Exclusive: FXCM UK sees lower revenues but higher profits in 2022

FNG Exclusive… FNG has learned via regulatory filings that Stratos Markets Limited, the London based, FCA regulated UK arm of global Retail FX broker FXCM, saw a modest 11% decrease in Revenues in 2022, but an increase in profitability for the year.

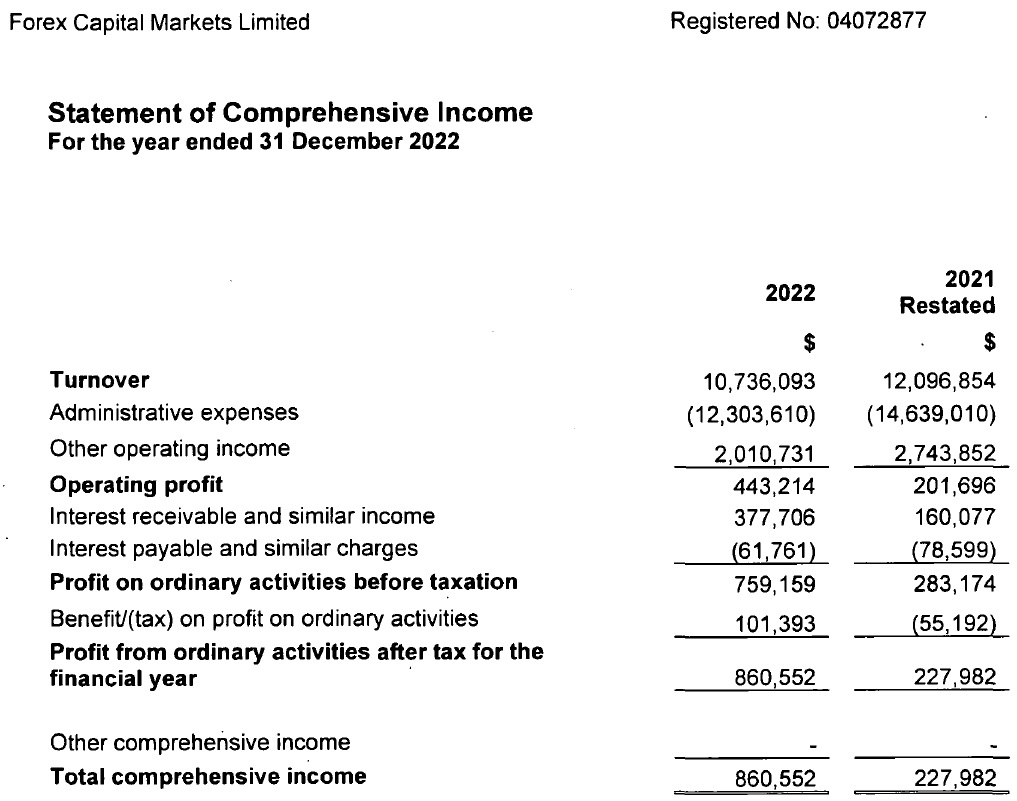

FXCM UK operator Stratos Markets Limited, which was renamed earlier this year from Forex Capital Markets Limited, brought in Revenue of $10.7 million in 2022, versus $12.1 million in 2021. Net profit for 2022 was $861K, versus $228K the previous year.

The company offers online FX and CFD trading to its retail and professional clients utilising the online trading platforms of affiliated companies. FXCM UK offsets all of its FX and CFD trades with affiliate entities and is compensated for selling this risk on a commission basis. In this capacity, the company is acting as a referring broker to these entities and is the principal counterparty to the client transaction. The profit or loss for the company is dependent on the trading volume of its clients.

In 2022, the company’s turnover decreased by 11.2%, year on year, to $10.7 million. 2021 turnover has been restated down by $1.5 million and other income restated up by the same amount: a $1.5 million negative adjustment to trading income was classified to other income as opposed to turnover in 2021, the reclassification of this charge to turnover has been done to aid comparability between years. Profit on ordinary activities before taxation increased by 168.1% compared to the previous year to $0.759 million in 2022. Retail trading volumes increased 3.2% in 2022.

