eToro survey: most retail investors confident bull market will continue into 2026

The majority (56%) of retail investors globally are optimistic that the current bull market will extend into the next year, according to the latest quarterly Retail Investor Beat from online broker eToro.

The study, which surveyed 11,000 retail investors across 13 countries, found that retail investors’ positive outlook for 2026 is also reflected in their confidence in their portfolios, with 78% expressing confidence in their investments, a percentage that remains unchanged from Q3 and the same time last year.

When asked about whether they are on track to achieve their investment goals, a majority (51%) believe they are, while 36% say it is too early to tell.

eToro’s Global Market Strategist Lale Akoner, commented:

“Despite the recent market downturn, declining interest rates, robust corporate earnings and a calming of the political landscape are driving investors’ confidence in the market’s potential for 2026. Retail investors’ confidence in their portfolios also remains high, suggesting that investors are looking past short-term fears, but they also recognise that achieving long-term goals requires more time, stability and consistent market performance.”

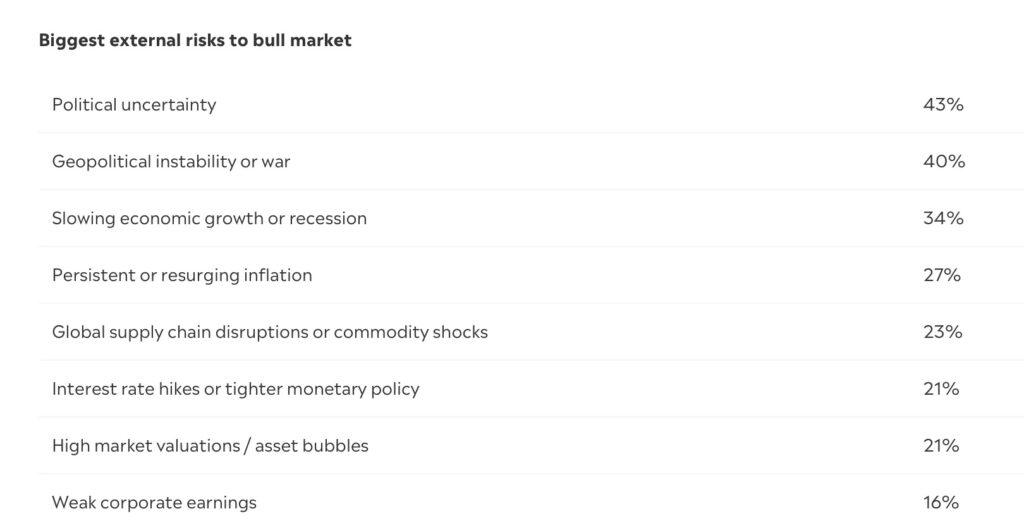

The latest Retail Investor Beat reveals that investors see political uncertainty (43%), geopolitical instability or war (40%) and slowing economic growth or a recession (34%) as the leading external risks to the bull market in 2026.

Lale Akoner added:

“While strong fundamentals support investors’ optimism, this year has proven that market certainty is never guaranteed. At a time of heightened market volatility, fueled by political and geopolitical instability, it has become essential for investors to remain vigilant and closely monitor potential risks.

“These risks loom large as we head into 2026 because they carry the potential to reshape policy priorities, trade relationships and the global economic outlook in ways that are difficult to predict. Retail investors understand that political outcomes can materially affect sectors, valuations and capital flows at a time when markets are assessing the durability of the current rally.”

A majority of investors anticipate changes in interest rates in 2026, with 37% expecting a decrease and 29% an increase. Among those who foresee a decrease, 18% predict a slight reduction of up to 0.25%, while 16% expect a moderate decrease between 0.25% and 0.75%.

The current interest rate decline has prompted 51% of retail investors to adjust their portfolios. Of those planning further changes, 26% intend to invest more. This is particularly so for younger investors with 38% of Generation Z and 34% of millennials planning to increase their investments, compared to 12% of baby boomers and 23% of Generation X.

As interest rates decline, retail investors are planning to allocate more of their investments in the next 12 months to growth sector stocks (23%), cryptoassets (20%), cash or short-term savings (19%), dividend-yielding stocks (18%), commodities such as gold and oil (18%), and real estate and property funds (17%).

Lale Akoner commented:

“With central banks now firmly in cutting mode, many investors expect room for additional reductions in 2026. The recent moves have already encouraged a more active approach, particularly among younger investors, who see this as an opportunity to rebuild and reposition for long-term wealth creation.

“As rates decline, investors are showing interest in a blend of growth opportunities and defensive assets, reflecting a pragmatic balance between near-term caution and long-term ambition.”