Exclusive: ADSS UK sees 44% drop in Revenue in 2019

FNG Exclusive… FNG has learned via regulatory filings that ADS Securities London Limited, the FCA regulated arm of UAE based Retail FX brokerage group ADSS, saw a 44% decline in activity in 2019.

The company, which operates website adss.com, said that the decrease in activity and resulting revenue was a direct impact of the ESMA/FCA product intervention rules that came into force at the end of Q3 2018. Those rules, of course, included the limitation of the leverage which brokers such as ADSS could provide retail traders to 30x and below.

ADSS noted in the filing that it has undertaken an independent strategic review in Q1 2020 in the wake of the activity decline, and that the board remains committed to its strategy of predominantly focusing upon the professional client sector within the UK.

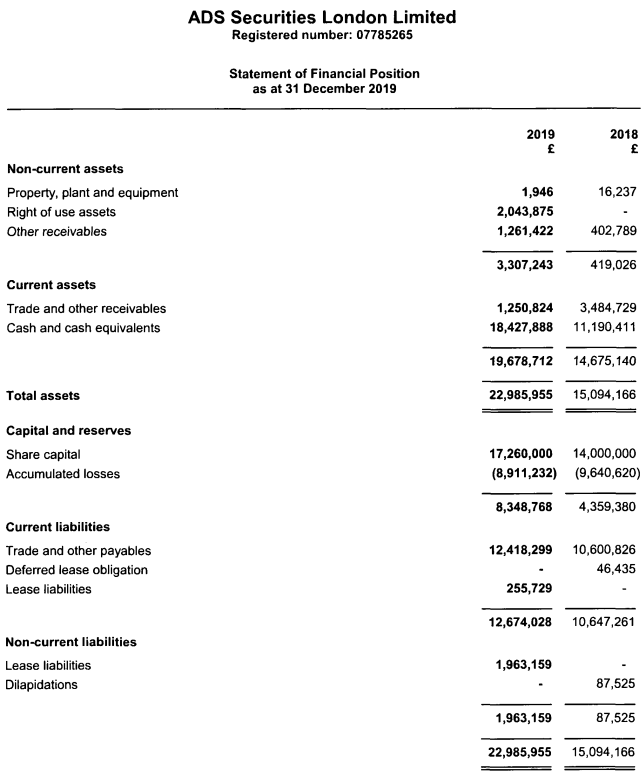

Despite the decline in activity, ADSS UK did see an increase in client assets, coming in at £3.48 million at year end 2019 versus £2.11 million the previous year.

ADSS UK has been run by CEO Paul Webb since 2016. Mr. Webb had originally joined ADSS in 2012 (then known as ADS Securities) as Chief Dealer, following nine years at CMC Markets and a brief stop at now defunct WorldSpreads.

ADSS, via its parent company ADS Holding LLC, is controlled by UAE businessman Mahmood Ebraheem Al Mahmood.

The ADSS UK board stated that it is committed to ensuring the company remains adequately capitalized, highlighted by the introduction and implementation of a formal Transfer Pricing policy in November 2016 which enables the company to charge ADSS with respect to services provided, which protects the capital base of the company. It enables the company to control its liquidity ensuring there is at least a 10% buffer on top of the regulatory requirements as per the company’s Internal Capital Adequacy Assessment Process. The board of directors reviews dividend proposals in light of financial results and market conditions. The sources of funding to date has been the immediate parent company and ultimate holding company, ADS Holding LLC, a company incorporated in the United Arab Emirates.

In August 2019 the company received a £3.26 million injection of capital, via the allotment of 3,260,000 regulatory £1 shares to its parent company ADS Holding LLC.

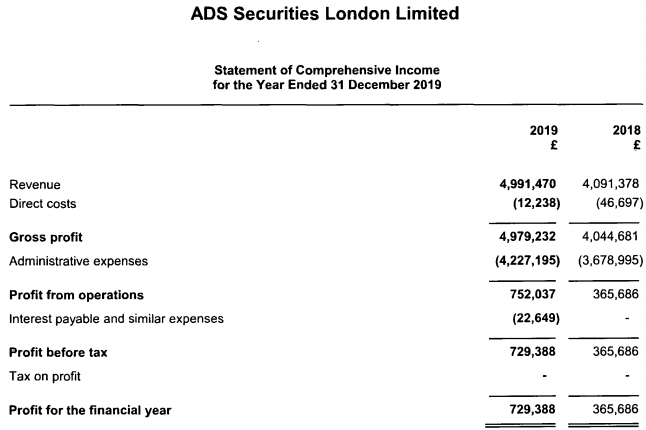

The company’s aforementioned Transfer Policy allocated more Revenue to ADSS UK in 2019, such that formally ADSS UK showed a 23% rise in Revenues, from £4.09 million in 2018 to £4.99 million in 2019. However, without the Transfer Policy injection, Revenues were down 44% in 2019 as described above.

ADSS UK employs 24 people (same as in 2018), with most engaged in sales, back office and administration duties.

Looking forward, ADSS stated that a key focus of the business strategy for 2020 is growing and diversifying the client base; for the professional client segment the key focuses are around a personalized and experienced sales trading service supplemented by competitive pricing and execution. The institutional focus is based on enhancing current technology and leveraging on non-bank liquidity which provides a USP, and the prime of prime product focusing on utilization of credit lines.

With the introduction of the new ESMA rule changes in 2018, the company and the sector underwent a period of major change. Despite the continuing impact of the 2018 rule changes the company said it finished the year in a strong financial position in terms of its capital base and its controlled cost base. While the company currently relies on transfer pricing it is well capitalized and yielding the forward view that the business will move into a position that it is not dependent on it. With this sound financial footing the company noted it is in a firm position to continue to expand its technology and services to supplement its client acquisition strategy.

ADSS UK’s income statement and balance sheet for 2019 follows: