Exclusive: Trading 212 UK sees Revenues down 3%, Profit down 26% in 2023

FNG Exclusive… FNG has learned that online brokerage firm Trading 212 UK Limited has seen a slight decrease in activity and profitability in 2023, following a fairly strong 2022 for the company.

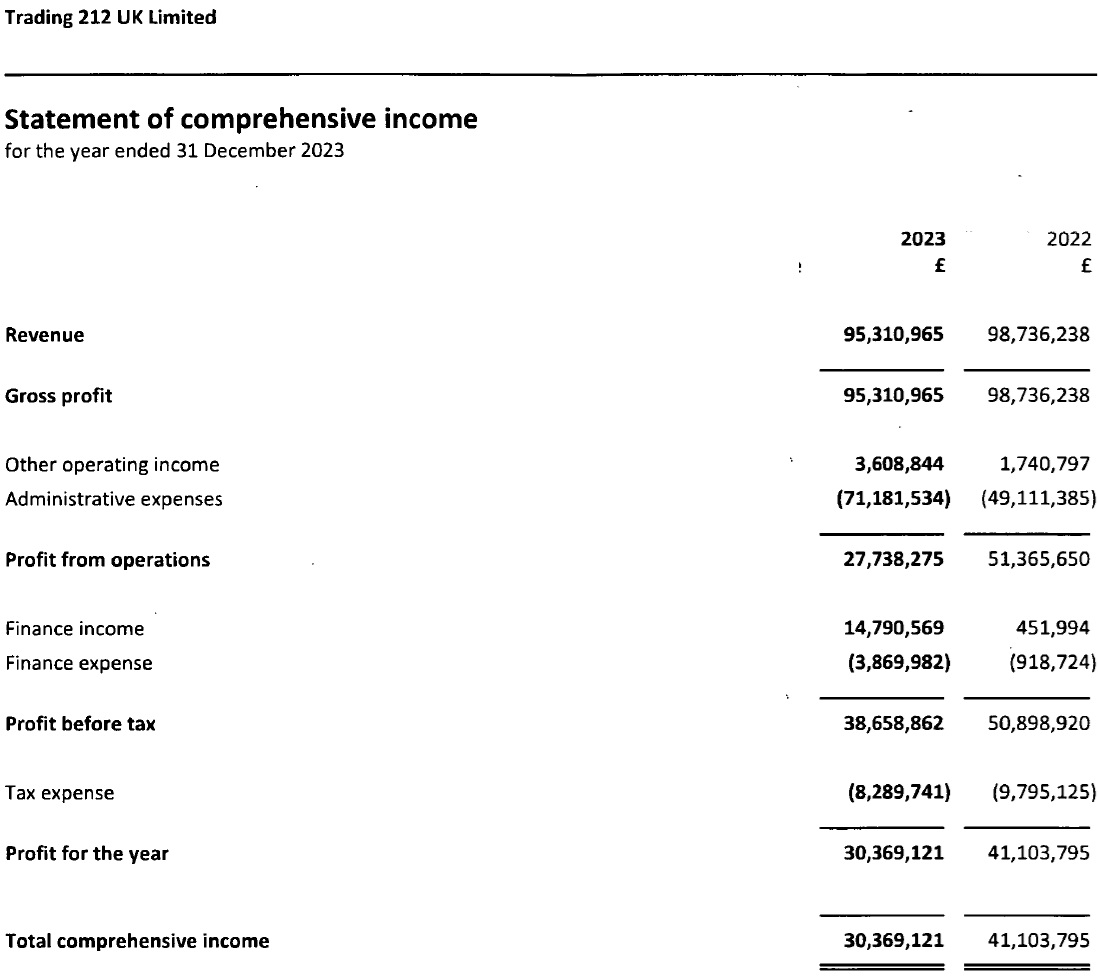

Trading 212 UK posted Revenues of £95.3 million (USD $121 million) in 2023, down 3% from £98.7 million in 2022. Net Profit for 2023 was £30.4 million, off 26% from 2022’s profit of £41.1 million.

The aforementioned results are for the FCA regulated entity of London/Sofia based Trading 212 Group only. The Group also includes Trading 212 Limited (registered in Bulgaria and regulated by the Bulgarian Financial Supervision Commission), and Cyprus based / CySEC licensed Trading 212 Markets Limited. In 2022 Trading 212 UK accounted for about 86% of overall Trading 212 Group Revenues (£114.9 million), so assuming that the group dynamics didn’t change much in 2023, the UK results probably give a pretty good overall picture of what is going on at the company. (Trading 212 Group Limited has yet to file its 2023 results).

Trading 212 is controlled by Bulgarian entrepreneurs Borislav Nedialkov and Ivan Ashminov.

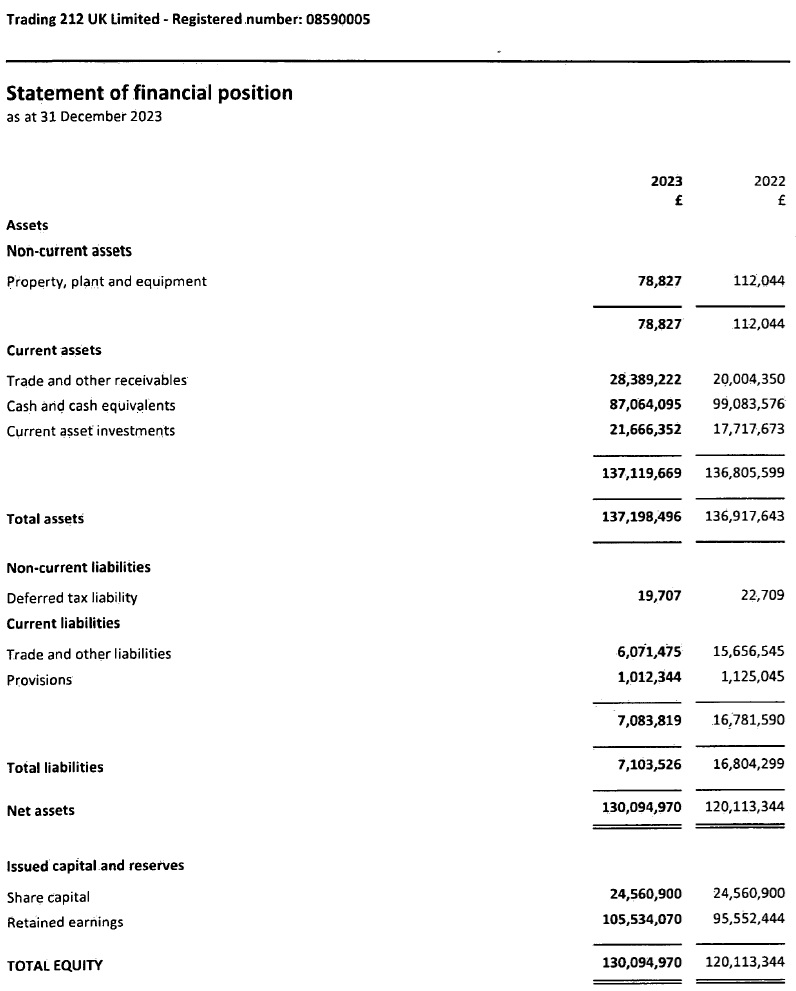

The company operates segregated client money bank accounts and client transaction accounts. As at 31 December 2023, the total balance of these accounts was £391.2 million (2022: £286.5 million). As at 31 December 2023 the total value of clients’ custody assets held was £2.97 million (2022: £1.92 million).

Principal activity

Trading 212 UK Limited’s (‘T212’ or ‘the company’) activities during the year consisted of:

i. The provision of a stockbroking platform.

ii. The provision of an internet/app-based Contract for Difference (“CFD”) trading service platform where two parties agree to exchange the market performance of an underlying security, currency, or other financial asset through a derivative contract.

