Exclusive: Publicly traded Retail FX/CFD brokers see (very!) mixed results in 2022

As we wrote in our Top FX/CFD industry news stories of 2022 year-end review, it was very much a haves versus the have-nots FX/CFDs industry last year – with some brokers month after month setting client trading volume (and revenues and profit) records, while others faltered.

And that theme seems to be very much in play as well when we look at how the publicly traded FX and CFD brokers fared over the past 12 months.

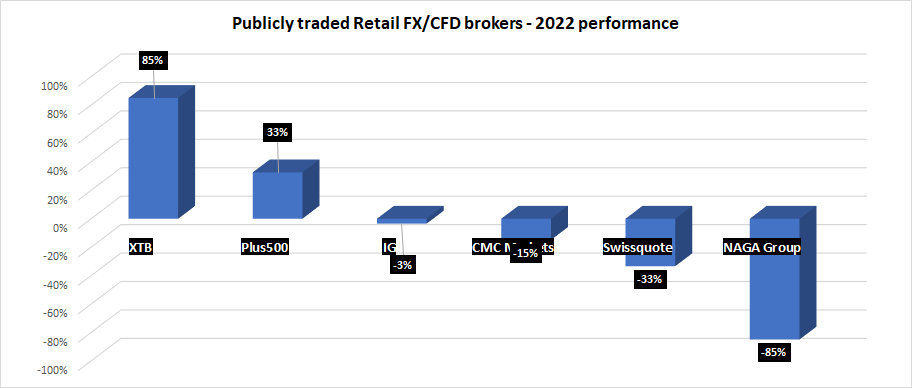

When sorting through the numbers we come up with an average 3% decline in share price (median: 9%) for the publicly traded brokers. But that doesn’t tell the whole story, as the distribution was fairly wide.

Leading the pack in 2022 were Poland based XTB (WSE:XTB) and Israel based Plus500 (LON:PLUS), which saw their respective share prices increase by 85% and 33% in 2022. These brokers, which largely run using their own proprietary trading platforms, are also somewhat similar in that they are Europe-centric (with Plus500 now taking a run at expanding in the Far East) and have developed into true multi-asset brokers. In its most recent quarter XTB saw Revenues divided fairly evenly between Index CFDs (37%), FX trading (31%), and Commodity CFDs (28%). XTB shares topped the PLN 30 level for the first time ever in November, and now sit near a 52-week (and all-time) high giving XTB a market cap of over $800 million.

On the other end of the spectrum was once high-flying NAGA Group (ETR:N4G), which saw its shares decimated by investors in 2022 to the tune of an 85% decline – bringing NAGA’s market cap down from $364 million as at year-end 2021 to just $66 million now. NAGA’s problems were somewhat internal, with the company forced to restate results and forecasts for both 2021 and 2022, and the broker eventually parting company with auditor E&Y. The company’s big bet (and spend) on crypto didn’t help either, and NAGA focused on cutting costs in the second half of 2022 after posting a first half net loss of €19 million.

The UK based online trading leaders, IG Group (LON:IGG) and CMC Markets (LON:CMCX), each had a fairly steady year with a good multi-asset trading balance as well as Retail and B2B offerings. IG’s shares were basically unchanged in 2022 (down 3%) and CMC shares were off 15%, as the shares of both companies traded in a fairly tight range during the year.

Following a stellar 2021 (up 133%) Swiss industry leader Swissquote (SWX:SQN) saw its shares cool somewhat (down 33%) in 2022. However Swissquote shares have been again on the rise since the company posted its 1H-2022 results and full year outlook during the summer.

We should of course put all this analysis in context of the overall equity market. In the US, all three of the “major averages” suffered their worst year since 2008 (and first down year in four years), with the Dow down 9%, the S&P off 19%, and the tech-heavy Nasdaq losing 33% of its value in 2022. In Europe things were somewhat more muted with the FTSE 100 down 1% and Germany’s DAX decreasing by 12%.

Observations?

Well, as we state above some brokers seem to have been prepared for the healthy yet very different markets we saw in 2022. And some weren’t. Heightened financial market volatility across all products (equities, FX, commodities, crypto…) made for some very fertile ground for retail brokers – whose fate usually correlates quite strongly with volatility. But the discipline required to maintain strong internal controls and risk management (and spending) were still needed to do well in 2022. And likely, into 2023.

We’d also make mention that the ranks of the publicly traded FX/CFD brokers was supposed to have increased in 2022, with both Israel based eToro and Denmark domiciled Saxo Bank looking to go public via SPAC mergers. However both transactions were scuttled, as equity market conditions generally became less friendly as the year progressed and as issues surfaced between the different stakeholders involved in each deal.

Some more data on the publicly traded Retail FX brokers for 2022:

| Share Price on: | Mkt Cap | |||

| 31-Dec-2021 | 31-Dec-2022 | % change | (USD $M) | |

| XTB | 16.78 | 31.02 | 85% | 831 |

| Plus500 | 1360.5 | 1804 | 33% | 2057 |

| IG | 813 | 785 | -3% | 3956 |

| CMC Markets | 263.5 | 224 | -15% | 768 |

| Swissquote | 200.5 | 133.5 | -33% | 2217 |

| NAGA Group | 7.65 | 1.15 | -85% | 66 |

| Average return | -3% | |||

| Median return | -9% | |||

Note that share prices are stated in the currency listed. Market Cap stats converted to USD.