few months from operations?

The flipside, of course, is that March was an aberration. Even with volatility continuing through April in the financial markets Gain’s results came back down to earth somewhat, with $41 million of Revenue and $18 million in EBITDA for the month of April. But still, you likely wouldn’t sell a company generating that kind of cash for $236 million.

There’s still some time between now and the June 5 shareholder vote, but we would expect some kind of improved offer by FCStone in order to get the dissenting directors on board to try and seal the deal. Either way, the battle for Gain is likely not yet over. Should be an interesting few weeks at Gain.