Exclusive: ActivTrades revenues decline 43% in 2H-2022 as resources diverted to StreamBank

FNG Exclusive… FNG has learned via regulatory filings that London based Retail FX and CFDs broker ActivTrades saw a sharp decline in activity during the second half of 2022, following what was a very strong first half of the year.

The decline came as ActivTrades diverted a significant amount of capital and resources into StreamBank, a new online lender and savings bank in the UK being launched by ActivTrades’ controlling shareholder Alex Pusco.

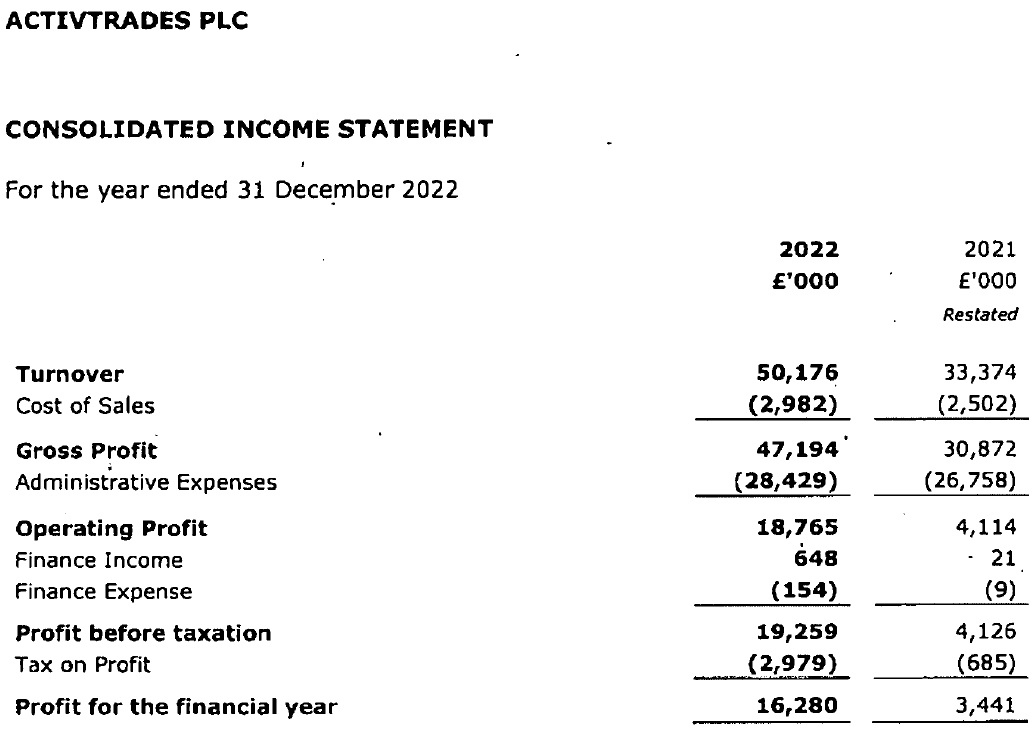

ActivTrades 2022 results

In 1H-2022 ActivTrades reported that its Revenues came in at £32 million, nearly more than the £33 million ActivTrades brought in for all of 2021. However the trend reversed in 2H-2022, with ActivTrades seeing just £18 million in Revenues during the last six months of the year – down 43% from the first six months.

Profit-wise, after earning £19 million in pre-tax profits in 1H-2022 ActivTrades operated at roughly breakeven throughout the second half of the year.

For all of 2022, ActivTrades brought in £50.2 million in Revenues – up 50% from 2021’s £33.4 million – and earned a Net Profit of £16.3 million, up from £3.4 million in 2021. But again, the increases were all due to a strong 1H-2022.