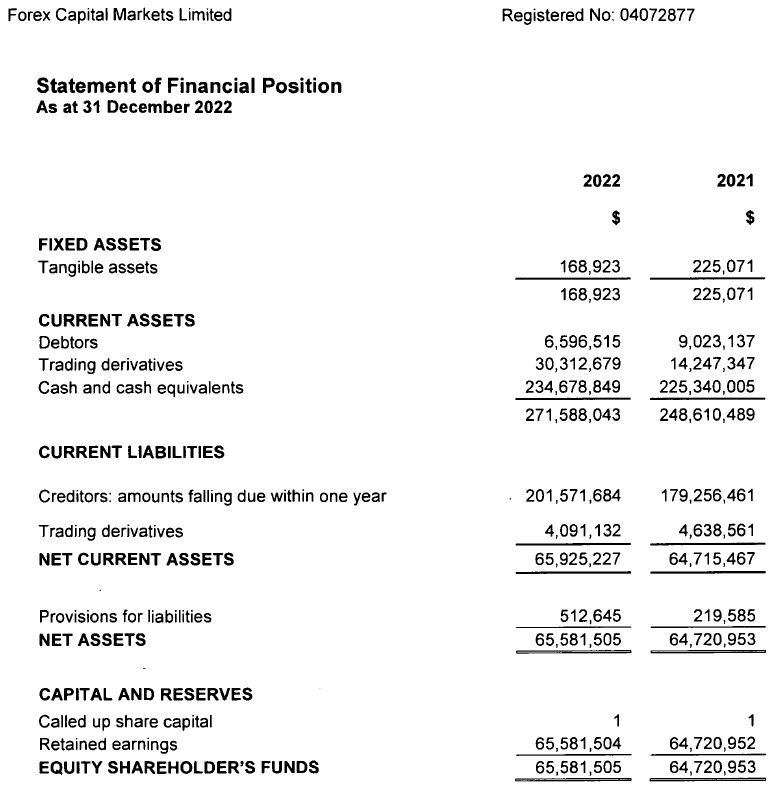

Client cash held at FXCM UK reduced 3.3% to $142.2 million in 2022, from $147.0 million in 2021. Capital resources decreased to $64.4 million as compared to the previous year ($64.5 million). There were no distributions in 2022.

The Company hedges its client trades with affiliates and is compensated in return with a commission based upon a relative contribution to the total FXCM Group profits. The company also earns other forms of revenue such as fees from white label arrangements with third parties to provide platform, back office and trade execution services, FX market prices and various ancillary FX and CFD related services.

FXCM UK’s revenue and profitability rely on, among other things, the levels of volatility, which in the FX markets is partly contingent upon the expectation of how much interest rates will change in the future. Prima facie, increased volatility in the markets is favorable to FX and CFD trading and revenue and profitability due to the countercyclical nature of the company’s business model.

FXCM management noted that volatility for 2022 was higher than in 2021. The VIX average, a measure of volatility, was an average of 25.64 for 2022. By comparison it was 19.66 in 2021. While factors affecting volatility are varied, the economic outlook for 2023 seems to indicate a contraction for the UK economy followed by growth in the following year.

The UK formally left the EU on 31 January 2020 and entered the transitional period which ended on 31 December 2020. Since 2021, the company is no longer able to service EU clients directly and they were invited to transition to an FXCM Group EU affiliate.

During 2021 the company undertook restructuring both in its London and its European offices. The process of winding-down the European offices continued into early 2022. During 2021 $2.1 million was expensed for these restructuring costs.

FXCM is now 100% owned by US financial services company Jefferies Financial Group Inc (NYSE:JEF).

FXCM UK’s income statement and balance sheet for 2022 follow.