Both products are operated through T212’s trading platform to clients predominantly resident in the UK.

For the stockbroking business, the company operates a zero-commission model where clients do not pay commission for trading nor suffer custody fees for the assets held. T212 earns fees from clients when they trade in a currency different to that in which their cash was deposited. T212 also keeps a portion of the interest earned on the client money, and for part of 2023, earns fees through a fully collateralised stock lending programme

For the CFD products, T212 manages its own risk in accordance with its trading risk management policy and limits which are based on defined and approved risk parameters on each product and asset class, hedging exposures outside of these with reputable third parties. For positions held overnight T212 applies an overnight interest rate charge/credit based upon the value of the positions, the prevailing market interest rates and a mark-up.

Strategy

While operating both a stockbroking and CFD platform, T212’s growth strategy remains focused on the stockbroking part of the business and growing the value of client money and client asset balances.

While this growth continues to be driven in part by broader market trends and activity, crucially, it is driven by the increasing popularity of T212’s platform and our product offering which includes, for example, T212’s zero commission pricing structure, the ability to trade in fractional amounts of shares, and the functionality within the platform to build portfolios. In addition, the ability to trade via T212’s mobile app has proved to be extremely popular with the tech savvy demographic.

These features have helped open up share trading to a significantly wider and diverse client base who may not historically have had access to the financial markets or been considered as potential customers. Trading 212’s products, services and technology has facilitated and enabled a wider audience to participate in managing their own financial affairs and investment decisions that they were previously unable to do.

During the year, the firm launched two key initiatives to increase the return to its customers on their investment accounts. Firstly, in June 2023, T212 began sharing the interest it was earning with its customers on uninvested cash. And then, in July T212 gave the option to its customers to earn additional income via T212’s fully collateralised share lending programme. Both these initiatives have proved very popular with our customer base and encouraged an increase in new customer sign ups.

T212 continues to review new product ideas such that it can further contribute and support the investing public in gaining access to the wider financial markets and enabling them to take control of their financial undertakings, investment portfolios and ultimately to build wealth for their futures.

Financial performance

In 2023, T212 made revenues of £95.3m (2022: £98.7m) and profit before tax of £36.6m (2022: £50.9m). This year marks a continued stabilisation in the revenue following on from the exponential growth seen between 2019 and 2021.

Net assets have increased from £120.1m to £128.1m year on year, a result of continued profitability less £20.4m in dividends.

The company’s total administrative expenses rose 45% to £71.2m (2022: £49.1m) predominantly down to increased marketing activities which only restarted properly in the last quarter of 2022.

Interest income increased in 2023 to £14.8m (2022: £0.5m) as a result of the higher interest rates now being offered by banks.

Non-financial indicators

Non-financial indicators have historically been focused on customer acquisition and customer activity. As there is no cost for a client to open an account, the number of accounts holding either cash or assets is the more useful gauge of business growth and potential.

During 2023 some of the key metrics the company analyses have moved as follows:

- number of funded Invest/ISA accounts up 20%

- number of monthly active users up 28%

- number of monthly active trades up 32%

- total value of client deposits up 22%

- total value of client money up 37%

- total value of client custody assets up 55%

Other positive indicators of performance during the year include the significant improvements made across the business including:

- improvements made to the company’s operational resilience framework and operations;

- the maturity of the risk management framework and risk reporting capabilities; and

- further embedding the changes from the new operating model throughout the business.

Future developments

The firm will continue its objective of increasing the value of client assets safeguarded by expanding the number of products and features offered to its customers through the T212 app. This has been or will be realised in 2024 through further enhancement of its high interest-sharing programme, the ability to undertake in-specie portfolio transfers, model portfolios, and 24/5 trading.

Trading 212 UK’s 2023 income statement and balance sheet follow.