StreamBank launch

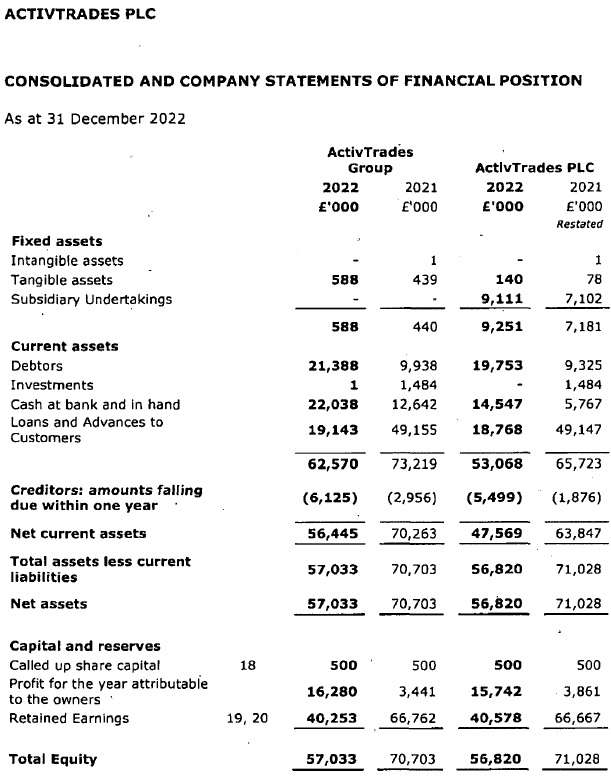

At 31 December 2022, ActivTrades’ Shareholder funds fell to £57.0m (2021: £70.7m) following dividends paid out during the year of £30.0m (2021: £1.5m). The reason for the large amount of dividends was due to the company’s controlling shareholder re-investing capital in StreamBank PLC, a separate legal entity outside the ActivTrades Group, which received its authorisation with restrictions from the Bank of England in June 2022.

StreamBank was originally named ActivTrades Loans PLC, but a decision was apparently made last year to launch the business separately brand-wise from the ActivTrades CFDs / spreadbetting operation. Regulatory filings indicate that StreamBank received capital injections of £30.95 million in June 2022, and a further £5 million in December 2022, with the majority of those funds effectively transferred from ActivTrades, as noted above.

ActivTrades operations and client activity

ActivTrades’ direct cost of sales increased 19% to £3.0m in 2022 (2021: £2.5m), while total administrative expenses (excluding FX revaluations) rose 11% to £29.0m (2021: £26.1m), representing the continued expanding operations of the business.

During the year, the business also acquired broker licenses in both Brazil and Portugal which are expected to begin trading in 2023.

In terms of client activity, ActivTrades reported that it had 20,339 clients actively trading at the end of the year. This was up 5% from 19,448 at the end of 2021. During 2022, total deposits from clients equaled £103.1m (2021: £95.7m) and total withdrawals £55.9m (2021: £52.7m). This leaves net deposits 10% up in 2022 at £47.3m (2021: £43.0m). Monthly client trading volume averaged USD $51.8 billion for 2022 at ActivTrades, 24% down on 2021.

About ActivTrades

ActivTrades PLC is a financial markets broker which specialises in offering customers online trading of contracts for difference (CFDs) and spread betting in Forex, Indices, Financials, Commodities and Equities. In 2018 the service offering was extended to cover loans to UK domiciled borrowers. The Company is regulated by the Financial Conduct Authority (FCA) and its permissions allow it to provide services to UK and non-UK based customers.

The Company has a branch in Bulgaria which performs the IT development and risk management as well as other support services.

The Company has four broker subsidiaries which all offer the same trading activities; ActivTrades Corp, authorized and regulated by The Securities Commission of the Bahamas (“SC8”); ActivTrades Europe S.A., authorised and regulated by the Commission de Surveillance du Secteur Financier (“CSSF”) in Luxembourg, ActivTrades CCTVM, authorised by the Central Bank of Brazil (“BACEN”) and regulated by the Securities Commission of Brazil (“CVM””), and ActivMarkets Empresa de Investimento S.A, authorised and regulated by the Portuguese Securities Market Commission (“CMVM”). ActivTrades Europe S.A. also has a branch in Italy for administrative purposes and ActivTrades CCTVM also has an intermediary holding company, ActivTrades Brasil Participacoes LTDA in Brazil, which is also a wholly owned subsidiary of the Company.

ActivTrades is controlled by its longtime CEO, Swiss national and Monaco resident Alex Pusco.

ActivTrades’ 2022 income statement and balance sheet follow.